157

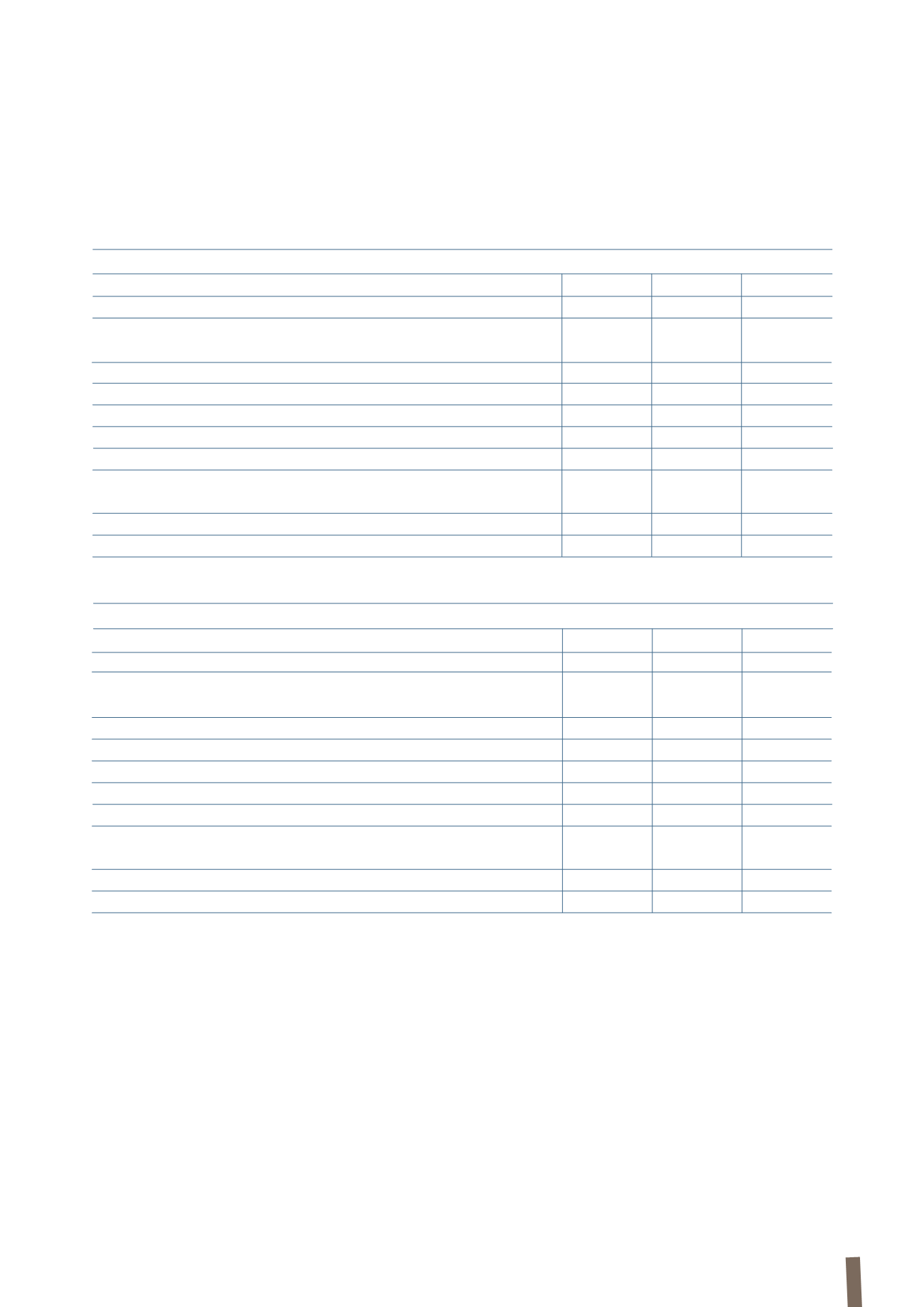

(in millions of Euro)

31 December 2012

Level 1

Level 2

Level 3

Total

Assets

Financial assets at fair value through profit or loss:

Derivatives

3

7

-

10

Financial assets held for trading

74

4

-

78

Hedging derivatives

-

9

-

9

Available-for-sale financial assets

1

-

13

14

Total assets

78

20

13

111

Liabilities

Financial liabilities at fair value through profit or loss:

