171

Gross investments in intangible assets amount to Euro 18

million in 2013, and primarily refer to:

• Euro 8 million for development of the SAP Consolidation

project, aimed at standardising the information system

throughout the Group. In 2013 the new system was rolled

out to the following countries in Europe: Czech Republic,

Norway, Denmark and Sweden.

• Euro 3 million for the Brazilian subsidiary’s development of

a prototype destined for flexible pipe production.

As at 31 December 2013, the Prysmian Group had capitalised

Euro 394 million in Goodwill; this figure has been remeasured

as a result of the following:

• finalisation of the fair value of the assets and liabilities of

Global Marine Systems Energy Ltd (now renamed Prysmian

PowerLink Services Ltd): leading to a restatement of the

amounts recognised at 31 December 2012 by a total of Euro

11 million. Goodwill recognised in respect of this company

amounts to Euro 38 million at 31 December 2013.

• finalisation of the values for the acquisition of a majority

interest in Telcon Fios e para Telecomuniçaoes Cabos

S.A., resulting in an increase of Euro 2 million. Goodwill

recognised in respect of this company amounts to Euro 6

million at 31 December 2013.

Further details can be found in Section F. Business

combinations.

Goodwill impairment test

As reported earlier, the Chief Executive Officer reviews

operating performance by macro type of business (Energy and

Telecom). Goodwill is monitored internally at the Energy and

Telecom operating segment level.

