153

At 31 December 2013, the increase/decrease in the fair value

of derivatives designated as cash flow hedges arising from

an increase/decrease of 25 basis points in interest rates on

year-end rates would have respectively increased other equity

reserves by Euro 0.8 million and decreased them by Euro 1.5

million for hedges of underlying transactions in Euro.

At 31 December 2012, the increase/decrease in the fair value

of derivatives designated as cash flow hedges arising from

an increase/decrease of 25 basis points in interest rates on

year-end rates would have respectively increased other equity

reserves by Euro 2.32 million and decreased them by Euro 2.39

million for hedges of underlying transactions in Euro.

(c) Price risk

The Group is exposed to price risk in relation to purchases and

sales of strategic materials, whose purchase price is subject to

market volatility. The main raw materials used by the Group in

its own production processes consist of strategic metals such

as copper, aluminium and lead. The cost of purchasing such

strategic materials accounted for approximately 54% of the

Group’s total cost of materials in 2013 (57% in 2012), forming

part of its overall production costs.

In order to manage the price risk on future trade transactions,

the Group negotiates derivative contracts on strategic metals,

setting the price for planned future purchases.

Although the ultimate aim of the Group is to hedge risks to

which it is exposed, these contracts do not qualify as hedging

instruments for accounting purposes.

The derivative contracts entered into by the Group are

negotiated with major financial counterparties on the basis of

strategic metal prices quoted on the London Metal Exchange

(“LME”), the New York market (“COMEX”) and the Shanghai

Futures Exchange (“SFE”).

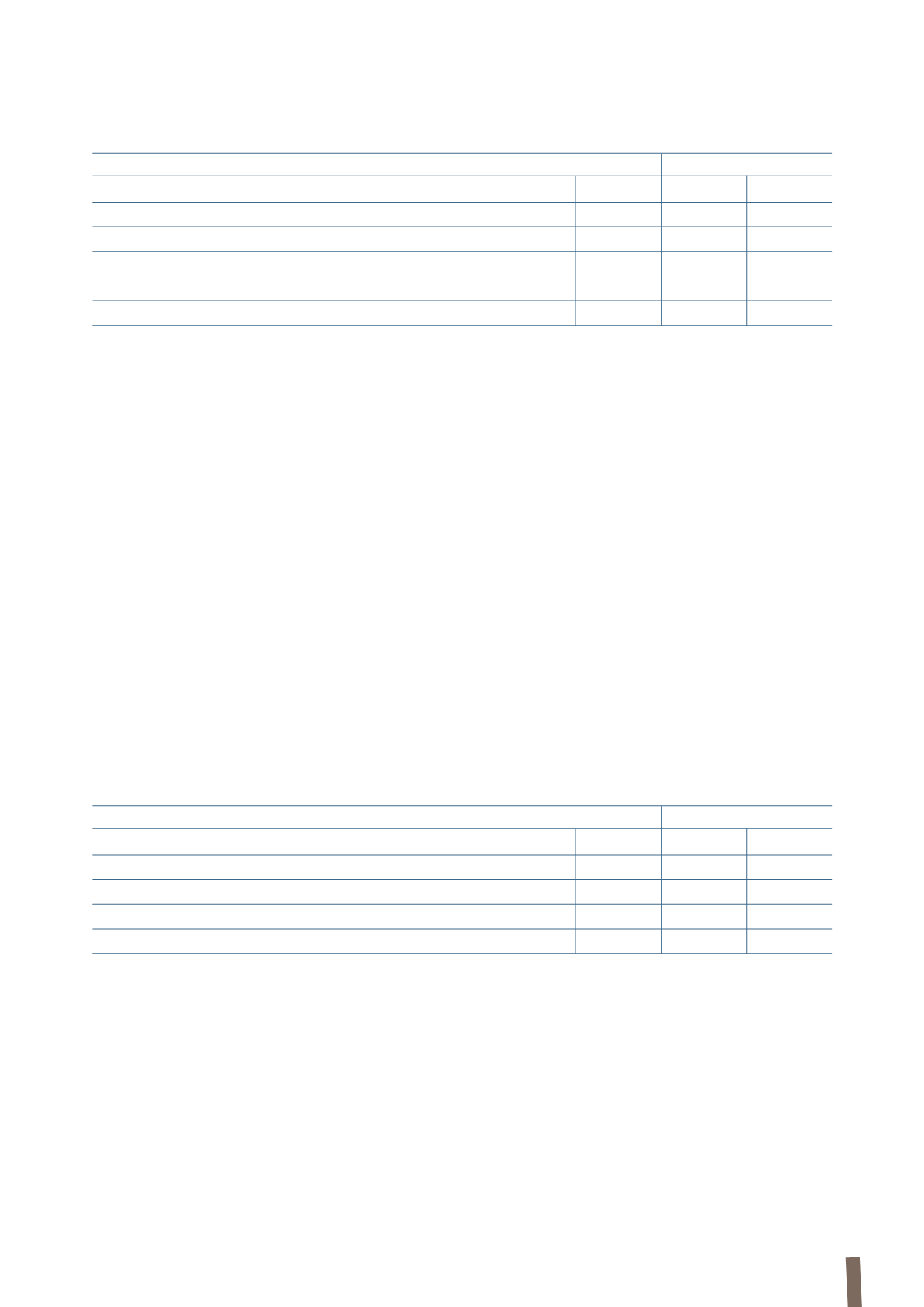

The following sensitivity analysis shows the effect on net

profit and consolidated equity of a 10% increase/decrease in

strategic material prices versus prices at 31 December 2013

and 31 December 2012, assuming that all other variables

remain equal.

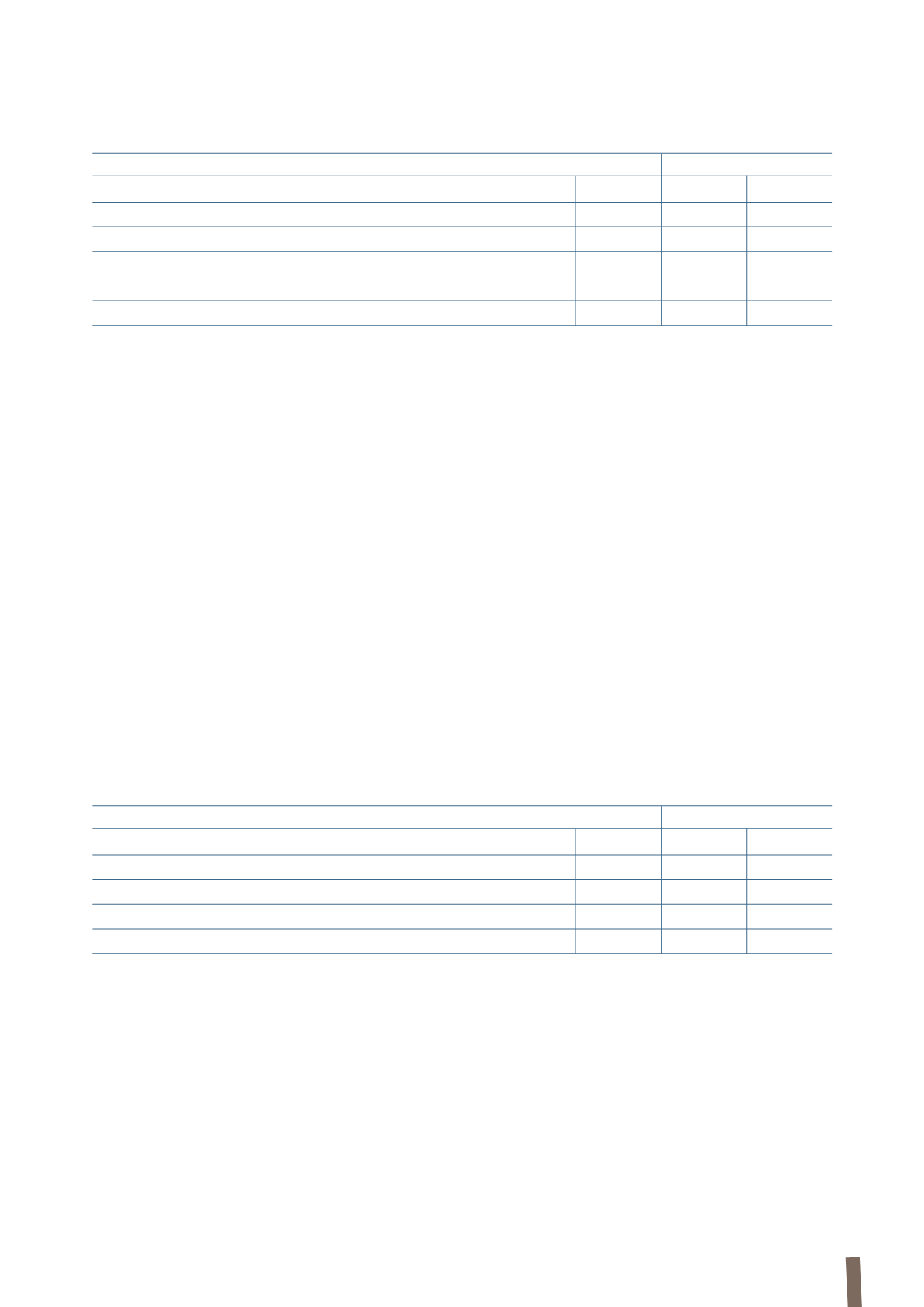

(in millions of Euro)

2013

2012

-0.25% +0.25% -0.25% +0.25%

Euro

(0.12)

0.12

(0.33)

0.33

US Dollar

0.06

(0.06)

0.14

(0.14)

British Pound

(0.03)

0.03

(0.01)

0.01

Other currencies

(0.44)

0.44

(0.34)

0.34

Total

(0.53)

0.53

(0.54)

0.54

(in millions of Euro)

2013

2012

-10%

+10%

-10%

+10%

LME

(13.85)

13.85

(20.88)

20.88

COMEX

(0.78)

0.78

0.56

(0.56)

SFE

(4.88)

4.88

(3.27)

3.27

Total

(19.51)

19.51

(23.59)

23.59

The potential impact shown above is solely attributable to

increases and decreases in the fair value of derivatives on strategic

material prices which are directly attributable to changes in the

prices themselves. It does not refer to the impact on the income

statement of the purchase cost of strategic materials.

(d) Credit risk

Credit risk is connected with trade receivables, cash and cash

equivalents, financial instruments, and deposits with banks and

other financial institutions.

Customer-related credit risk is managed by the individual

subsidiaries and monitored centrally by the Group Finance

Department. The Group does not have significant concentrations

of credit risk. It nonetheless has procedures aimed at ensuring

that sales of products and services are made to reliable customers,

taking account of their financial position, track record and other

factors. Credit limits for major customers are based on internal