Derivatives

8

8

-

16

Hedging derivatives

-

49

-

49

Total liabilities

8

57

-

65

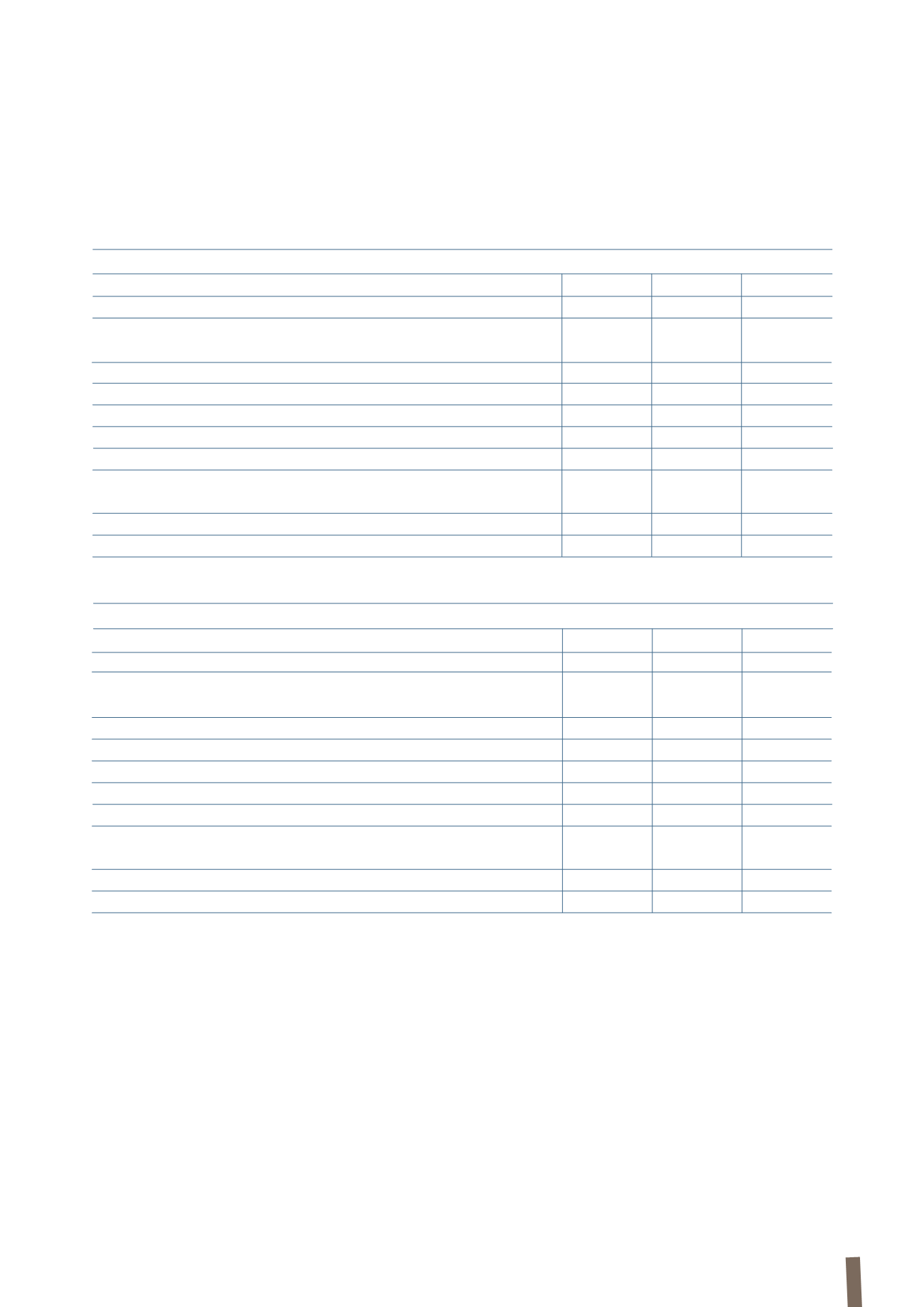

(in millions of Euro)

31 December 2013

Level 1

Level 2

Level 3

Total

Assets

Financial assets at fair value through profit or loss:

Derivatives

5

15

-

20

Financial assets held for trading

87

7

-

94

Hedging derivatives

-

5

-

5

Available-for-sale financial assets

1

-

14

15

Total assets

93

27

14

134

Liabilities

Financial liabilities at fair value through profit or loss:

Derivatives

18

18

36

Hedging derivatives

13

13

Total liabilities

18

31

-

49

The following tables present the assets and liabilities that are measured at fair value:

Financial assets classified in fair value Level 3 reported no

significant movements in either 2013 or 2012.

Given the short-term nature of trade receivables and payables,

their book values, net of any allowance for doubtful accounts,

are treated as a good approximation of fair value.

During 2013 there were no transfers of financial assets

and liabilities between the different levels of the fair value

hierarchy.