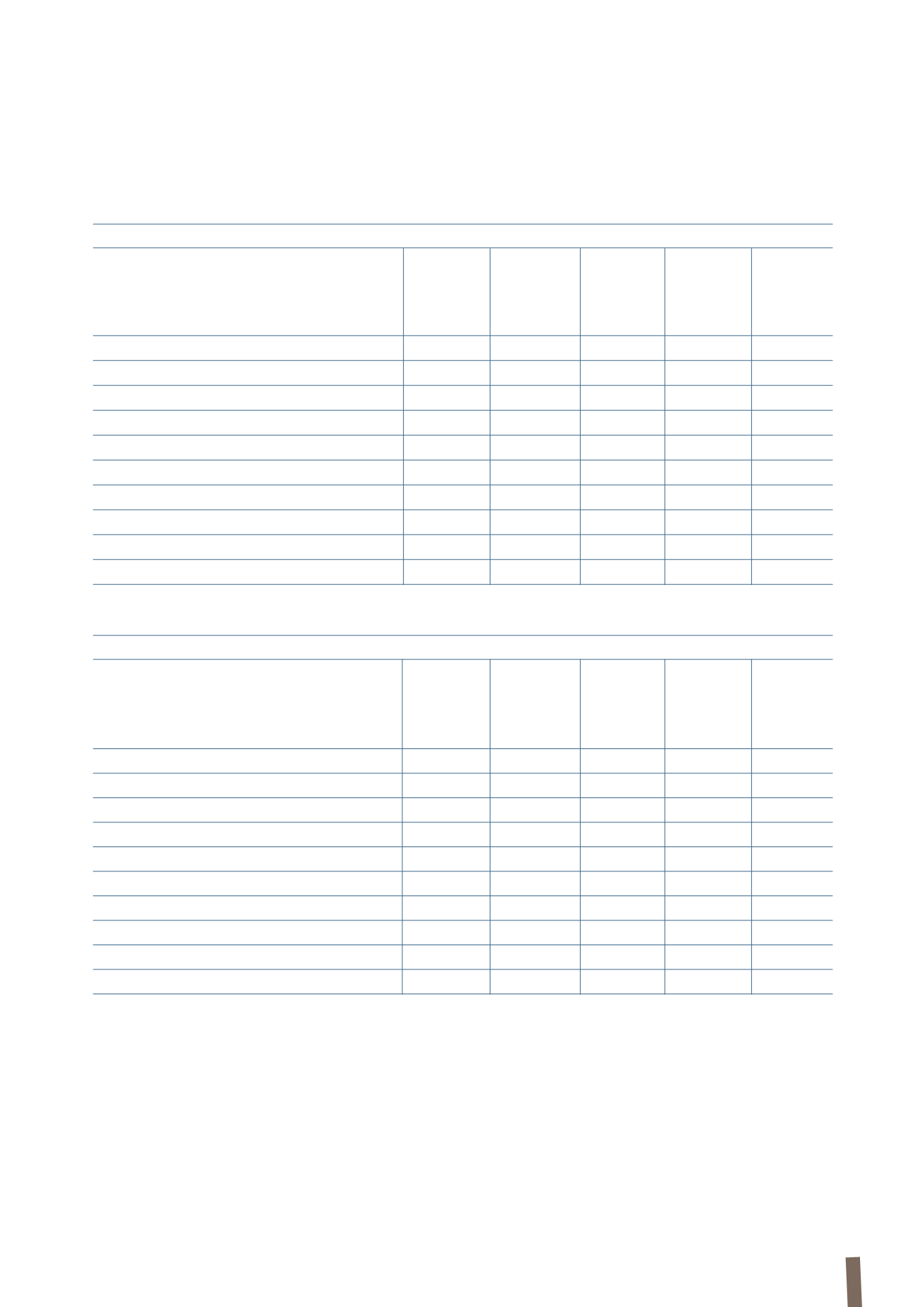

155

(in millions of Euro)

31 December 2013

Financial

Loans and

Available-for-

Financial

Financial

Hedging

assets at fair

receivables sale financial

liabilities

liabilities

derivatives

value through

assets at fair value

carried

profit or loss

through

at amortised

profit or loss

cost

Available-for-sale financial assets

-

-

15

-

-

-

Trade receivables

-

1,010

-

-

-

-

Other receivables

-

768

-

-

-

-

Financial assets held for trading

94

-

-

-

-

-

Derivatives (assets)

20

-

-

-

-

5

Cash and cash equivalents

-

561

-

-

-

-

Borrowings from banks and other lenders

-

-

-

-

1,492

-

Trade payables

-

-

-

-

1,441

-

Other payables

-

-

-

-

752

-

Derivatives (liabilities)

