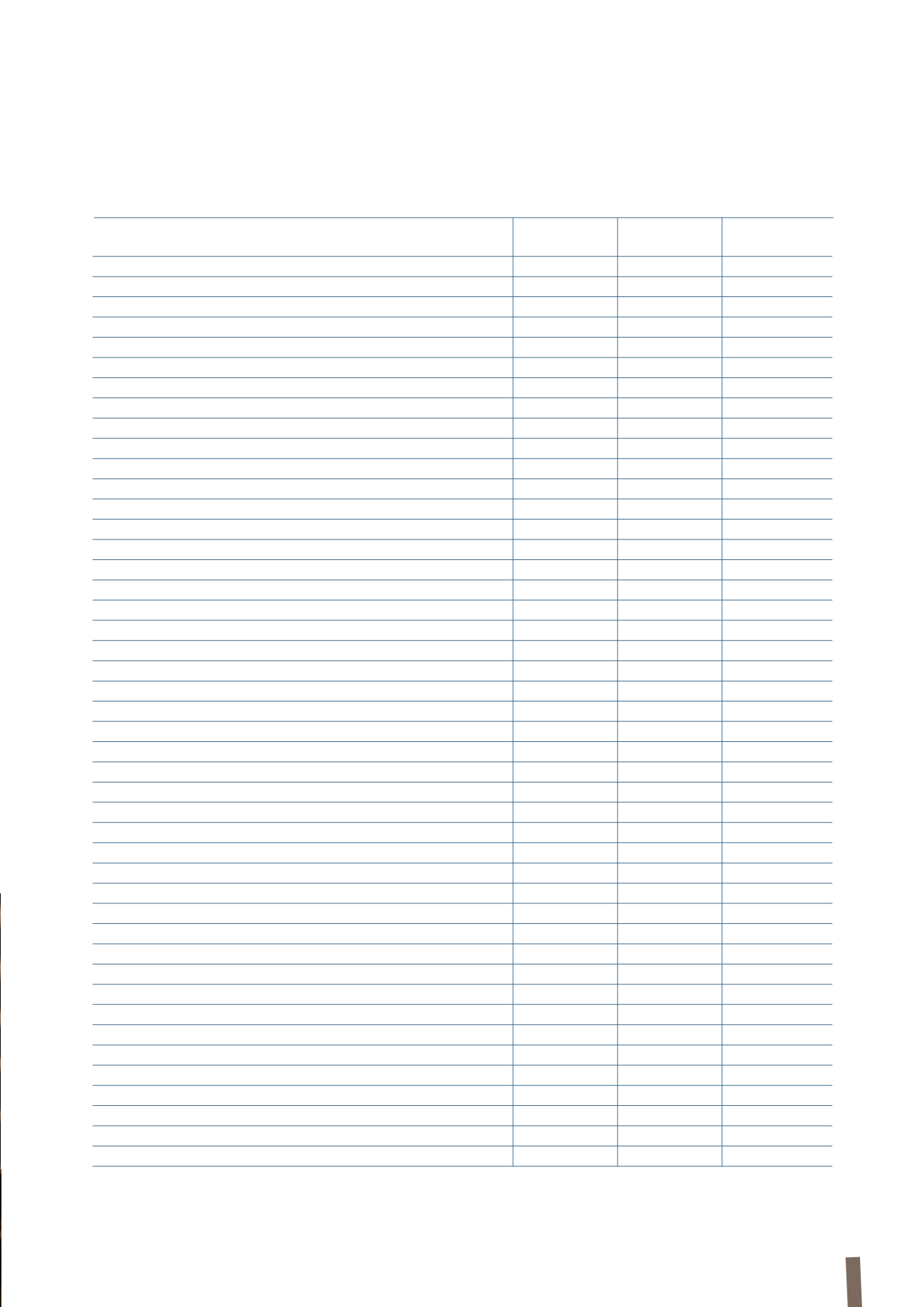

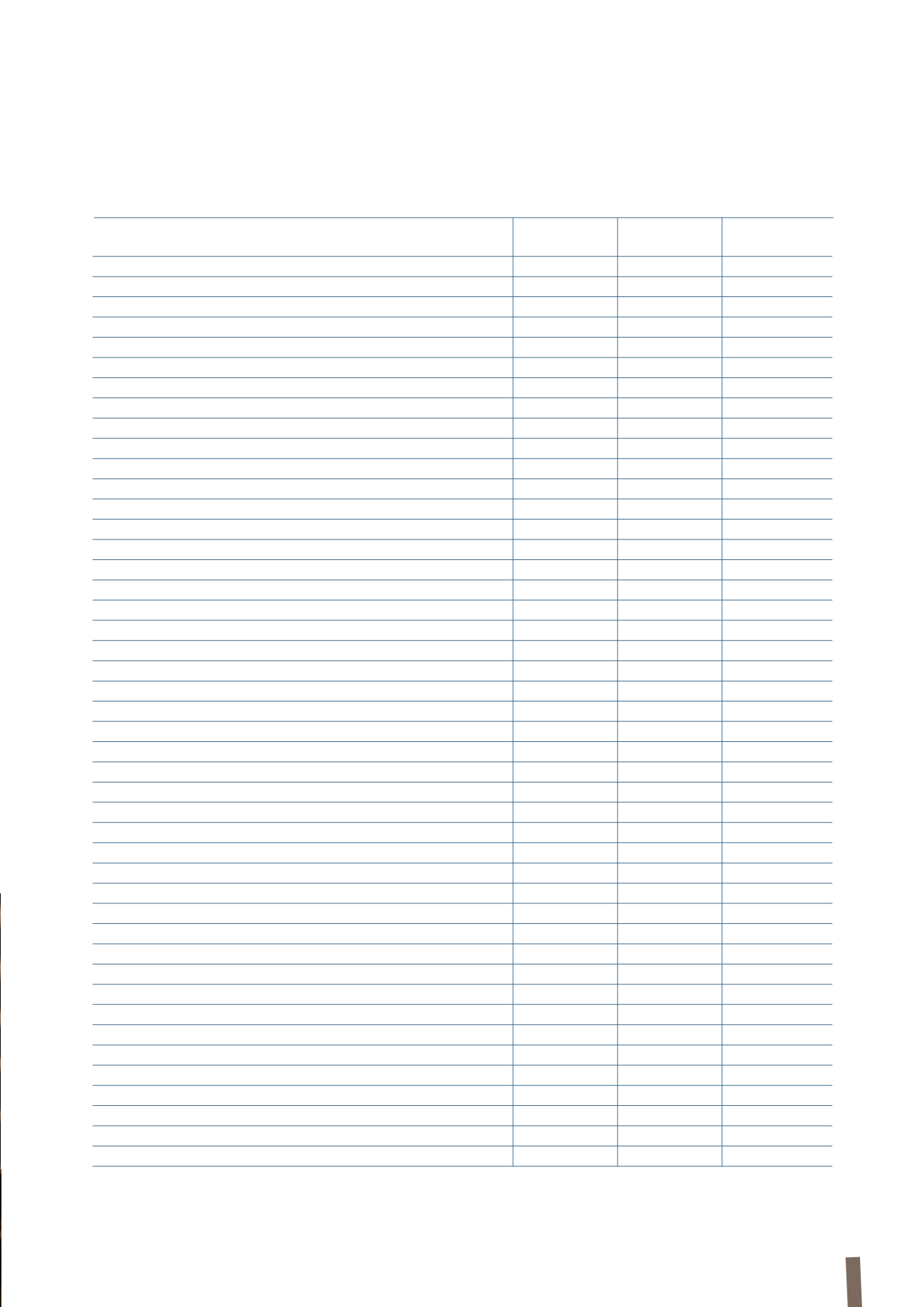

149

The above amendments are shown below:

(in millions of Euro)

31 December

Application

Business

31 December

2012 IAS19 Revised

combinations

2012 Restated

Non-current assets

Property, plant and equipment

1,539

1,539

Intangible assets

655

(11)

644

Investments in associates

99

99

Available-for-sale financial assets

14

14

Derivatives

3

3

Deferred tax assets

127

127

Other receivables

41

41

Total non-current assets

2,478

-

(11)

2,467

Current assets

Inventories

897

897

Trade receivables

1,163

1,163

Other receivables

570

3

573

Financial assets held for trading

78

78

Derivatives

16

16

Cash and cash equivalents

812

812

Total current assets

3,536

-

3

3,539

Assets held for sale

4

4

Total assets

6,018

-

(8)

6,010

Equity attributable to the Group:

1,112

-

-

1,112

Share capital

21

21

Reserves

923

2

925

Net profit/(loss) for the year

168

(2)

166

Equity attributable to non-controlling interests:

47

-

-

47

Share capital and reserves

44

44

Net profit/(loss) for the year

3

3

Total equity

1,159

-

-

1,159

Non-current liabilities

Borrowings from banks and other lenders

1,433

1,433

Other payables

27

27

Provisions for risks and charges

76

76

Derivatives

41

41

Deferred tax liabilities

95

95

Employee benefit obligations

344

344

Total non-current liabilities

2,016

-

-

2,016

Current liabilities

Borrowings from banks and other lenders

361

361

Trade payables

1,450

1,450

Other payables

654

654

Derivatives

24

24

Provisions for risks and charges

325

(8)

317

Current tax payables

29

29

Total current liabilities

2,843

-

(8)

2,835

Total liabilities

4,859

-

(8)

4,851

Total equity and liabilities

6,018

-

(8)

6,010

CONSOLIDATED STATEMENT OF FINANCIAL POSITION