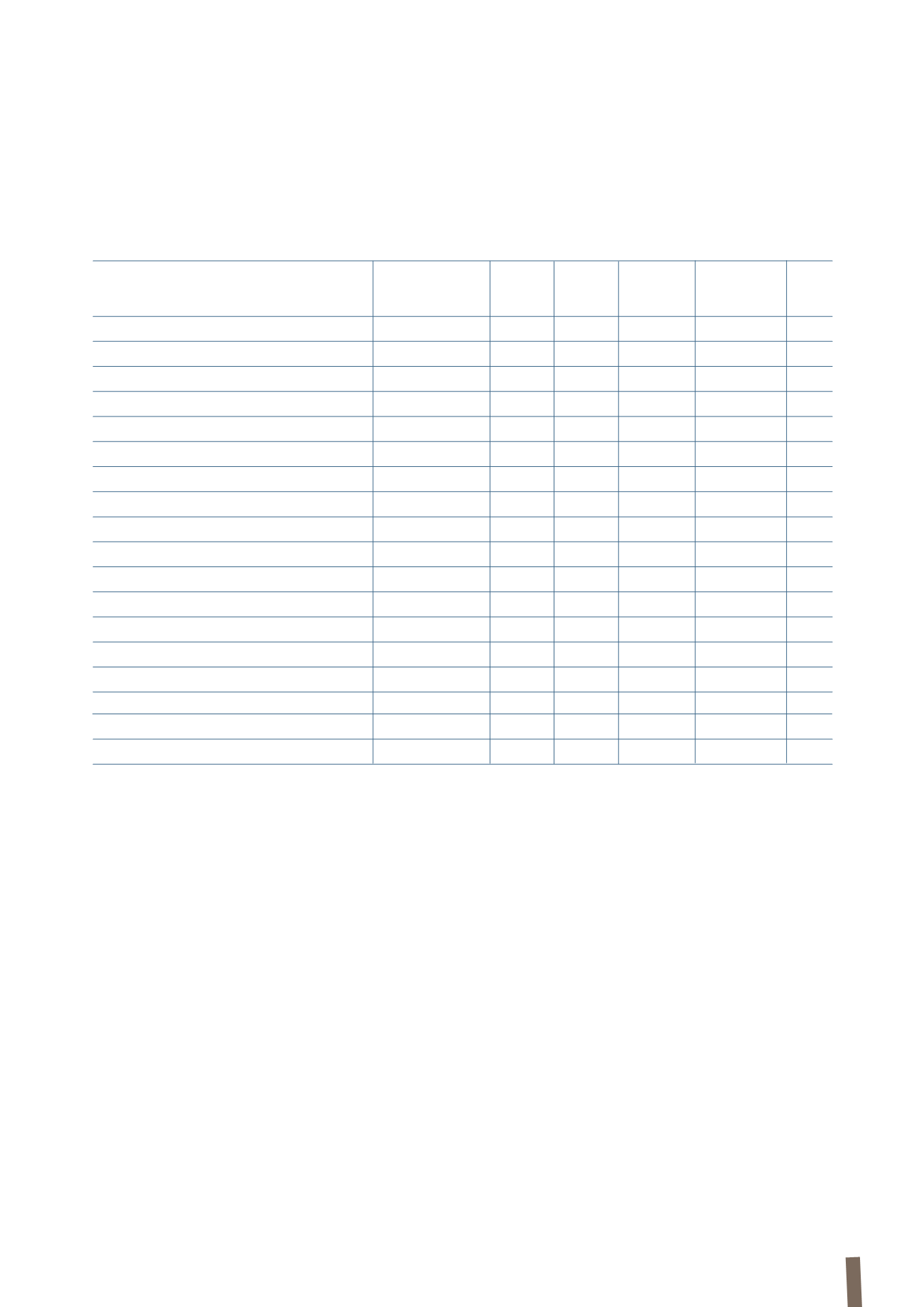

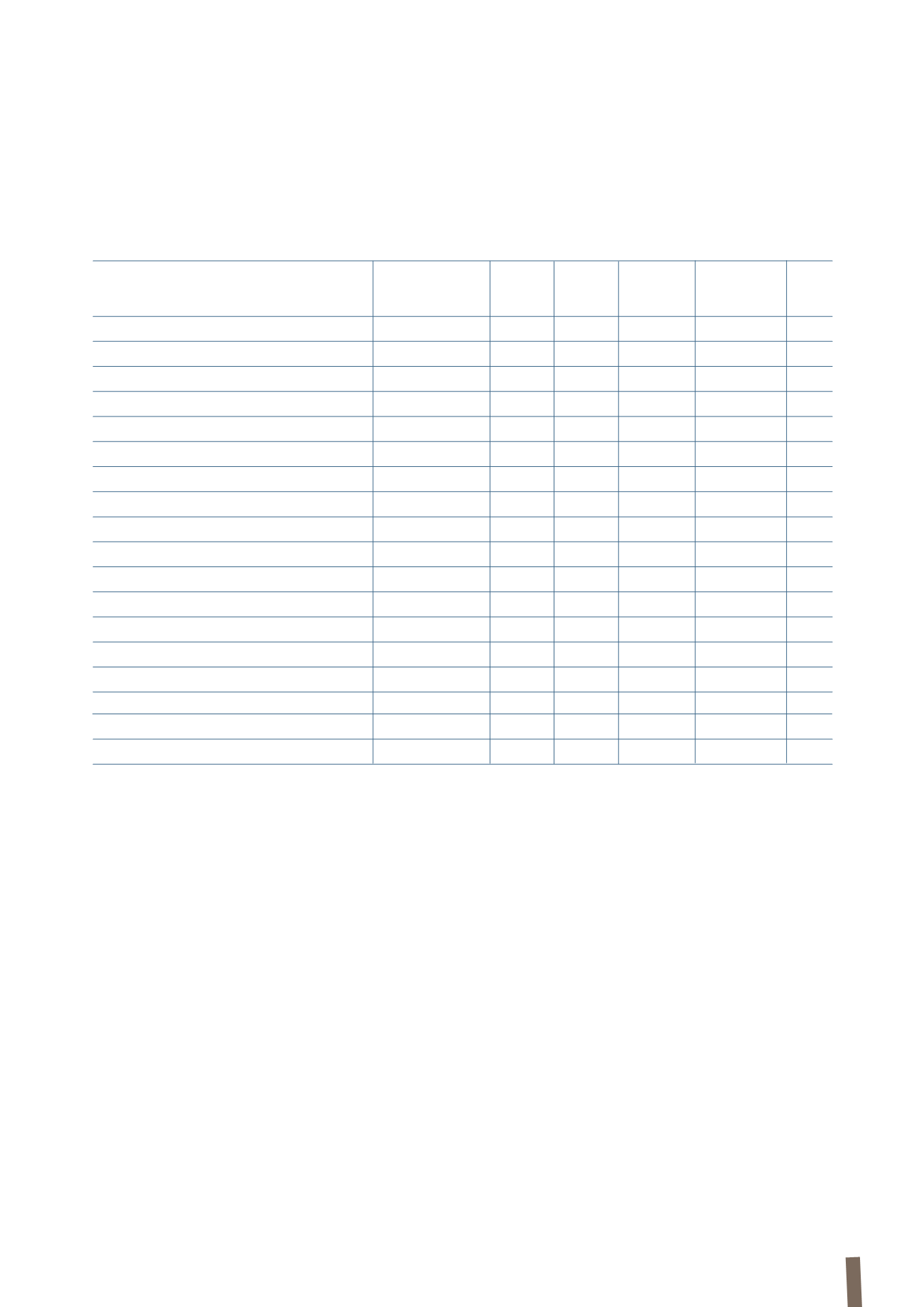

(in millions of Euro)

Patents

Concessions,

Goodwill

Software

Other

Intangibles in

Total

licences, trademarks

intangible progress and

and similar rights

assets

advances

Balance at 31 December 2011

34

4

352

35

179

14

618

Movements in 2012:

- Business combinations

-

-

53

-

2

-

55

- Business combinations restatement (*)

(11)

(11)

- Effects of deconsolidation

-

-

-

-

-

-

-

- Investments

2

1

-

2

-

8

13

- Internally generated intangible assets

-

-

-

3

-

4

7

- Disposals

-

-

-

-

-

-

-

- Amortisation

(9)

(1)

-

(10)

(15)

-

(35)

- Impairment

-

-

-

-

-

-

-

- Currency translation differences

-

-

-

-

(1)

(1)

(2)

- Other

-

-

-

4

1

(6)

(1)

Total movements

(7)

-

42

(1)

(13)

5

26

Balance at 31 December 2012

27

4

394

34

166

19

644

Of which:

- Historical cost

46

52

414

68

216

19

815

- Accumulated amortisation and impairment

(19)

(48)

(20)

(34)

(50)

-

(171)

Net book value

27

4

394

34

166

19

644

(*) The “Business combinations restatement” at 31 December 2012 relates to the Goodwill of Global Marine Systems Energy Ltd (now renamed Prysmian

PowerLink Services Ltd).