293

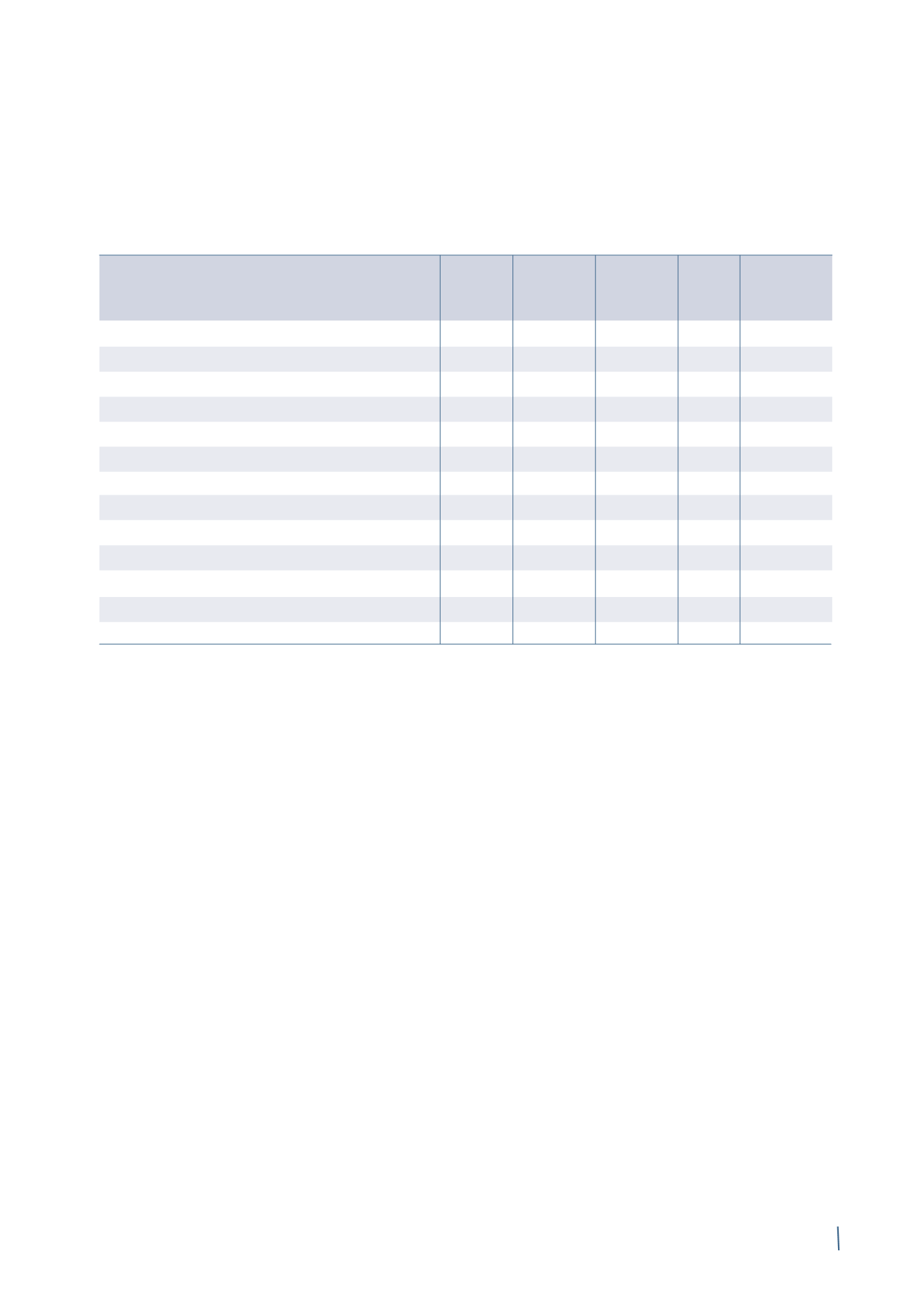

With a balance of Euro 1,818,399 thousand at 31 December 2014, these investments report the following movements over the year:

3.

