CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

152

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

When assessing the potential impact of the above, the

assets and liabilities of each Group company in currencies

other than their accounting currency were considered, net of

any derivatives hedging the above-mentioned flows.

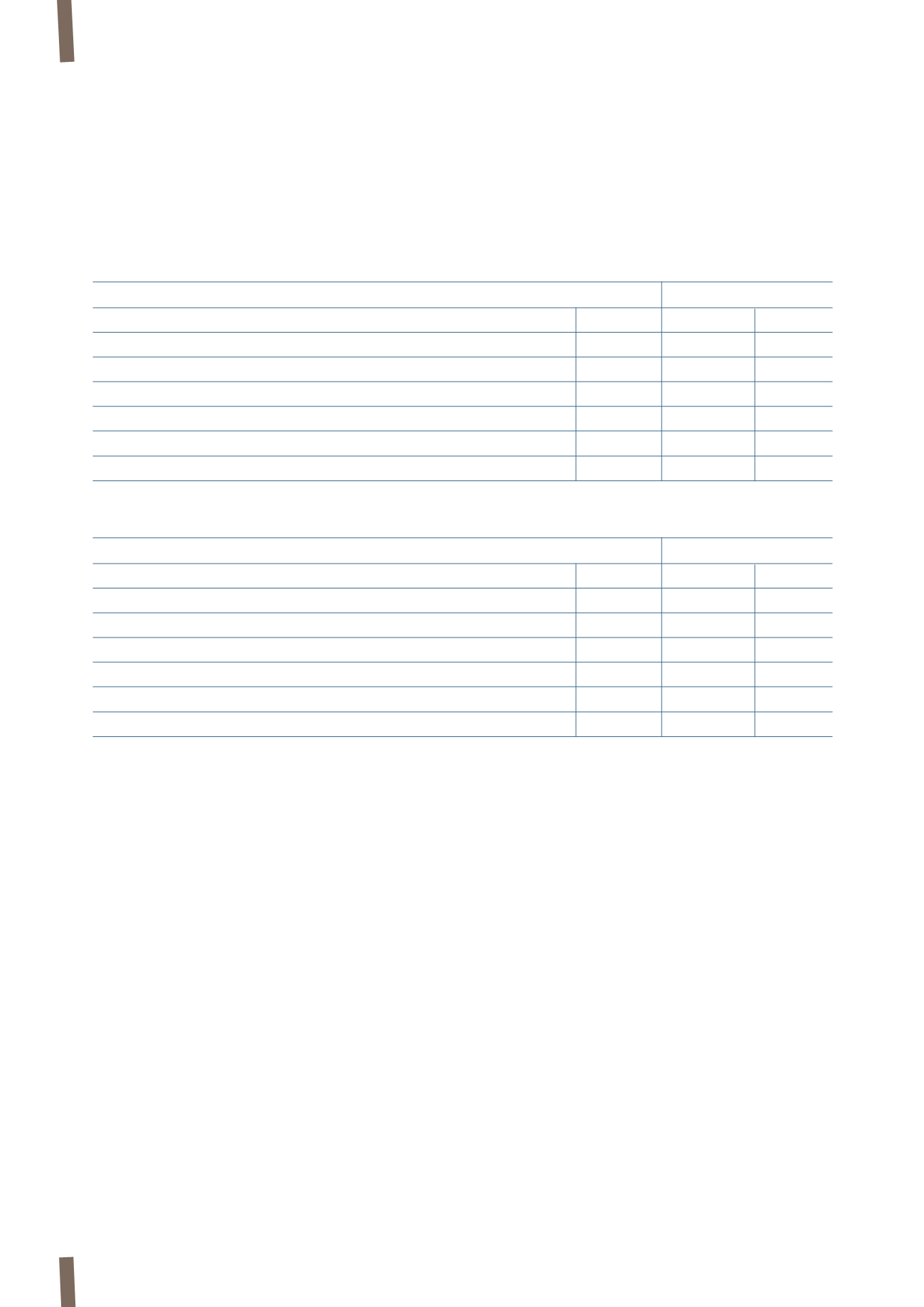

The following sensitivity analysis shows the post-tax effects

The above analysis ignores the effects of translating the

equity of Group companies whose functional currency is not

the Euro.

(b) Interest rate risk

The interest rate risk to which the Group is exposed is mainly

on long-term financial liabilities, carrying both fixed and

variable rates.

Fixed rate debt exposes the Group to a fair value risk. The

Group does not operate any particular hedging policies in

relation to the risk arising from such contracts.

Variable rate debt exposes the Group to a rate volatility risk

(cash flow risk). In order to hedge this risk, the Group can use

derivative contracts that limit the impact of interest rate

changes on the income statement.

The Group Finance Department monitors the exposure to

interest rate risk and adopts appropriate hedging strategies

on equity reserves of an increase/decrease in the fair value

of derivatives designated as cash flow hedges following a 5%

and 10% increase/decrease in exchange rates versus closing

exchange rates at 31 December 2013 and 31 December 2012.

to keep the exposure within the limits defined by the Group

Administration, Finance and Control Department, arranging

derivative contracts, if necessary.

The following sensitivity analysis shows the effects on

consolidated net profit of an increase/decrease of 25 basis

points in interest rates on the interest rates at 31 December

2013 and 31 December 2012, assuming that all other variables

remain equal.

