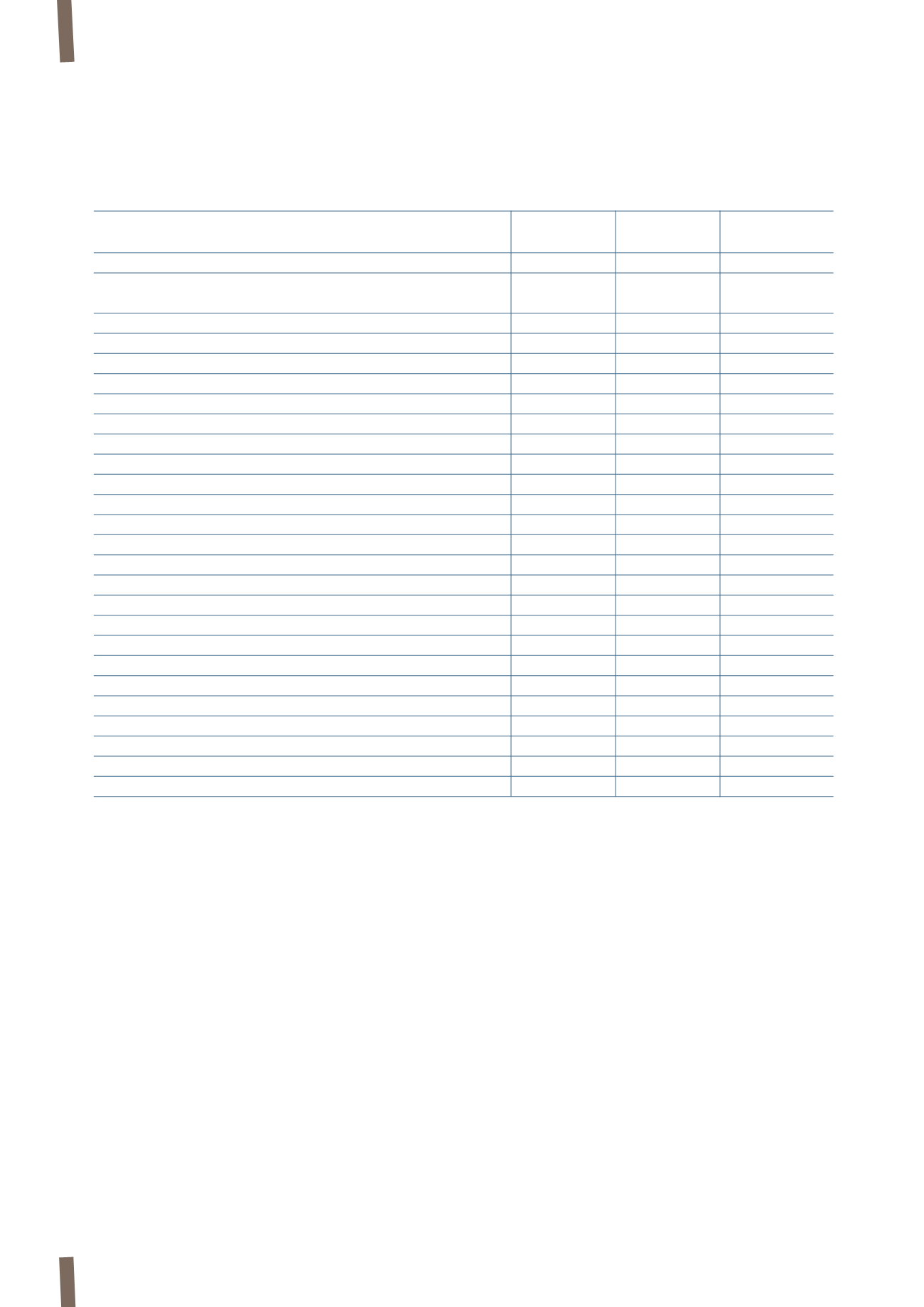

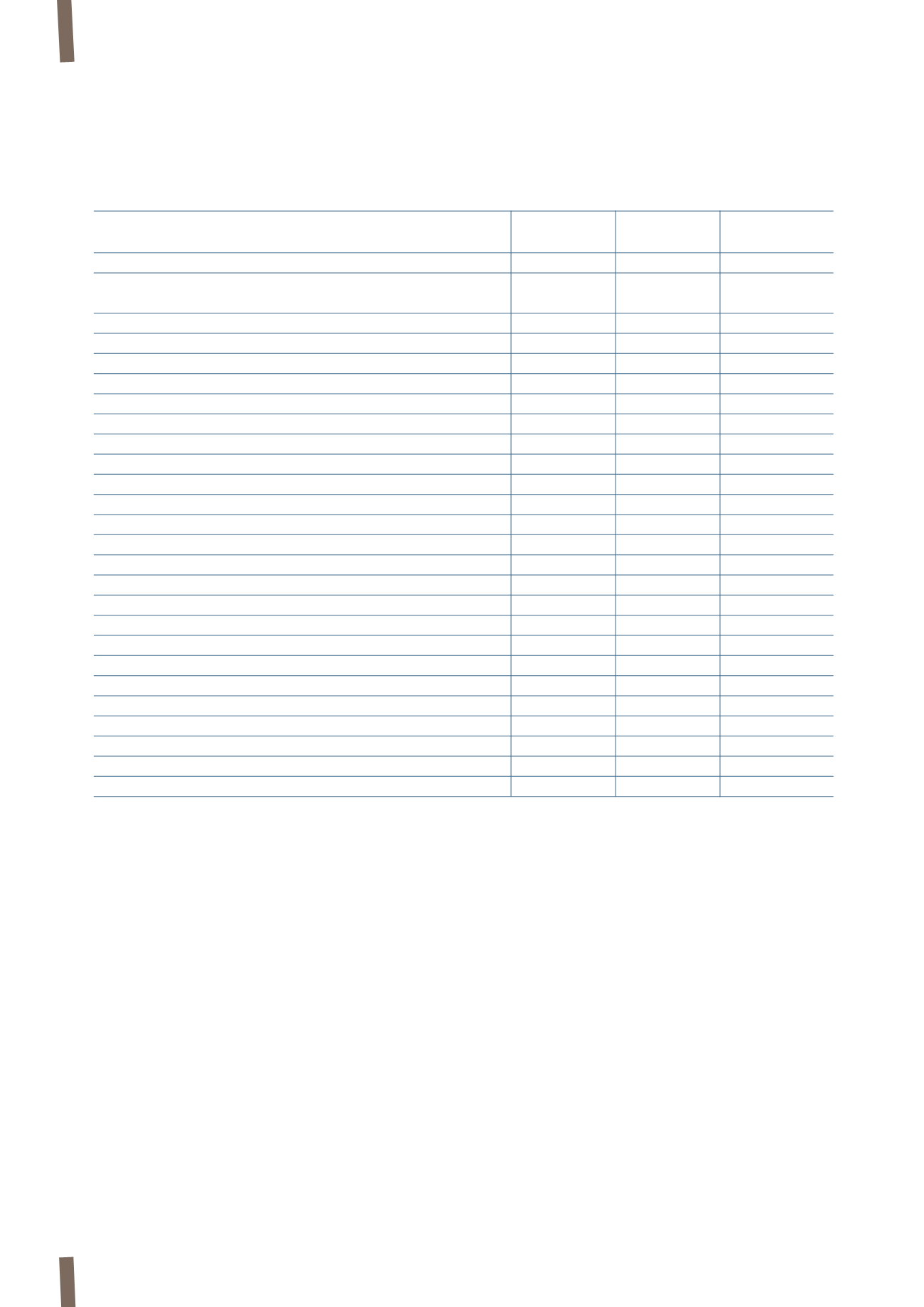

CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

150

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

(in millions of Euro)

2012

Application

Business

2012 Restated

IAS19 Revised

combinations

Sales of goods and services

7,848

7,848

Change in inventories of work in progress, semi-finished

and finished goods

(31)

(31)

Other income

71

71

of which non-recurring other income

15

15

of which remeasurement of minority put option liability

7

7

Raw materials, consumables used and goods for resale

(5,083)

(5,083)

Fair value change in metal derivatives

14

14

Personnel costs

(1,041)

(1,041)

of which non-recurring personnel costs

(65)

(65)

of which personnel costs for stock option fair value

(17)

(17)

Amortisation, depreciation and impairment

(188)

(188)

of which non-recurring impairment

(24)

(24)

Other expenses

(1,228)

(1,228)

of which non-recurring other expenses

(51)

(51)

Operating income

362

-

-

362

Finance costs

(393)

(2)

(395)

of which non-recurring finance costs

(8)

(8)

Finance income

258

258

of which non-recurring finance income

3

3

Share of net profit/(loss) of associates and dividends from other companies

17

17

Profit/(loss) before taxes

244

(2)

-

242

Taxes

(73)

(73)

Net profit/(loss) for the year

171

(2)

-

169

Attributable to:

Owners of the parent

168

(2)

166

Non-controlling interests

3

3

CONSOLIDATED INCOME STATEMENT

D.

FINANCIAL RISK MANAGEMENT

The Group’s activities are exposed to various forms of risk:

market risk (including exchange rate, interest rate and

price risks), credit risk and liquidity risk. The Group’s risk

management strategy focuses on the unpredictability of

markets and aims to minimise the potentially negative

impact on the Group’s results. Some types of risk are

mitigated using derivatives.

Monitoring of key financial risks is centrally coordinated

by the Group Finance Department, and by the Purchasing

Department where price risk is concerned, in close cooperation

with the Group’s operating companies. Risk management

policies are approved by the Group Finance, Administration

and Control Department, which provides written guidelines on

managing the above risks and on using (derivative and non-

derivative) financial instruments.

The impact on net profit and equity described in the

following sensitivity analyses has been determined net

of tax, calculated using the Group’s weighted average

theoretical tax rate.

(a) Exchange rate risk

The Group operates worldwide and is therefore exposed to

exchange rate risk caused by changes in the value of trade

and financial flows expressed in a currency other than the

accounting currency of individual Group companies.

The principal exchange rates affecting the Group are: