CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

154

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

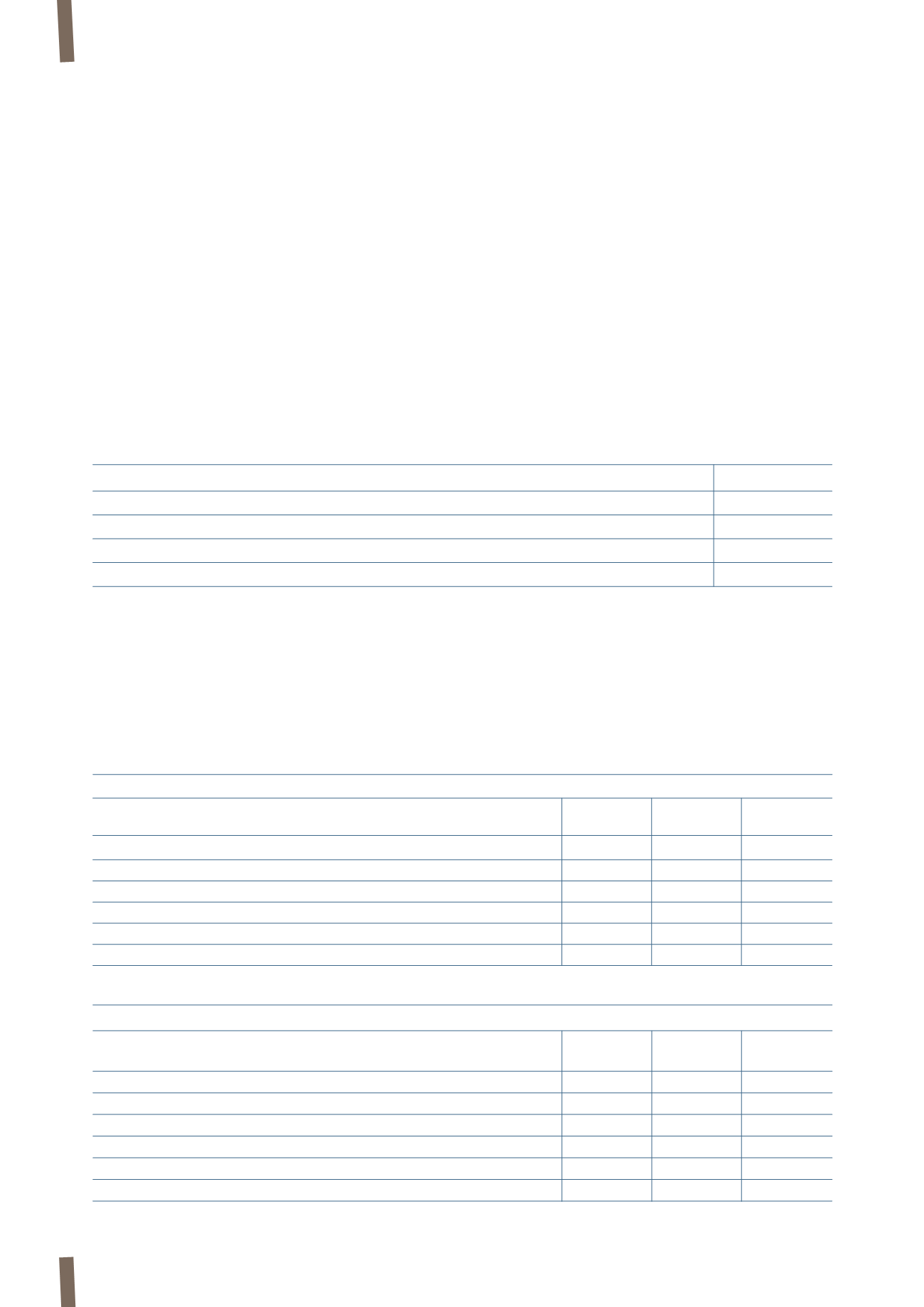

(in millions of Euro)

31 December 2013

Due within Due between Due between

Due after

1 year

1 - 2 years

2- 5 years

5 years

Borrowings from banks and other lenders

368

448

721

3

Finance lease obligations

3

3

4

11

Credit lines guaranteed by securitized receivables

-

-

-

-

Derivatives

42

3

4

-

Trade and other payables

2,169

7

6

11

Total

2,582

461

735

25

Unused committed lines of credit at 31 December 2013 refer

both to Revolving Credit Facilities (Euro 797 million) and to

the EIB loan (Euro 100 million); at 31 December 2012 they

comprised Euro 75 million for the securitization programme

and Euro 796 million for Revolving Credit Facilities.

The line serving the securitization programme was terminated

at the end of July 2013.

and external assessments within ceilings approved by local

country management. The utilisation of credit limits is periodically

monitored at local level.

During 2013 the Group had a global insurance policy in place to

provide coverage for part of its trade receivables against any

losses.

As for credit risk relating to the management of financial and

cash resources, this risk is monitored by the Group Finance

Department, which implements procedures aimed at ensuring that

Group companies deal with independent, high standing, reliable

counterparties. In fact, at 31 December 2013 (like at 31 December

2012) almost all the Group’s financial and cash resources were

held with investment grade counterparties. Credit limits relating

The following table includes an analysis, by due date, of

payables, other liabilities, and derivatives settled on a net

basis; the various due date categories are determined on

the basis of the period between the reporting date and the

contractual due date of the obligations.

to the principal financial counterparties are based on internal

and external assessments, within ceilings defined by the Group

Finance Department.

