CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

184

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

10.

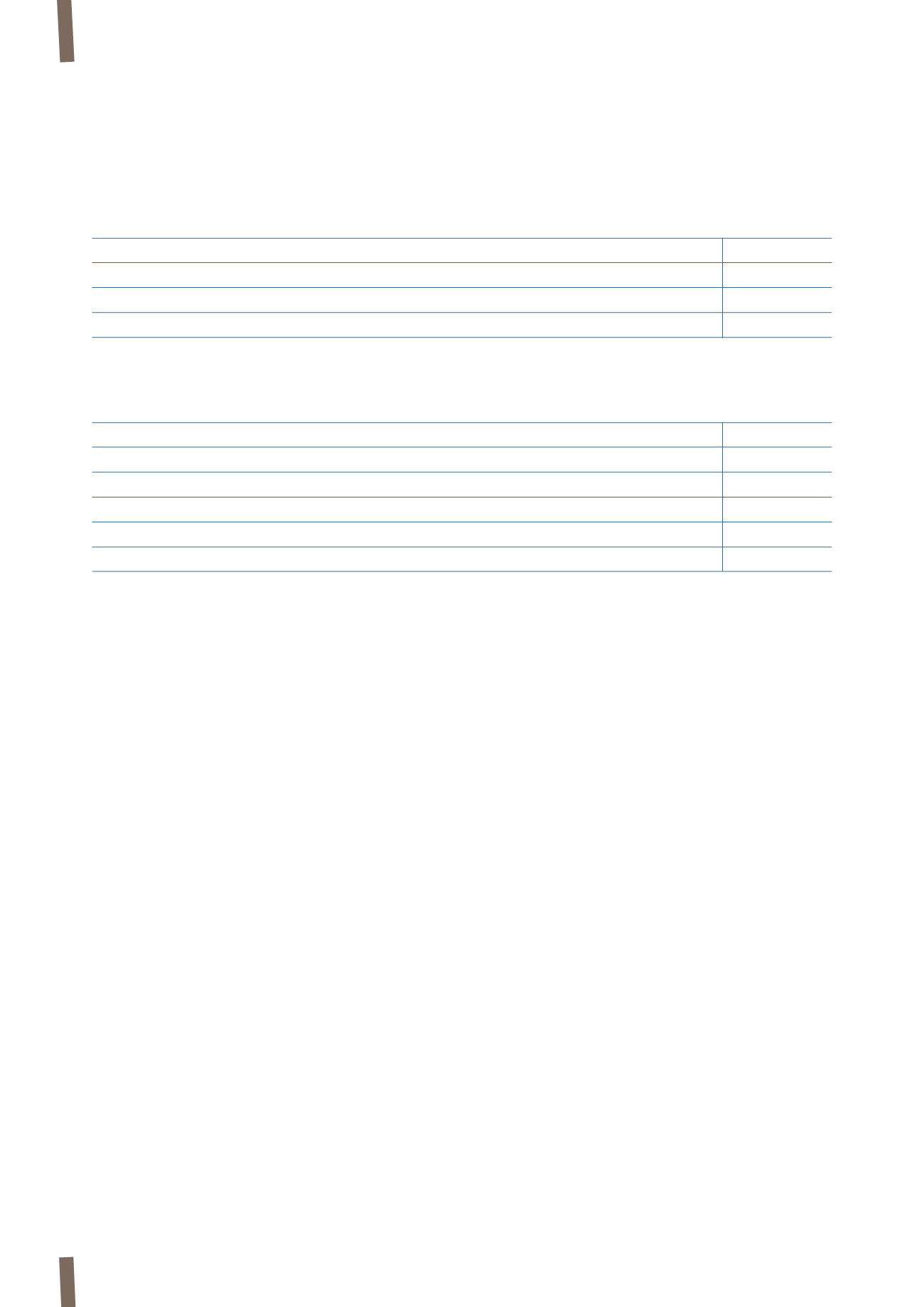

ASSETS HELD FOR SALE

These are detailed as follows:

