CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

156

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

D.1

CAPITAL RISK MANAGEMENT

The Group’s objective in capital risk management is mainly to

safeguard business continuity in order to guarantee returns

for shareholders and benefits for other stakeholders. The

Group also aims to maintain an optimal capital structure in

order to reduce the cost of debt and to comply with a series

of covenants required by the various Credit Agreements (Note

32. Financial covenants).

The Group also monitors capital on the basis of its gearing ratio

(ie. the ratio between net financial position and capital). Note

12. Borrowings from banks and other lenders contains details

of how the net financial position is determined. Capital is equal

to the sum of equity, as reported in the Group consolidated

financial statements, and the net financial position.

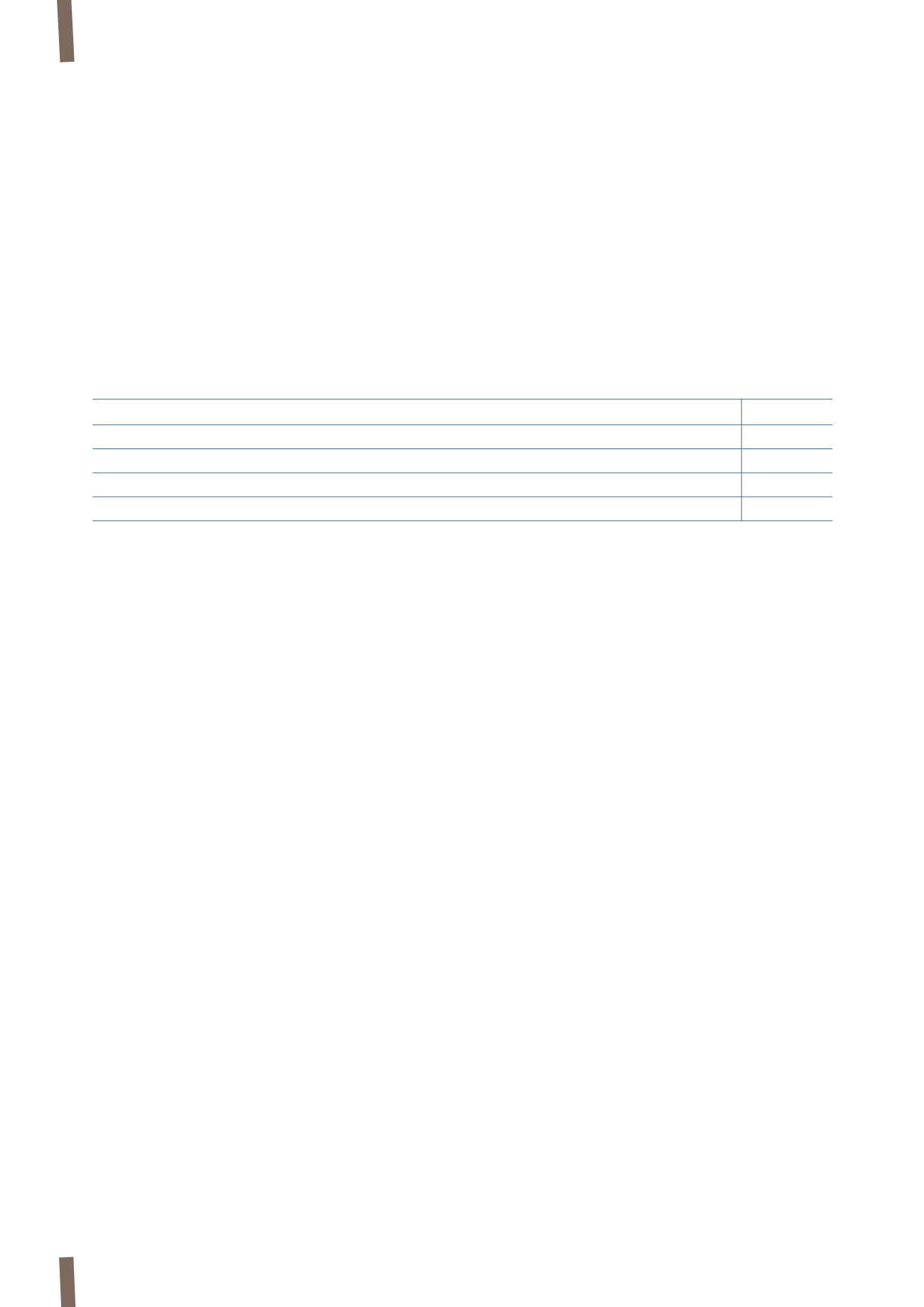

The gearing ratios at 31 December 2013 and 31 December 2012

are shown below:

(in millions of Euro)

2013

2012

Net financial position

834

918

Equity

1,195

1,159

Total capital

2,029

2,077

Gearing ratio

41.10%

44.20%

D.2

FAIR VALUE

With reference to assets and liabilities recognised in the

statement of financial position, IFRS 13 requires that such

amounts are classified on the basis of a hierarchy that reflects

the significance of the inputs used in determining fair value.

The fair value of financial instruments is classified according

to the following hierarchy:

Level 1

: fair value is determined with reference to quoted

prices (unadjusted) in active markets for identical financial

instruments. Therefore, the emphasis within Level 1 is on

determining both of the following:

(a) the principal market for the asset or liability or, in the

absence of a principal market, the most advantageous

market for the asset or liability; and

(b) whether the entity can enter into a transaction for

the asset or liability at the price in that market at the

measurement date.

Level 2

: fair value is determined using valuation techniques

where the input is based on observable market data. The

inputs for this level include:

(a) quoted prices for similar assets or liabilities in active

markets;

(b) quoted prices for identical or similar assets or liabilities in

markets that are not active;

(c) inputs other than quoted prices that are observable for

the asset or liability, for example:

i. interest rate and yield curves observable at commonly

quoted intervals;

ii. implied volatilities; and

iii. credit spreads;

(d) market-corroborated inputs.

Level 3

: fair value is determined using valuation techniques

where the input is not based on observable market data.