287

The Company's objective in capital risk management is mainly

to safeguard business continuity in order to guarantee returns

for shareholders and benefits for other stakeholders. The

Company also aims to maintain an optimal capital structure in

order to reduce the cost of debt and to comply with a series of

covenants under the various credit agreements (Note 10. Bor-

rowings from banks and other lenders and Note 29. Financial

covenants).

The fair value of financial instruments quoted in an active

market is based on market price at the reporting date. The

market price used for derivatives is the bid price, while for

financial liabilities the ask price is used.

The fair value of instruments not listed on an active market

is determined using valuation techniques based on a series of

methods and assumptions linked to market conditions at the

reporting date.

The change in the gearing ratio is largely attributable to:

• the increase of Euro 113,714 thousand in the net financial

position, mainly due to the greater liquidity available

to the Company after contracting the EIB Loan and the

C.1 CAPITAL RISK MANAGEMENT

C.2 FAIR VALUE

The Company monitors capital on the basis of its gearing

ratio (i.e. the ratio between net financial position and capital).

Details of how the net financial position is determined can be

found in Note 10. Borrowings from banks and other lenders.

Capital is defined as the sum of equity and the net financial

position.

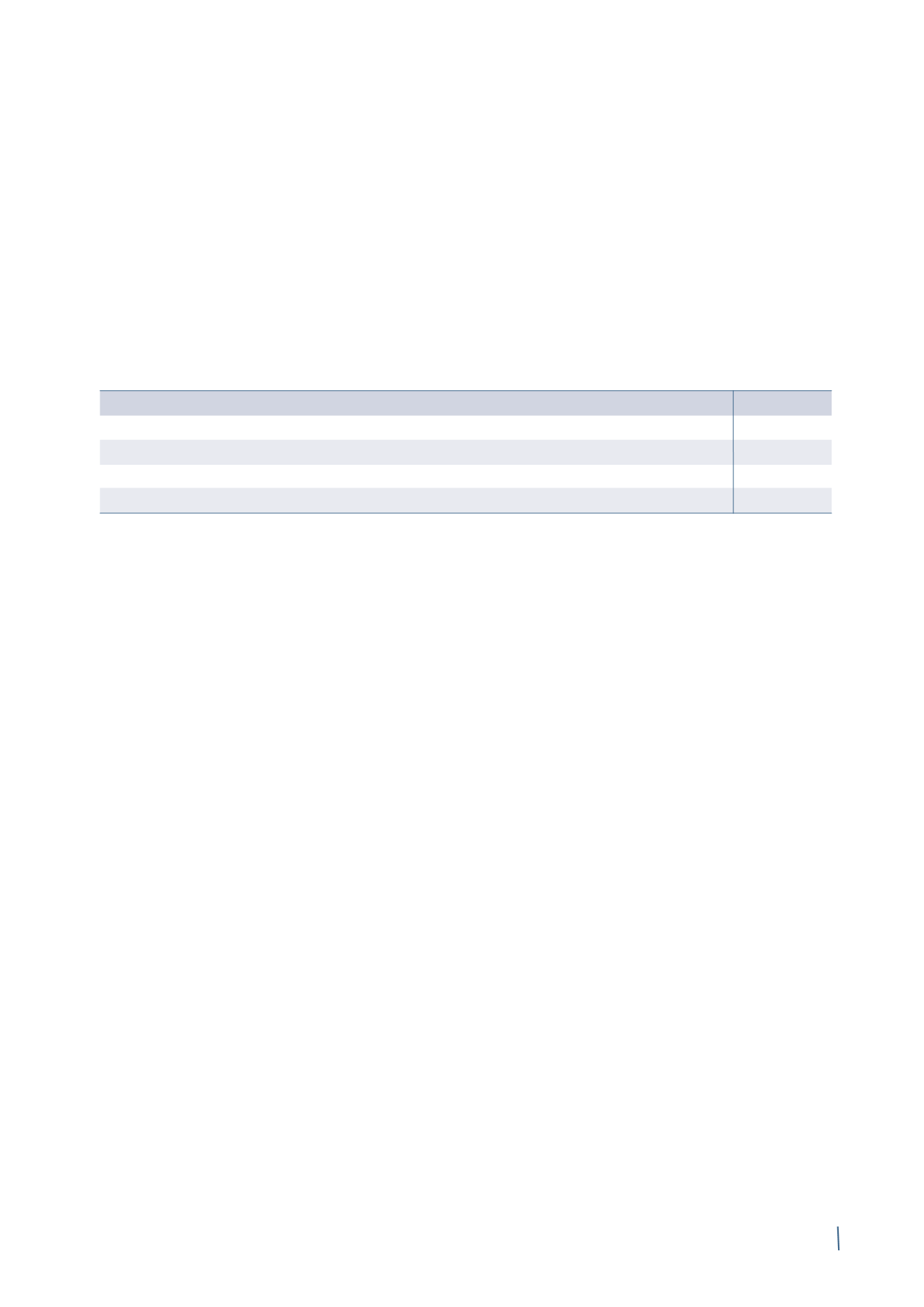

The gearing ratios at 31 December 2014 and 31 December 2013

are shown below:

Other techniques, such as that of estimating discounted cash

flows, are used for the purposes of determining the fair value

of other financial instruments.

Given the short-termnature of trade receivables and payables,

their book values, net of any allowance for doubtful accounts,

are treated as a good approximation of fair value.

Revolving Credit Facility 2014;

• the increase of Euro 85,975 thousand in equity, reflecting

an improvement in net profit, more details of which can

be found in Note 9. Share capital and reserves.

31 December 2014 31 December 2013

Net financial position

726,381

612,667

Equity

1,107,027

1,021,052

Total capital

1,833,408

1,633,719

Gearing ratio

40%

38%

(in thousands of Euro)