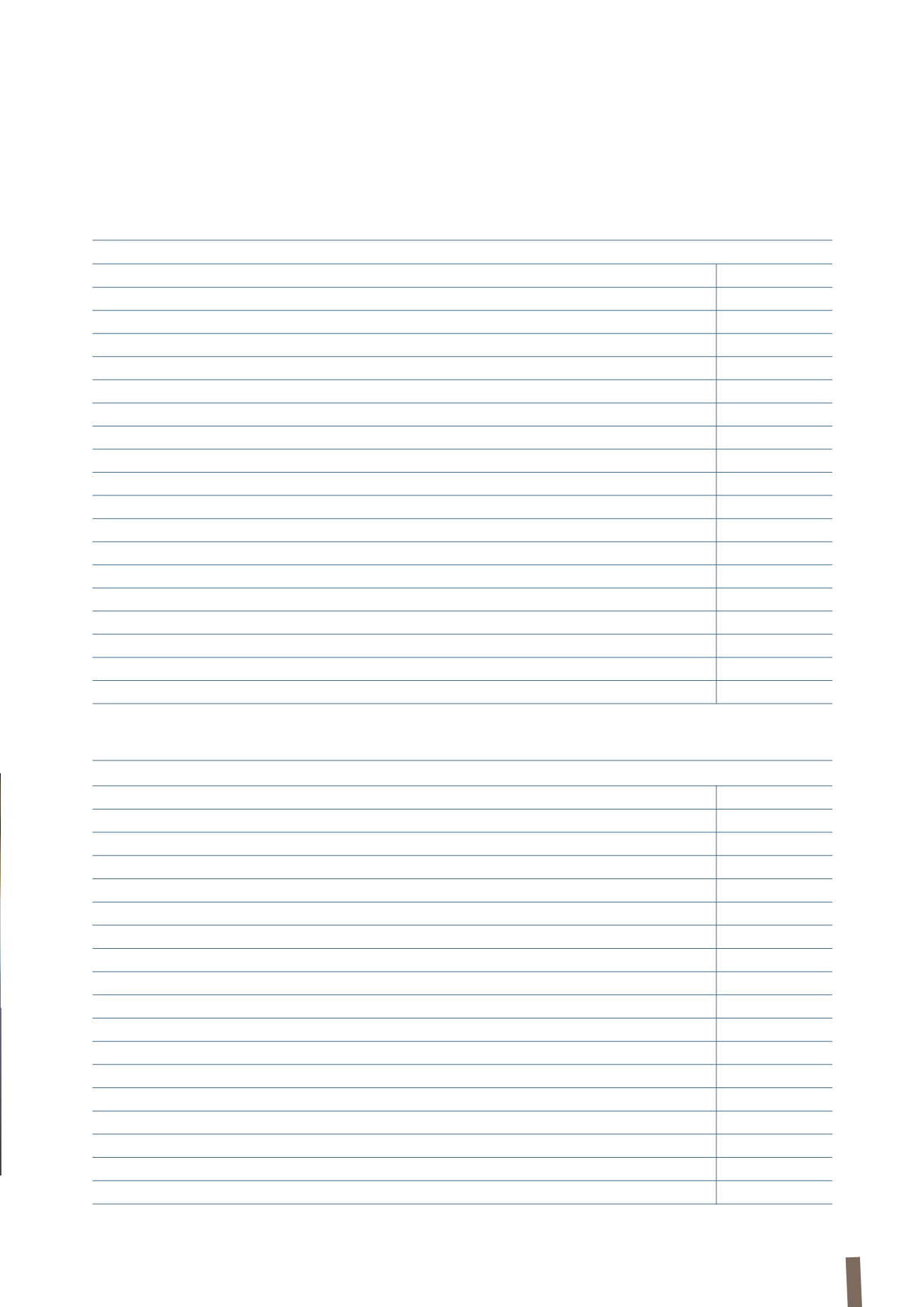

181

(in millions of Euro)

31 December 2013

Asset

Liability

Non-current

I

nterest rate swaps (cash flow hedges)

-

4

Forward currency contracts on commercial transactions (cash flow hedges)

1

1

Total hedging derivatives

1

5

Metal derivatives

1

2

Total other derivatives

1

2

Total non-current

2

7

Current

Interest rate swaps (cash flow hedges)

-

5

Forward currency contracts on commercial transactions (cash flow hedges)

