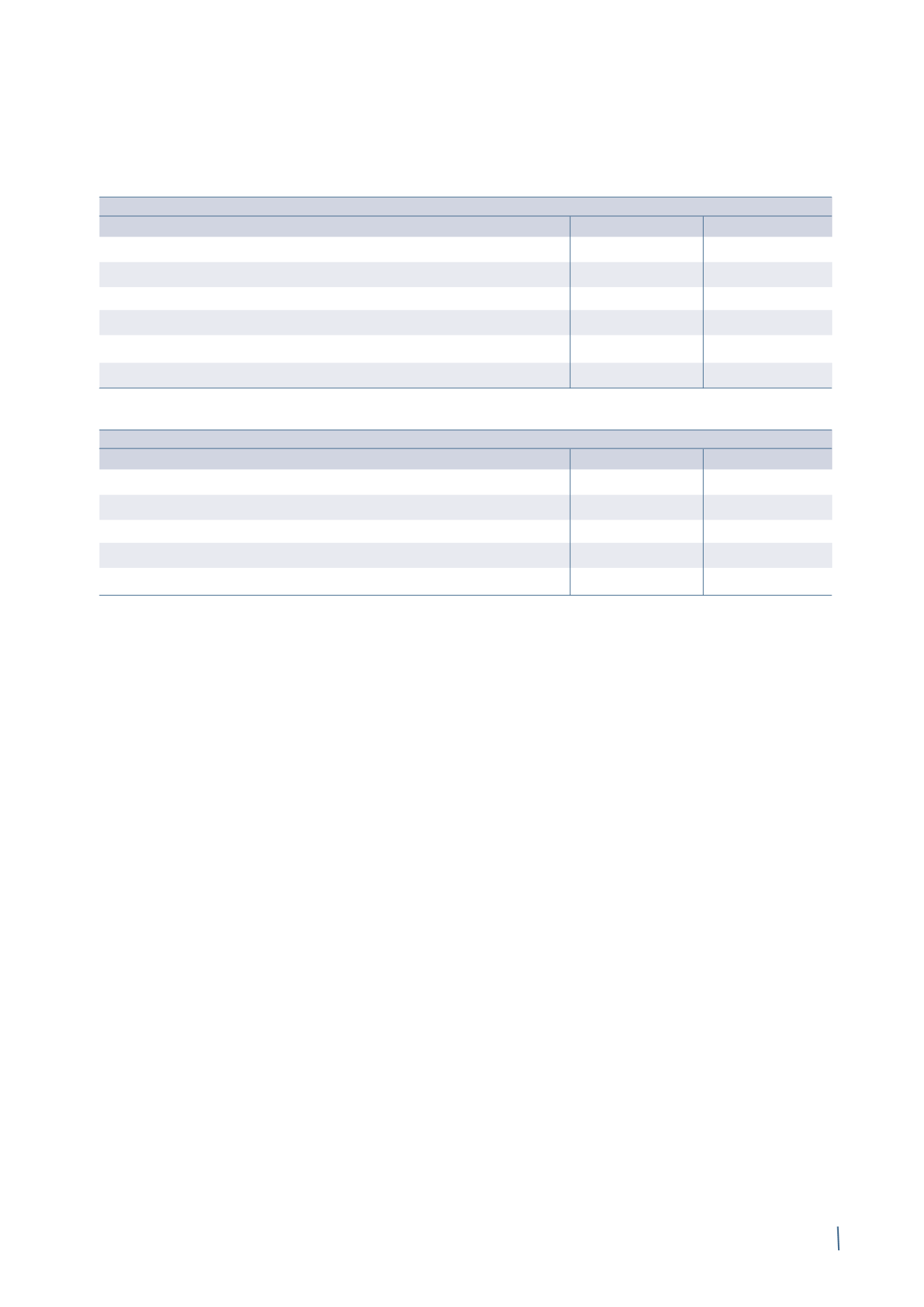

305

31 December 2013

Total lines

Used

Unused

Term Loan Facility 2010

87,916

(87,916)

-

Term Loan Facility 2011

400,000

(400,000)

-

Total Credit Agreements

487,916

(487,916)

-

EIB Loan

100,000

-

100,000

Total

587,916

(487,916)

100,000

At the Group level there is also another committed facility

in the form of the Revolving Credit Facility 2011 for Euro 400

million. This line is available to a certain number of Group

companies, including Prysmian S.p.A..

As at 31 December 2014 and 31 December 2013, the Company

had not drawn down the above Group credit facility.

More details about the nature and drawdown of the

Group-level facilities shown above can be found in the Ex-

planatory Notes to the Consolidated Financial Statements

(Note 12. Borrowings from banks and other lenders).

Bonds

Prysmian S.p.A. has the following bonds outstanding as at 31

December 2014:

Non-convertible bond

Further to the resolution adopted by the Board of Directors on

3 March 2010, Prysmian S.p.A. completed the placement of

an unrated bond with institutional investors on the Eurobond

market on 30 March 2010 for a total nominal amount of Euro

400 million. The bond, with an issue price of Euro 99.674, has

a 5-year term and pays a fixed annual coupon of 5.25%. The

bond settlement date was 9 April 2010. The bond has been

admitted to the Luxembourg Stock Exchange's official list

and is traded on the related regulated market. The fair value

of the non-convertible bond at 31 December 2014 was Euro

410,468 thousand (Euro 417,440 thousand at 31 December

2013). Fair value has been determined with reference to the

quoted price in the relevant market.

Convertible bond

On 4 March 2013, the Board of Directors approved the

placement of an Equity Linked Bond, referred to as

"€300,000,000 1.25 per cent. Equity Linked Bonds due

2018", maturing on 8 March 2018 and reserved for qualified

investors.

On 16 April 2013, the Shareholders' Meeting authorised the

convertibility of the Bond at a value of Euro 22.3146 per

share. As a result, the shareholders approved the proposal to

increase share capital for cash, in single or multiple issues,

with the exclusion of pre-emptive rights under art. 2441, par.

5 of the Italian Civil Code, by a maximum nominal amount

of Euro 1,344,411.30, by issuing, in single or multiple instal-

ments, up to 13,444,113 ordinary shares of the Company with

the same characteristics as its other outstanding ordinary

shares.

The following tables summarise the Committed Lines available to the Company at 31 December 2014 and 31 December 2013:

31 December 2014

Total lines

Used

Unused

Term Loan Facility 2011

400,000

(400,000)

-

Syndacated Revolving Credit Facility 2014

1,000,000

-

1,000,000

Total Credit Agreements

1,400,000

(400,000)

1,000,000

Revolving Credit Facility 2014

100,000

(30,000)

70,000

EIB Loan

100,000

(100,000)

-

Total

1,600,000

(530,000)

1,070,000

(in thousands of Euro)

(in thousands of Euro)