297

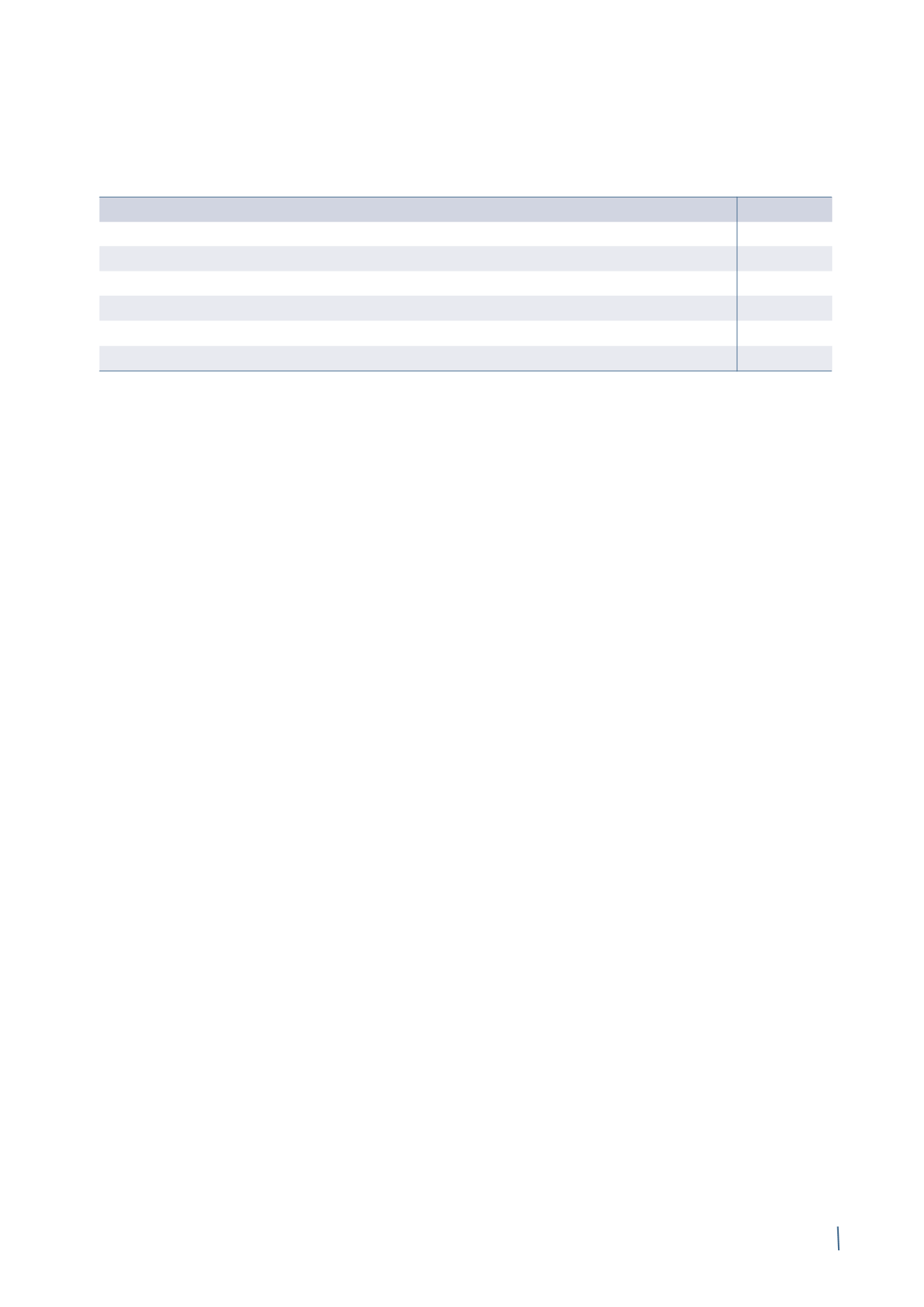

The following table breaks down trade and other receivables according to the currency in which they are expressed:

31 December 2014 31 December 2013

Euro

703,404

666,994

British Pound

19,064

95,823

US Dollar

1,657

3,004

Australian Dollar

-

468

Other currencies

-

237

Total

724,125

766,526

"Trade receivables" at 31 December 2014 mainly refer to

charges made by Prysmian S.p.A. to its subsidiaries for head

office services and the resale of strategic materials.

The book value of trade receivables approximates their fair

value.

Trade receivables are all due within the next year and do not

include any significant past due balances.

"Tax receivables" of Euro 34,555 thousand mainly refer to:

• tax credits for withholdings paid abroad (Euro 10,361

thousand);

• residual credits for IRES - Italian corporate income tax

(Euro 4,890 thousand), after duly offsetting against the

provision of Euro 4,904 thousand;

• VAT credits (Euro 17,579 thousand).

"Financial receivables" mostly comprise the credit balance

of Euro 489,552 thousand on the current account with

Prysmian Treasury S.r.l., the Group's central treasury

company (Euro 553,744 thousand at 31 December 2013).

"Prepaid finance costs" of Euro 6,744 thousand mainly

relate to:

• Euro 6,274 thousand for the Company's portion of the

costs incurred for the Syndicated Revolving Credit

Facility 2014 agreed with a syndicate of leading banks on

27 June 2014 (for more details, see Note 10. Borrowings

from banks and other lenders); the Company is amortis-

ing these costs over the term of the agreement, i.e. until

27 June 2019;

• Euro 451 thousand for the Company's portion of the

costs incurred for the Euro 100 million Revolving Credit

Facility 2014 agreed with Mediobanca – Banca di Credito

Finanziario S.p.A. on 19 February 2014 (for more details,

see Note 10. Borrowings from banks and other lenders);

the Company is amortising these costs over the term of

the agreement, i.e. until 19 February 2019.

At 31 December 2014, "Other" mainly comprises:

• Euro 8,976 thousand in receivables from Group

companies for the chargeback of user licences for

patents and know-how;

• Euro 24,385 thousand in receivables from Italian Group

companies for the transfer of IRES (Italian corporate

income tax) under the group tax consolidation (art. 117

et seq of the Italian Income Tax Code).

The book value of financial receivables and other current

receivables approximates the respective fair value.

(in thousands of Euro)