Consolidated Financial Report |

DIRECTORS’ REPORT

2014 Annual Report

Prysmian Group

72

The net financial position of Euro 802 million at 31 December

2014 has decreased by Euro 3 million from Euro 805 million

at 31 December 2013. The main factors affecting the year-end

balance were:

• generation of Euro 400 million in cash from operating

activities (before changes in net working capital);

• substantial stability in net working capital (increase of

Euro 1 million);

• payment of Euro 72 million in taxes;

• receipt of Euro 36 million in dividends from investments

in equity-accounted companies, up from the previous

year following the extraordinary dividend of Euro 21

million distributed by Yangtze Optical Fibre and Cable

Joint Stock Limited Company;

• net receipt of Euro 9 million from business combinations

(comprising the net receipt of Euro 15 million upon com-

pleting the purchase price adjustment process for the

acquisition of Global Marine Systems Energy Ltd, and

the payment of Euro 6 million to acquire the remaining

34% of the subsidiary AS Draka Keila Cables);

• net operating investments of Euro 155 million;

• payment of Euro 110 million in net finance costs;

• payment of Euro 90 million in dividends;

• purchase of treasury shares for Euro 20 million.

More details about the change in net financial position can

be found in the subsequent comments accompanying the

statement of cash flows.

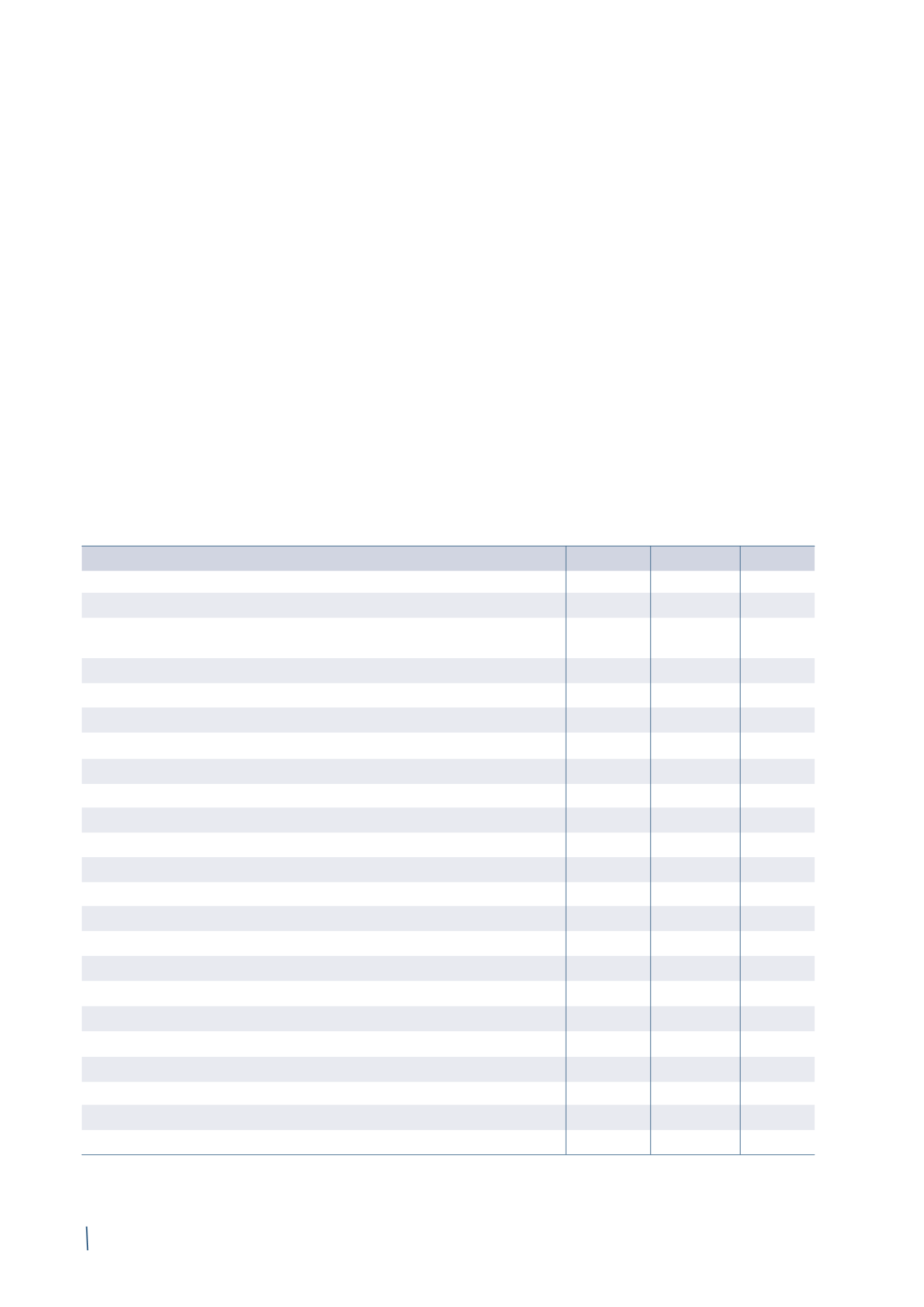

2014

2013 (*)

Change

2012 (*)

EBITDA

496

563

(67)

549

Changes in provisions (including employee benefit obligations)

(23)

(69)

46

13

(Gains)/losses on disposal of property, plant and equipment,

intangible assets and non-current assets

(8)

(7)

(1)

(14)

Share of net profit/(loss) of equity-accounted companies

(43)

(35)

(8)

(31)

Acquisition price adjustment

(1)

(22)

-

(22)

-

Net cash flow provided by operating activities (before changes in net working capital)

400

452

(52)

517

Changes in net working capital

(1)

(6)

5

69

Taxes paid

(72)

(60)

(12)

(72)

Dividends from investments in equity-accounted companies

36

16

20

16

Net cash flow provided/(used) by operating activities

363

402

(39)

530

Acquisitions

9

-

9

(86)

Net cash flow used in operational investing activities

(155)

(107)

(48)

(129)

Free cash flow (unlevered)

217

295

(78)

317

Net finance costs

(110)

(124)

14

(126)

Free cash flow (levered)

107

171

(64)

191

Increases in share capital and other changes in equity

(20)

-

(20)

1

Dividend distribution

(90)

(92)

2

(44)

Net cash flow provided/(used) in the year

(3)

79

(82)

148

Opening net financial position

(805)

(888)

83

(1.026)

Net cash flow provided/(used) in the year

(3)

79

(82)

148

Convertible bond equity component

-

39

(39)

-

Other changes

6

(35)

41

(10)

Closing net financial position

(802)

(805)

3

(888)

STATEMENT OF CASH FLOWS

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit (loss) of associates and joint ventures.

(1) This refers to the acquisition in November 2012 of Global Marine Systems Energy Ltd (now renamed Prysmian PowerLink Services Ltd) from Global Marine

Systems Ltd.

(in milions of Euro)