Parent Company Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

292

"Patents" refer to the patent portfolio held by Prysmian

S.p.A. and licensed to Group companies. "Concessions,

licences, trademarks and similar rights" refer to purchases of

software licences.

"Software" reports a net increase of Euro 683 thousand,

mainly in connection with progress in the SAP Consolidation

project that aims to harmonise this information system's

use throughout the Group. This system, with a net book

value (inclusive of intangibles in progress) of Euro 34,869

thousand at 31 December 2013, entered service in 2009;

during 2014 the useful life of the investment was revised,

taking the amortisation period from 8 to 10 years, reflecting

deferral in the system's full roll-out at Group level.

"Intangibles in progress and advances" refer to investments

still in progress at year end, which have therefore not been

amortised. The balance at 31 December 2014 includes Euro

7,014 thousand in expenditure on rolling out the SAP Con-

solidation project, and on developing other software in the

research and development area.

No borrowing costs were capitalised during the year.

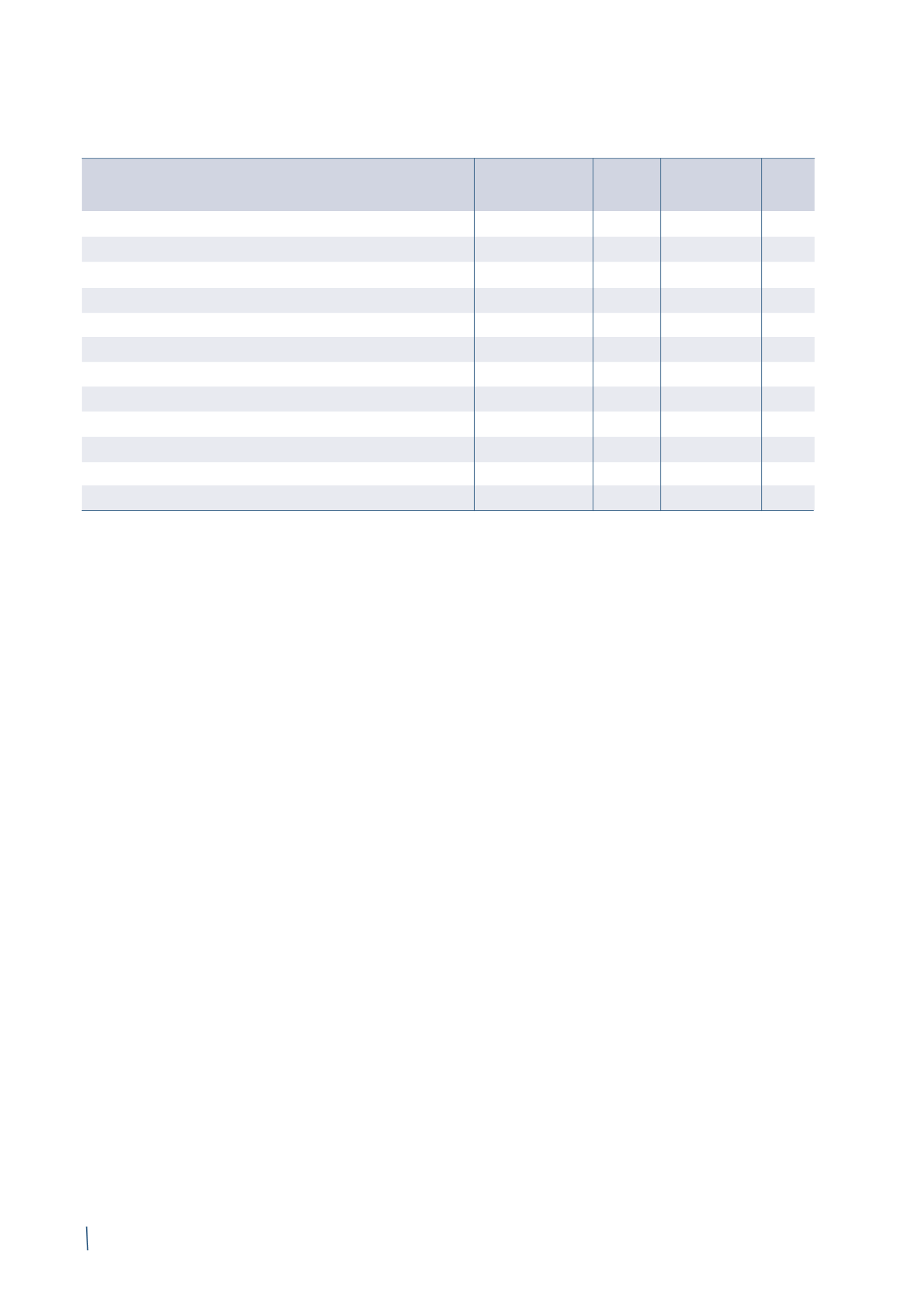

Patents

Concessions,

Software

Intangibles in

Total

licences, trademarks

progress and

and similar rights

advances

Balance at 31 December 2012

5,445

1,349

29,588

4,905 41,287

Movements in 2013:

- Investments

-

586

5,838

3,314 9,738

- of which internally generated intangible assets

-

-

5,828

2,374 8,202

- Amortisation

(1,192)

(368)

(8,062)

-

(9,622)

- Reclassifications

-

1,201

2,840

(4,261)

(220)

Total movements

(1,192)

1,419

616

(947)

(104)

Balance at 31 December 2013

4,253

2,768

30,204

3,958 41,183

Of which:

- Historical cost

11,394

3,409

56,504

3,958 75,265

- Accumulated amortisation and impairment

(7,141)

(641)

(26,300)

- (34,082)

Net book value

4,253

2,768

30,204

3,958 41,183

(in thousands of Euro)