INVESTMENTS IN SUBSIDIARIES

The change of Euro 89,883 thousand in the value of invest-

ments in subsidiaries is mainly attributable to the following

transactions:

• on 1 February 2014, as part of the corporate rationalisa-

tion following acquisition of the Draka Group, Prysmian

(Dutch) Holdings B.V., a company owned by the sub-

sidiary Prysmian Cavi e Sistemi S.r.l., was merged with

Draka Holding B.V.. This transaction, effective 1 January

2014 for accounting purposes, has increased the interest

of Prysmian Cavi e Sistemi S.r.l. in Draka Holding B.V. to

47.83%, and decreased the interest of Prysmian S.p.A. in

the same subsidiary from 63.43% to 52.17%;

• on 19 February 2014, the Ansaldo 20 property complex,

located in Milan, was spun off from the subsidiary Fibre

Ottiche Sud – F.O.S. S.r.l. to Prysmian S.p.A., more details

of which can be found in Note 1. Property, plant and

equipment. This spin-off, which was effective 1 March

2014, has led to a reduction of Euro 14,772 thousand in

the value of the investment in Fibre Ottiche Sud – F.O.S.

S.r.l.;

• on 8 April 2014, the share capital of the subsidiary

Prysmian PowerLink S.r.l. was increased by Euro 50,000

thousand;

• on 8 August 2014, a capital contribution of Euro 5,000

thousand was paid to the subsidiary Fibre Ottiche Sud –

F.O.S. S.r.l;

• on 26 August 2014, capital contributions were paid

to the subsidiaries Prysmian PowerLink S.r.l. (Euro

30,000 thousand) and Draka Holding B.V. (Euro 33,000

thousand);

• increases totalling Euro 3,120 thousand for the compen-

sation-related component of stock options over Prysmian

S.p.A. shares held by managers employed by other Group

companies, as explained in Note 17. Personnel costs. This

component has been treated like a capital contribution

and so reported as an increase in the value of the invest-

ments in the subsidiaries in which the plan beneficiaries

are directly or indirectly employees. These increases are

matched by a corresponding movement in the specific

equity reserve. Further information can be found in Note

9. Share capital and reserves.

The Company reviews the carrying amounts of its invest-

ments in accordance with the policy set out in Section B.

Accounting policies. In particular, as a result of impairment

testing, the Company has recognised an impairment loss of

Euro 16,465 thousand against the value of its investment in

Fibre Ottiche Sud – F.O.S. S.r.l..

31 December 2013

Capital

(Impairment)/

Capital

Effect 31 December 2014

contributions

Reversal of contributions of partial

impairment of

for stock spin-off

investments

options

Prysmian Cavi e Sistemi S.r.l.

278,522

-

-

449

-

278,971

Draka Holding B.V.

1,216,954

33,000

-

1,652

-

1,251,606

Prysmian Cavi e Sistemi Italia S.r.l.

49,159

-

-

712

-

49,871

Prysmian Power Link Srl

63,586

80,000

-

307

-

143,893

Fibre Ottiche Sud - F.O.S. S.r.l.

80,383

5,000

(16,465)

-

(14,772)

54,146

Prysmian Treasury Srl

37,757

-

-

-

-

37,757

Prysmian Kabel und Systeme GmbH

2,154

-

-

-

-

2,154

Prysmian Kablo SRO

1

-

-

-

-

1

Prysmian Pension Scheme Trustee Limited

-

-

-

-

-

-

Prysmian Surflex Umbilicais e Tubos Flexiveis do Brasil Ltda

-

-

-

-

-

-

Jaguar Communication Consultancy Services Private Ltd.

-

-

-

-

-

-

Prysmian Energia Cabos e Sistemas do Brasil S.A.

-

-

-

-

-

-

Total investments in subsidiaries

1,728,516

118,000

(16,465)

3,120 (14,772)

1,818,399

(in thousands of Euro)