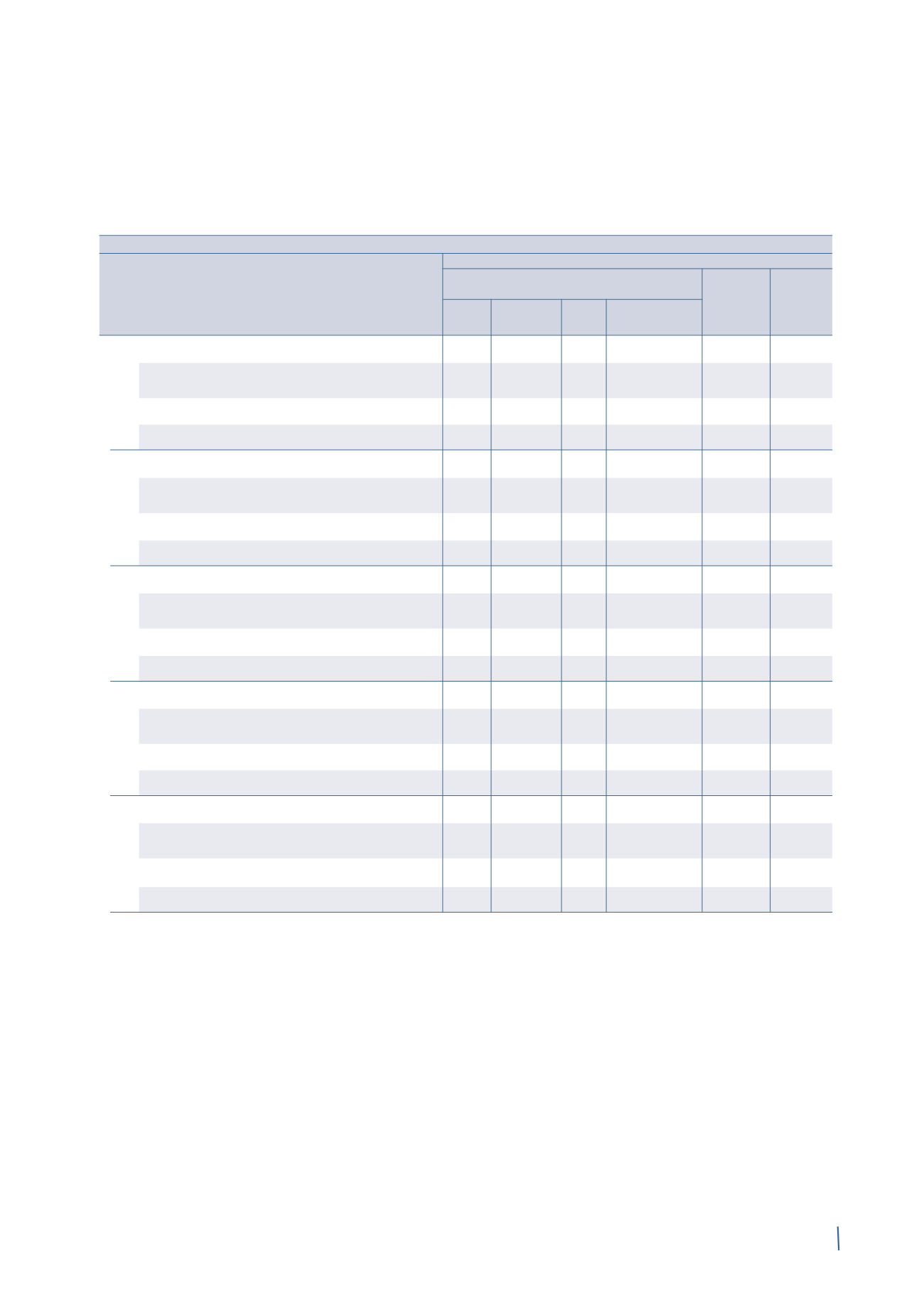

83

INCOME STATEMENT

Alternative performance indicators for 2013

2013

Published (*)

Restated

Energy - Products

Energy -

Total

Projects

Energy

E&I

Industrial

Other

Total Products

& NWC

Sales

2,217

833

136

-

969

1,248

2,217

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

282

42

24

-

66

216

282

Adjusted EBITDA

287

48

24

-

72

215

287

Adjusted operating income

247

36

21

-

57

190

247

Sales

1,914 1,914

-

-

1,914

-

1,914

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

71

71

-

-

71

-

71

Adjusted EBITDA

79

79

-

-

79

-

79

Adjusted operating income

54

54

-

-

54

-

54

Sales

1,764

-

1,652

-

1,652

112

1,764

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

134

-

117

1

118

16

134

Adjusted EBITDA

133

-

117

-

117

16

133

Adjusted operating income

97

-

95

-

95

2

97

Sales

114

-

-

114

114

-

114

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

4

-

-

4

4

-

4

Adjusted EBITDA

8

-

-

8

8

-

8

Adjusted operating income

4

-

-

4

4

-

4

Sales

6,009 2,747

1,788 114

4,649

1,360

6,009

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

491

113

141

5

259

232

491

Adjusted EBITDA

507

127

141

8

276

231

507

Adjusted operating income

402

90

116

4

210

192

402

Utilities

Trade & Installers

Industrial

Other

Energy

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit (loss) of associates and joint ventures.

(in millions of Euro)