Parent Company Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

286

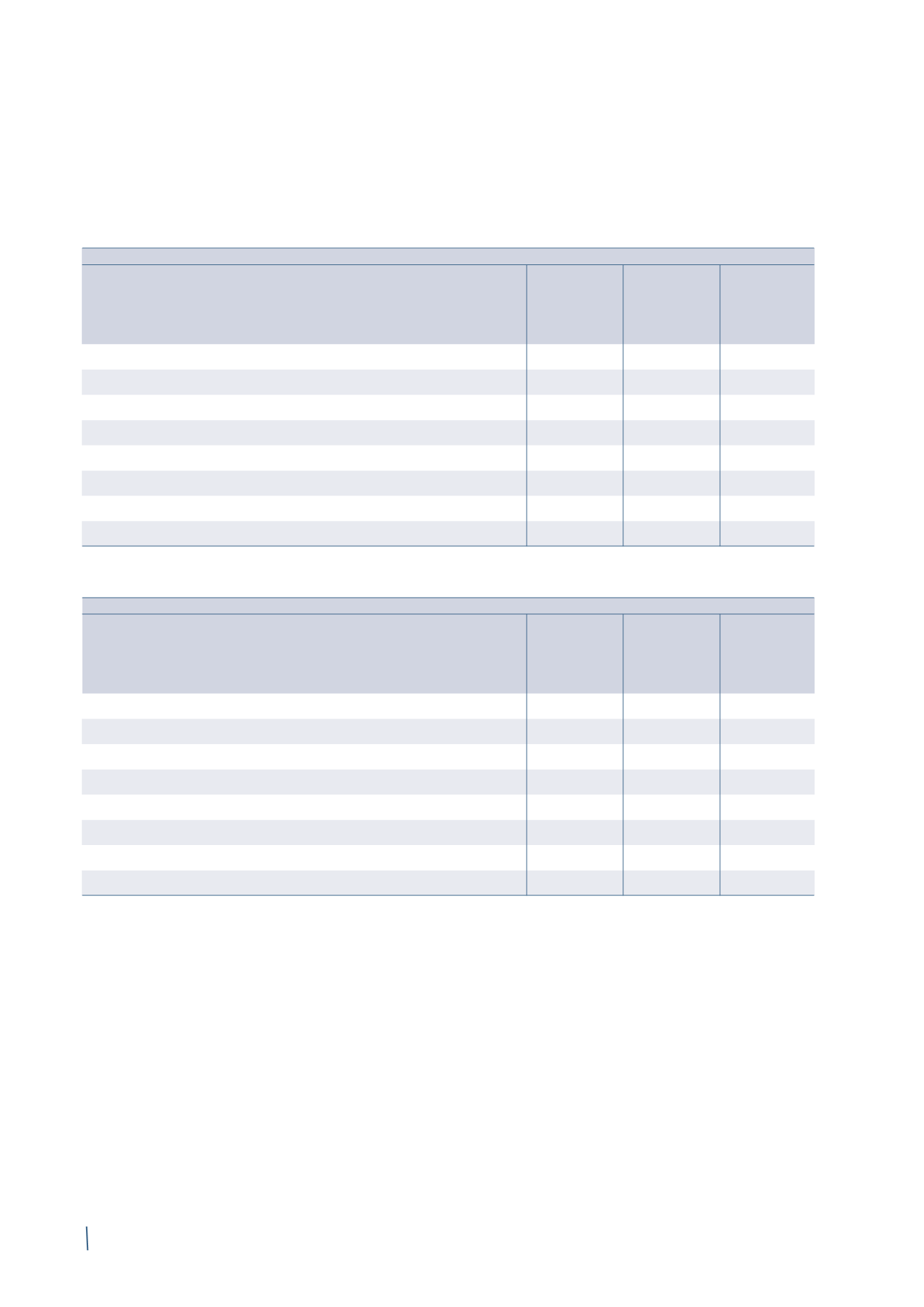

In completion of the disclosures about financial risks, the

following is a reconciliation between the classes of financial

assets and liabilities reported in the Company's consolidated

statement of financial position and the categories used by

IFRS 7 to identify financial assets and liabilities:

31 December 2014

Financial assets

Loans and

Financial

Financial

at fair value

receivables

liabilities

liabilities

through profit

at fair value

carried at

or loss

through profit

amortised

or loss

cost

Trade receivables

-

149,574

-

-

Other receivables

-

574,551

-

-

Derivatives (assets)

197

-

-

-

Cash and cash equivalents

-

2,314

-

-

Borrowings from banks and other lenders

-

-

-

1,228,317

Trade payables

-

-

-

255,320

Other payables

-

-

-

11,081

Derivatives (liabilities)

-

-

176

-

31 December 2013

Financial assets

Loans and

Financial

Financial

at fair value

receivables

liabilities

liabilities

through profit

at fair value

carried at

or loss

through profit

amortised

or loss

cost

Trade receivables

-

100,222

-

-

Other receivables

-

666,304

-

-

Derivatives (assets)

135

-

-

-

Cash and cash equivalents

-

4,600

-

-

Borrowings from banks and other lenders

-

-

-

1,175,121

Trade payables

-

-

-

295,791

Other payables

-

-

-

29,260

Derivatives (liabilities)

-

-

124

-

(in thousands of Euro)

(in thousands of Euro)