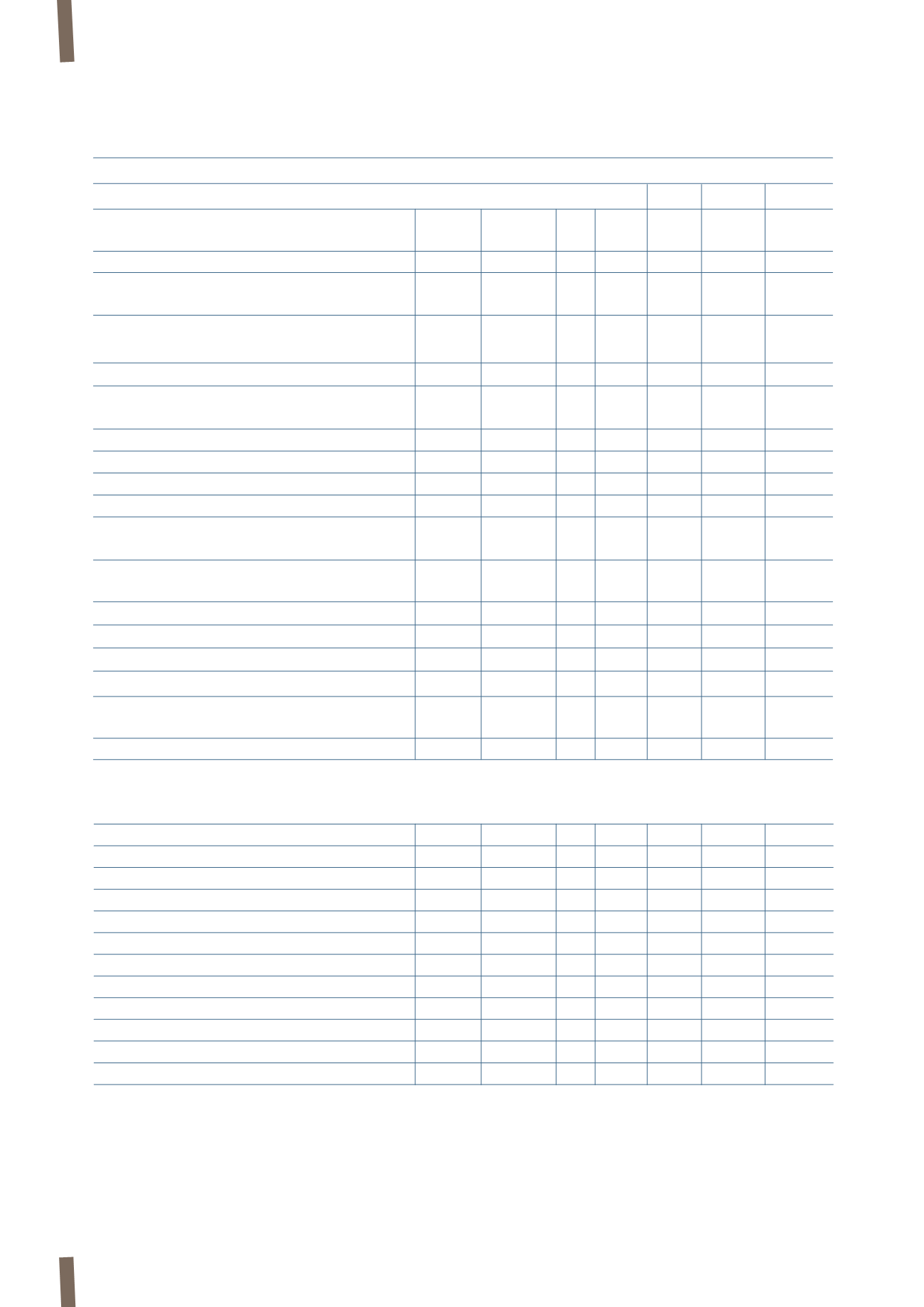

CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

166

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

(in millions of Euro)

2012 (*)

Energy Telecom Corporate Group total

Utilities

Trade & Industrial Other

Total

Installers

Sales of goods and services to third parties

(1)

2,287

2,159

1,801 135 6,382 1,466

-

7,848

Adjusted EBITDA (A)

270

77

139

1

487

160

-

647

% of sales

11.8% 3.6%

7.7% 0.6% 7.6% 10.9%

8.2%

EBITDA (B)

265

37

119 (4)

417

138

(9)

546

% of sales

11.6% 1.7% 6.6%

6.5% 9.4%

7.0%

Amortisation and depreciation (C)

(36)

(28)

(40)

(4)

(108)

(56)

-

(164)

Adjusted operating income (A+C)

234

49

99 (3)

379

104

483

% of sales

10.2% 2.3% 5.5%

5.9% 7.1%

6.2%

Fair value change in metal derivatives (D)

14

Fair value - stock options (E)

(17)

Remeasurement of minority put option liability (F)

-

-

-

-

-

-

7

Impairment of assets (G)

(3)

(5)

(15)

-

(23)

(1)

(24)

Operating income (B+C+D+E+F+G)