(e) Liquidity risk

Prudent management of the liquidity risk arising from the Group’s

normal operations involves the maintenance of adequate levels

of cash and cash equivalents and short-term securities as well as

availability of funds by having an adequate amount of committed

credit lines.

The Group Finance Department uses cash flow forecasts to

monitor the projected level of the Group’s liquidity.

The amount of liquidity reserves at the reporting date is as

follows:

(in millions of Euro)

31 December 2013 31 December 2012

Cash and cash equivalents

561

812

Financial assets held for trading

94

78

Unused committed lines of credit

897

871

Total

1,552

1,761

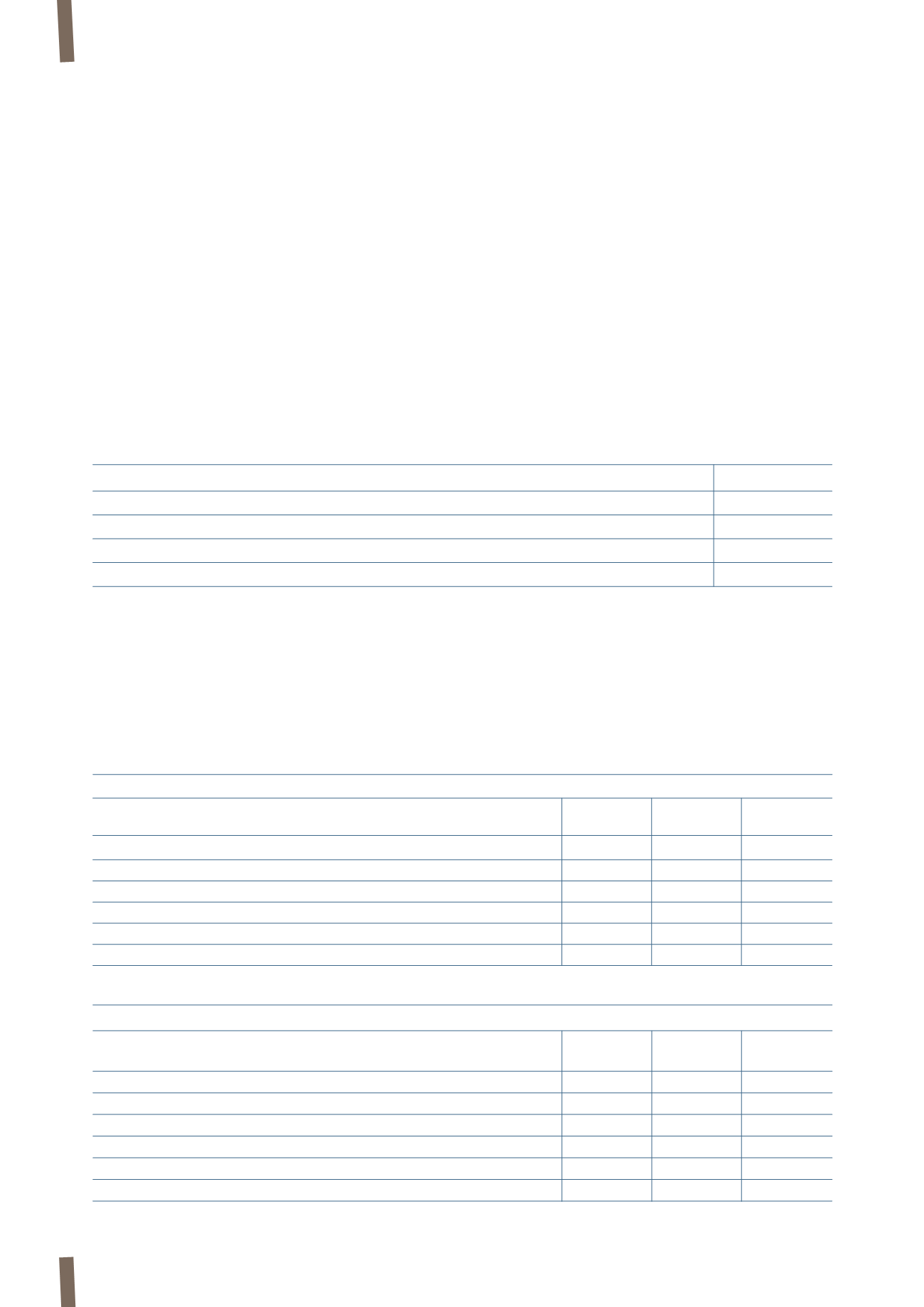

(in millions of Euro)

31 December 2012

Due within Due between Due between

Dueafter

1 year

1 - 2 years

2- 5 years

5 years

Borrowings from banks and other lenders

327

654

831

2

Finance lease obligations

2

2

7

9

Credit lines guaranteed by securitized receivables

75

-

-

-

Derivatives

24

33

8

-

Trade and other payables

2,104

4

5

18

Total

2,532

693

851

29