307

The finance lease obligation (Euro 11,144 thousand at 31 December 2014) is reconciled with outstanding payments as follows:

The finance lease obligation is analysed by maturity as follows:

Credit

EIB Revolving Credit

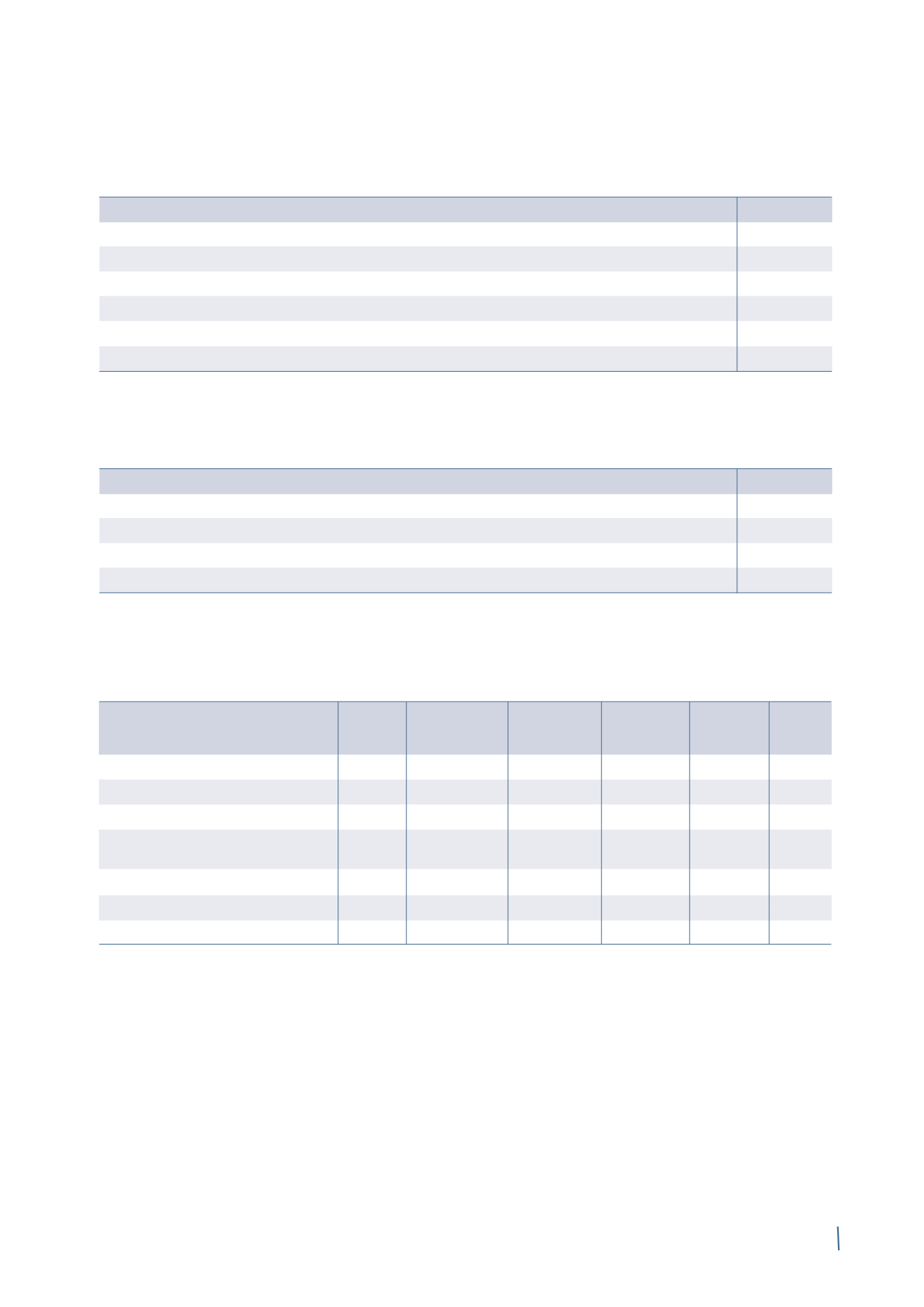

Non-convertible

Convertible

Other

Total

Agreements

Loan

Facility 2014

bond

bond borrowings

Balance at 31 December 2013

484,794

-

-

413,881

264,588

11,858 1,175,121

Drawdowns/new funds

-

99,850

30,000

-

-

-

129,850

Repayments

(87,916)

-

-

-

-

(491)

(88,407)

Amortisation of bank and financial

fees and other expenses

(1)

1,932

29

-

1,116

607

-

3,684

Interest and other movements

(53)

521

232

-

7,528

(158)

8,070

Total movements

(86,037)

100,400

30,232

1,116

8,135

(649)

53,197

Balance at 31 December 2014

398,757

100,400

30,232

414,997

272,723

11,209 1,228,318

(1) Includes the accelerated amortisation of Euro 1,643 thousand in bank fees following the early repayments of the Credit Agreement 2010.

31 December 2014 31 December 2013

Due within 1 year

699

778

Due between 1 and 5 years

2,563

2,605

Due after more than 5 years

9,960

10,626

Minimum finance lease payments

13,222

14,009

Future interest costs

(2,078)

(2,374)

Finance lease obligations

11,144

11,635

31 December 2014 31 December 2013

Due within 1 year

467

537

Due between 1 and 5 years

1,773

1,729

Due after more than 5 years

8,904

9,369

Total

11,144

11,635

(in thousands of Euro)

(in thousands of Euro)

The following tables report movements in borrowings from banks and other lenders:

(in thousands of Euro)