Parent Company Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

308

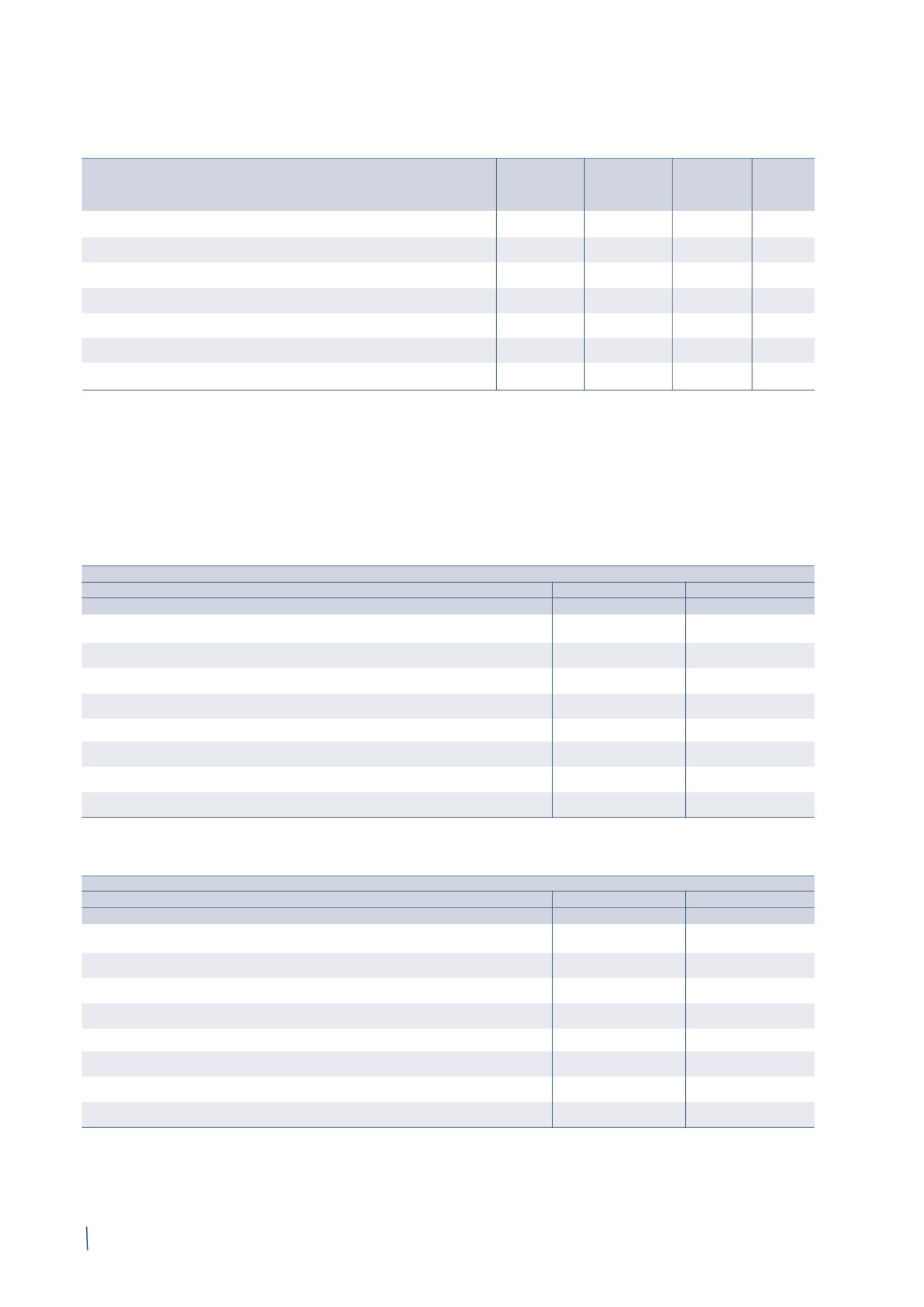

(1) "Drawdowns/New funds" pertaining to the convertible bond are stated net of the equity component of Euro 39,632 thousand and of Euro 3,341 thousand in

related expenses.

(2) Includes the accelerated amortisation of Euro 2,230 thousand in bank fees following the early repayments of the Credit Agreement 2010.

The following tables provide a breakdown of borrowings from banks and other lenders by maturity and currency at 31 December

2014 and 2013:

Credit Agreements

Non-

Convertible

Other

Total

convertible

bond

(1)

borrowings

bond

Balance at 31 December 2012

713,033

412,819

-

722 1,126,574

Drawdowns/new funds

-

-

257,027

11,587

268,614

Repayments

(232,084)

-

-

(92)

(232,176)

Amortisation of bank and financial fees and other expenses

(2)

4,410

1,062

461

-

5,933

Interest and other movements

(565)

-

7,100

(359)

6,176

Total movements

(228,239)

1,062

264,588

11,136 48,547

Balance at 31 December 2013

484,794

413,881

264,588

11,858 1,175,121

31 December 2014

Variable rate

Fixed rate

Euro

Euro

Total

Due within 1 year

40,036

416,184

456,220

Due between 1 and 2 years

415,393

-

415,393

Due between 2 and 3 years

17,070

271,537

288,607

Due between 3 and 4 years

17,075

-

17,075

Due between 4 and 5 years

17,102

-

17,102

Due after more than 5 years

33,921

-

33,921

Total

540,597

687,721

1,228,318

Average interest rate in period, as per contract

1.6%

4.9%

3.5%

31 December 2013

Variable rate

Fixed rate

Euro

Euro

Total

Due within 1 year

88,579

16,491

105,070

Due between 1 and 2 years

418

398,575

398,993

Due between 2 and 3 years

397,403

-

397,403

Due between 3 and 4 years

436

-

436

Due between 4 and 5 years

447

263,401

263,848

Due after more than 5 years

9,371

-

9,371

Total

496,654

678,467

1,175,121

Average interest rate in period, as per contract

1.6%

4.9%

3.5%

(in thousands of Euro)

(in thousands of Euro)

(in thousands of Euro)