4

3

Total hedging derivatives

4

8

Forward currency contracts on commercial transactions

9

3

Forward currency contracts on financial transactions

5

5

Interest rate swaps

-

9

Metal derivatives

5

17

Total other derivatives

19

34

Total current

23

42

Total

25

49

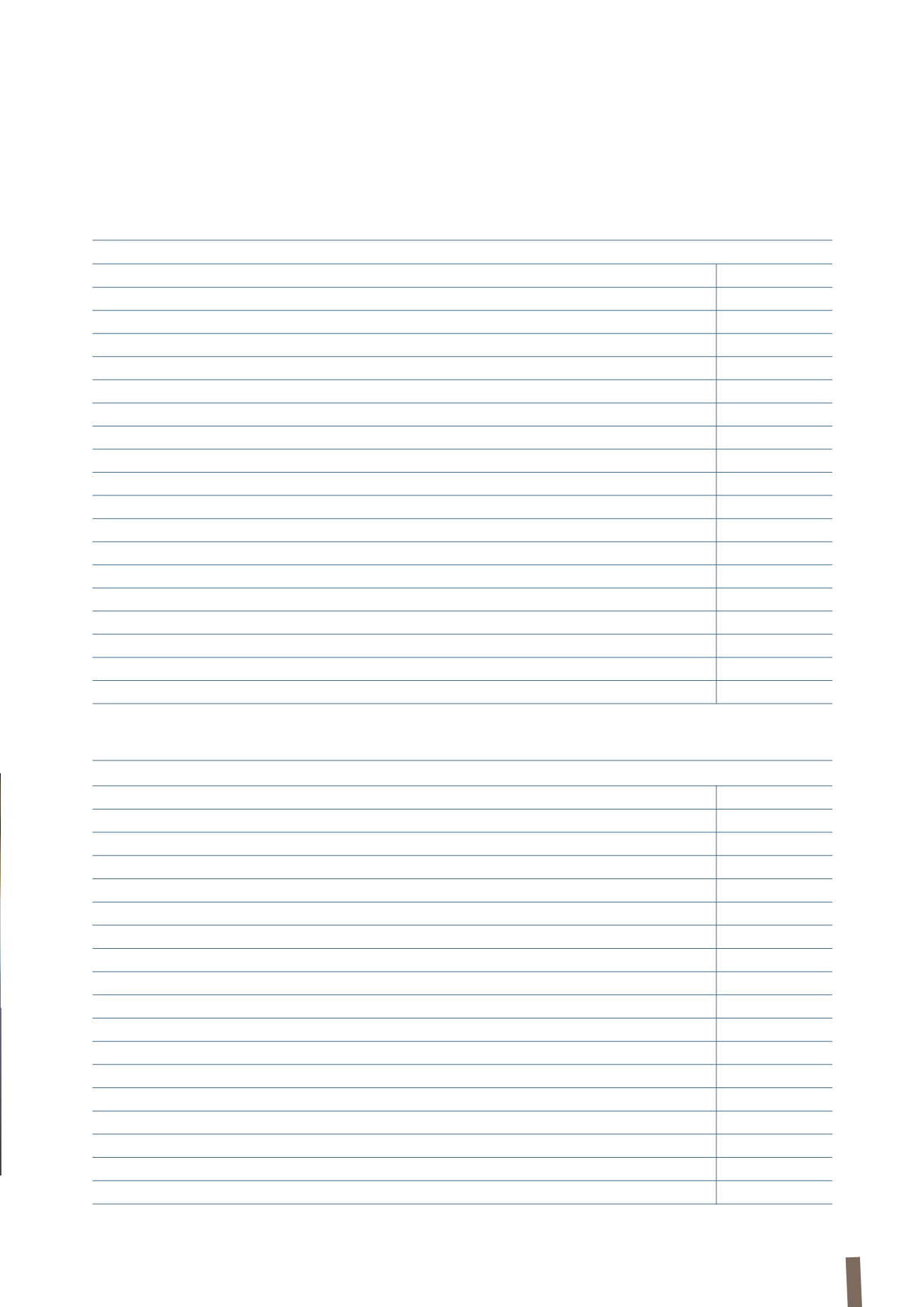

8.

DERIVATIVES

These are detailed as follows:

(in millions of Euro)

31 December 2012

Asset

Liability

Non-current

Interest rate swaps (cash flow hedges)

-

35

Forward currency contracts on commercial transactions (cash flow hedges)

3

3

Total hedging derivatives

3

38

Metal derivatives

-

3

Total other derivatives

-

3

Total non-current

3

41

Current

Forward currency contracts on financial transactions (cash flow hedges)

-

3

Forward currency contracts on commercial transactions (cash flow hedges)

6

8

Total hedging derivatives

6

11

Forward currency contracts on commercial transactions

3

3

Forward currency contracts on financial transactions

3

4

Metal derivatives

4

6

Total other derivatives

10

13

Total current

16

24

Total

19

65