-

-

-

36

-

13

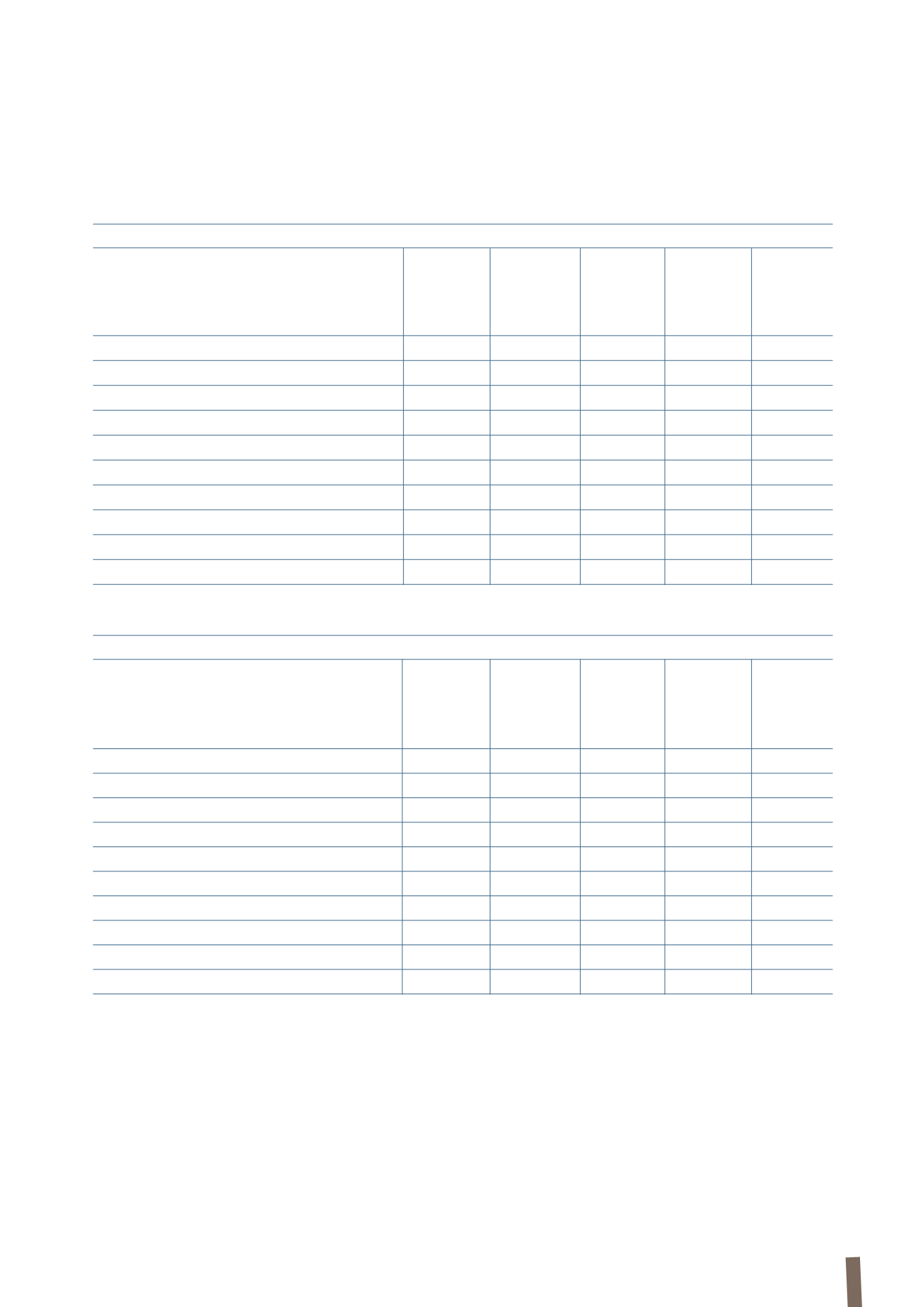

(in millions of Euro)

31 December 2012

Financial

Loans and

Available-for-

Financial

Financial

Hedging

assets at fair

receivables sale financial

liabilities

liabilities

derivatives

value through

assets at fair value

carried

profit or loss

through

at amortised

profit or loss

cost

Available-for-sale financial assets

-

-

14

-

-

-

Trade receivables

-

1,163

-

-

-

-

Other receivables

-

614

-

-

-

-

Financial assets held for trading

78

-

-

-

-

-

Derivatives (assets)

10

-

-

-

-

9

Cash and cash equivalents

-

812

-

-

-

-

Borrowings from banks and other lenders

-

-

-

-

1,794

-

Trade payables

-

-

-

-

1,450

-

Other payables

-

-

-

-

681

-

Derivatives (liabilities)

-

-

-

16

-

49

In completion of the disclosure about financial risks, a

reconciliation between the financial assets and liabilities

reported in the Group’s statement of financial position and

the financial assets and liabilities classified according to the

IFRS 7 definitions, is as follows: