299

These amount to Euro 2,314 thousand at 31 December 2014,

compared with Euro 4,600 thousand at 31 December 2013,

and relate to the cash held on Euro bank current accounts

repayable on demand.

The credit risk associated with cash and cash equivalents is

Equity amounts to Euro 1,107,027 thousand at 31 December

2014, reporting an increase of Euro 85,975 thousand since 31

December 2013. The changes over this period are discussed

in the following paragraphs about the individual compo-

nents of equity.

Share capital

Share capital amounts to Euro 21,671 thousand at 31

December 2014, consisting of 216,712,397 ordinary shares

8.

CASH AND CASH EQUIVALENTS

9.

SHARE CAPITAL AND RESERVES

limited insofar as the counterparties are major national and

international banks.

The value of cash and cash equivalents is considered to be in

line with the respective fair value.

(including 2,819,649 treasury shares), with a nominal value

of Euro 0.10 each. The total number of outstanding voting

shares is 213,882,079, stated net of 10,669 treasury shares

held indirectly.

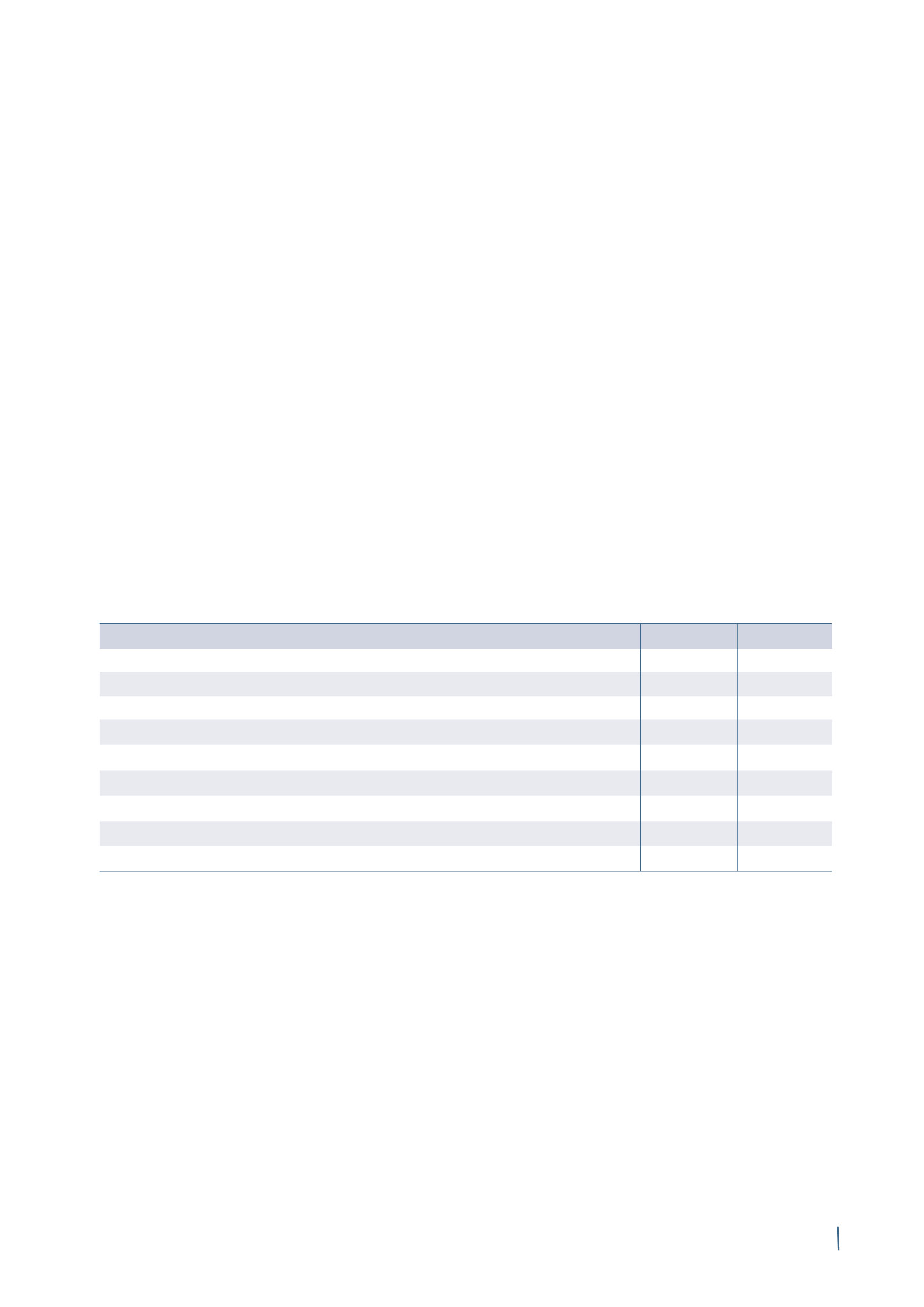

The following table reconciles the number of outstanding

shares at 31 December 2012, at 31 December 2013 and 31

December 2014:

Ordinary shares Treasury shares

Total

Balance at 31 December 2012

214,508,781

(3,028,500)

211,480,281

Capital increase

(1)

82,929

-

82,929

Treasury shares

-

-

-

Balance at 31 December 2013

214,591,710

(3,028,500)

211,563,210

Capital increase

(2)

2,120,687

-

2,120,687

Treasury shares - allotments

(3)

-

1,574,202

1,574,202

Treasury shares - sales

-

24,649

24,649

Treasury shares - purchases

-

(1,390,000)

(1,390,000)

Balance at 31 December 2014

216,712,397

(2,819,649)

213,892,748

(1) Capital increase following exercise of part of the options under the Stock Option Plan 2007-2012.

(2) Capital increase following exercise of the options under the Long-term incentive plan 2011-2013.

(3) The movement in treasury shares refers to the allotment of 162,650 shares under the Group employee share purchase plan (YES Plan) and to the allotment

of 1,411,552 shares under the Long-term incentive plan 2011-2013.

More details about treasury shares can be found in the sub-

sequent note on "Treasury shares".

Share premium reserve

This amounts to Euro 485,873 thousand at 31 December

2014, the same as at 31 December 2013.

Capital increase costs

This reserve, which reports a post-tax negative balance of

Euro 4,506 thousand at 31 December 2014, relates to the

costs incurred for the capital increase serving the public

mixed exchange and cash offer for the ordinary shares of

Draka Holding B.V., announced on 22 November 2010 and

formalised on 5 January 2011.

Legal reserve

This amounts to Euro 4,292 thousand at 31 December 2014,

and is Euro 1 thousand higher than at 31 December 2013