The potential effects shown below refer to net liabilities

representing the most significant part of Group debt at the

reporting date and are determined by calculating the effect on

net finance costs following a change in annual interest rates.

The net liabilities considered for sensitivity analysis include

variable rate financial receivables and payables, cash and cash

equivalents and derivatives whose value is influenced by rate

volatility.

(in millions of Euro)

2013

2012

-5%

+5%

-5%

+5%

US Dollar

1.31

(1.45)

1.88

(2.08)

United Arab Emirates Dirham

0.38

(0.42)

0.51

(0.57)

Qatari Riyal

1.86

(2.05)

2.21

(2.44)

Saudi Riyal

-

-

0.03

(0.03)

Other currencies

0.48

(0.53)

0.45

(0.50)

Total

4.03

(4.45)

5.08

(5.62)

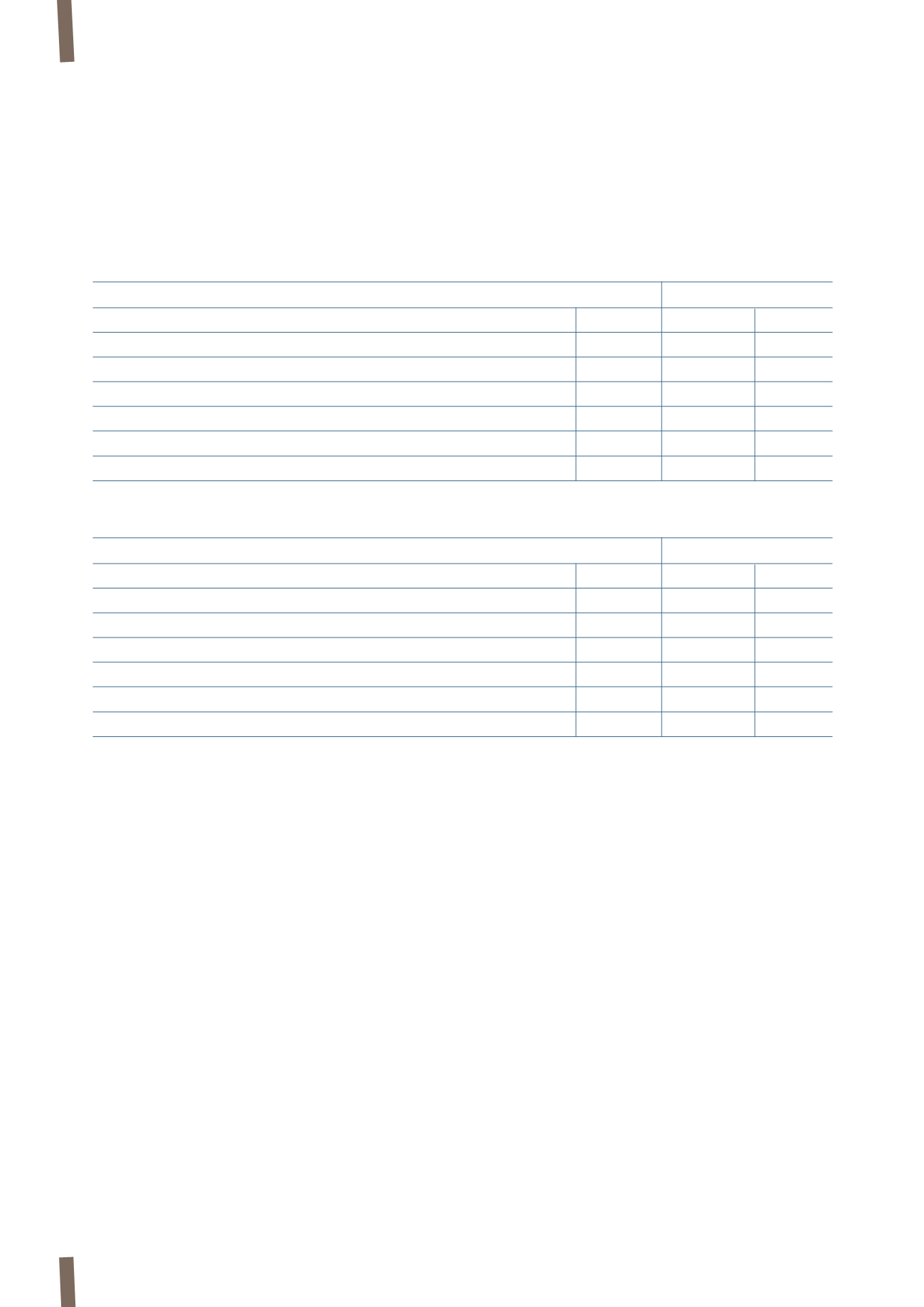

(in millions of Euro)

2013

2012

-10%

+10%

-10%

+10%

US Dollar

2.50

(3.06)

3.59

(4.39)

United Arab Emirates Dirham

0.72

(0.88)

0.98

(1.19)

Qatari Riyal

3.54

(4.33)

4.22

(5.15)

Saudi Riyal

0.01

(0.01)

0.05

(0.06)

Other currencies

0.92

(1.12)

0.86

(1.05)

Total

7.69

(9.40)

9.70

(11.84)