362

% of sales

4.6%

Share of net profit/(loss) of associates and

dividends from other companies

15

2

17

Finance costs

(395)

Finance income

258

Taxes

(73)

Net profit/(loss) for the year

169

Attributable to:

Owners of the parent

166

Non-controlling interests

3

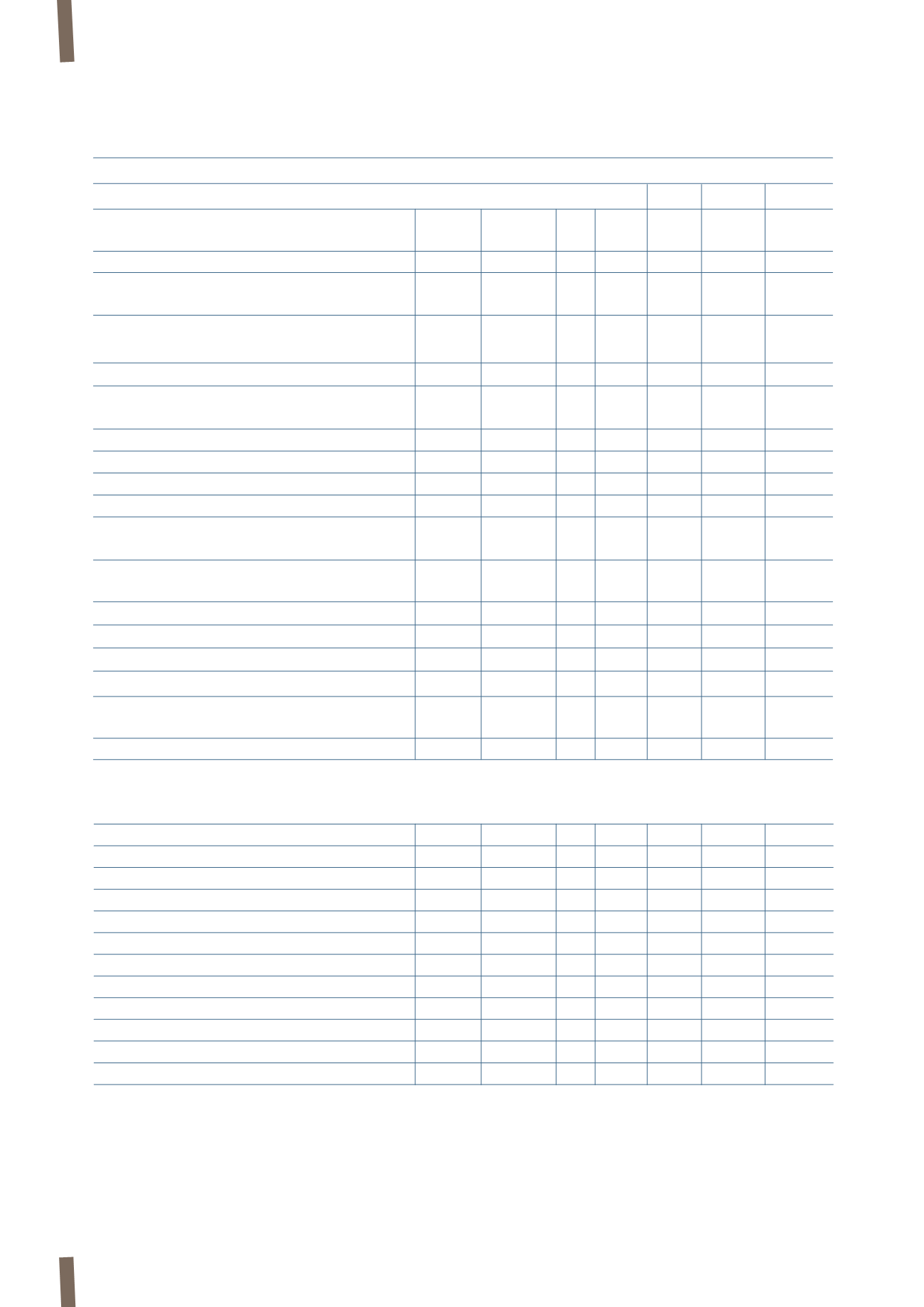

RECONCILIATION OF EBITDA TO ADJUSTED EBITDA

EBITDA (A)

265

37

119

(4)

417

138

(9)

546

Non-recurring expenses/(income):

Company reorganisation

3

29

16

5

53

16

5

74

Antitrust investigations

1

-

-

-

1

-

-

1

Draka integration costs

-

2

2

-

4

1

4

9

Tax inspections

-

-

-

1

1

2

-

3

Environmental remediation and other costs

-

1

2

-

3

-

-

3

Italian pensions reform

1

-

-

-

1

-

-

1

Other non-recurring expenses

2

8

-

-

10

3

-

13

Gains on asset disposals

(2)

-

-

(1)

(3)

-

-

(3)

Total non-recurring expenses/(income) (B)

5

40

20

5

70

22

9

101

Adjusted EBITDA (A+B)

270

77

139

1

487

160

-

647

(1) The sales of the operating segments and business areas are reported net of intercompany transactions, consistent with the presentation adopted in 2013.

(*) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December 2012.