Consolidated Financial Report |

DIRECTORS’ REPORT

2014 Annual Report

Prysmian Group

68

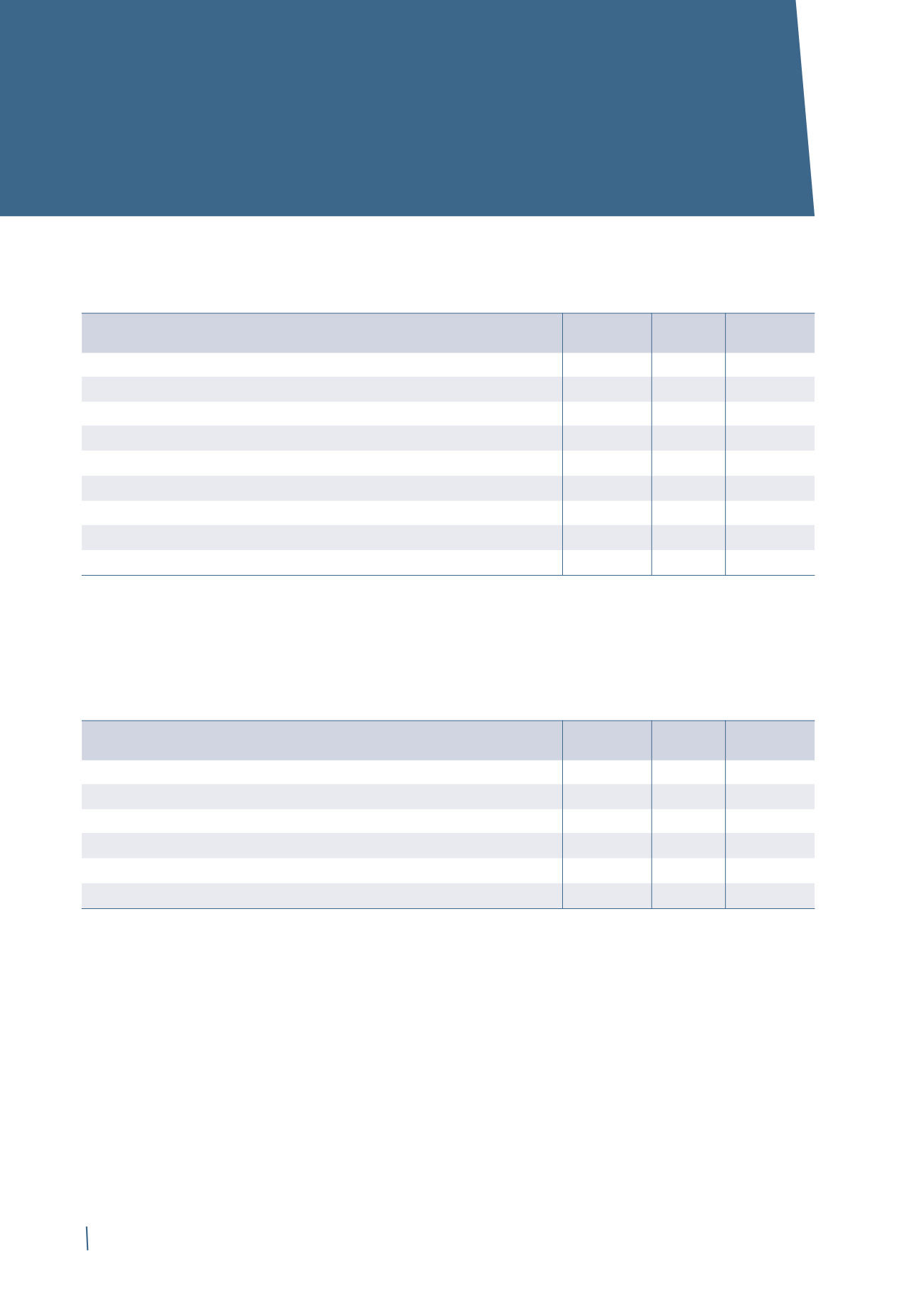

GROUP STATEMENT

OF FINANCIAL POSITION

31 December

31 December

Change 31 December

2014

2013 (*)

2012 (*)

Net fixed assets

2,219

2,207

12

2,301

Net working capital

407

386

21

433

Provisions

(281)

(297)

16

(355)

Net capital employed

2,345

2,296

49

2,379

Employee benefit obligations

360

308

52

344

Total equity

1,183

1,183

-

1,147

of which attributable to non-controlling interests

33

36

(3)

35

Net financial position

802

805

(3)

888

Total equity and sources of funds

2,345

2,296

49

2,379

31 December

31 December

Change 31 December

2014

2013 (*)

2012 (*)

Property, plant and equipment

1,414

1,390

24

1,484

Intangible assets

561

588

(27)

608

Equity-accounted investments

225

205

20

193

Available-for-sale financial assets

12

12

-

12

Assets held for sale

7

12

(5)

4

Net fixed assets

2,219

2,207

12

2,301

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11.

RECLASSIFIED STATEMENT OF FINANCIAL POSITION

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11.

NET FIXED ASSETS

Net fixed assets amounted to Euro 2,219 million at 31

December 2014, compared with Euro 2,207 million at 31

December 2013, posting an increase of Euro 12 million mainly

due to the combined effect of the following factors:

• Euro 163 million in investments in property, plant and

equipment and intangible assets;

• Euro 188 million in depreciation, amortisation and impair-

ment charges and reversals for the year;

• Euro 20 million for the net increase in equity-accounted

investments. This increase mainly consists of Euro 43

million for the share of net profit/(loss) of equity-account-

ed companies, net of Euro 36 million in dividend receipts,

and Euro 8 million as the positive effect of the share

dilution relating to Yangtze Optical Fibre and Cable Joint

Stock Limited Company;

• Euro 6 million in disposals of assets held for sale;

• Euro 24million in positive currency translation differences.

(in millions of Euro)

(in millions of Euro)