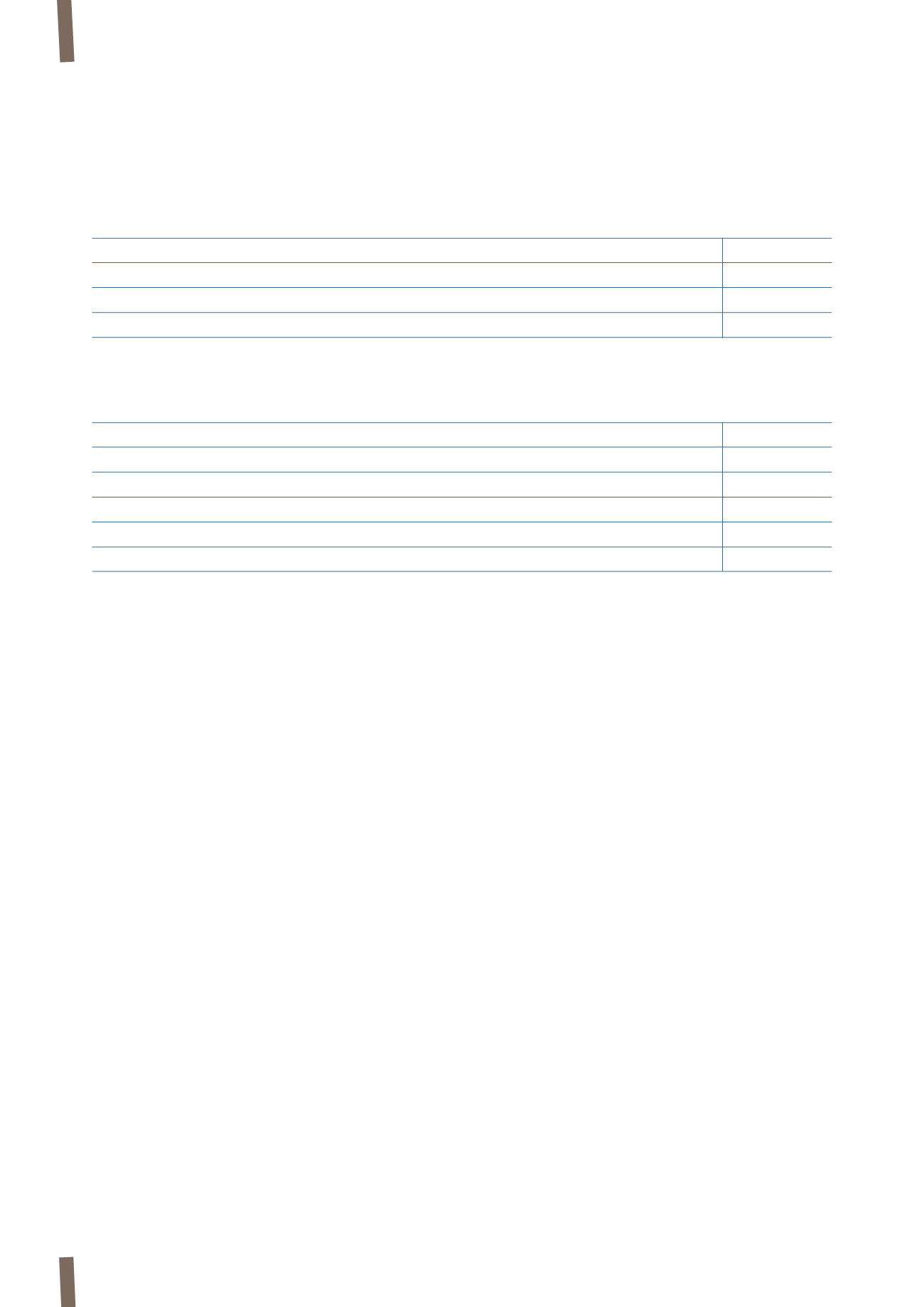

Movements in assets held for sale are detailed as follows:

The change in assets held for sale mainly refers to:

• the sale of the land and buildings of the St. Jean plant in

Canada, reclassified to this line item in the second quarter

of 2013, for Euro 3 million;

• the reclassification of Euro 2 million for a plot of land

located in Nuremberg (Germany), for which a sale

agreement has already been signed;

• the reclassification of Euro 3 million for the Eschweiler site

in Germany, for which a sale agreement has already been

signed;

• the reclassification of Euro 3 million for the building in

Derby (United Kingdom), expected to be sold soon.

Management expects the assets classified in this line item to

be sold within the next 12 months.

Assets held for sale are classified as Level 3 in the fair value

hierarchy.

(in millions of Euro)

31 December 2013 31 December 2012

Land

6

4

Buildings

6

-

Total

12

4

(in millions of Euro)

31 December 2013 31 December 2012

Opening balance

4

5

- Disposals

(3)

(3)

- Reclassification

11

2

Total movements

8

(1)

Closing balance

12

4

11.

SHARE CAPITAL AND RESERVES

Consolidated equity has recorded an increase of Euro 36

million since 31 December 2012, mainly reflecting the net

effect of:

• the increase associated with the recognition of Euro 39

million for the equity component of the convertible Bond;

• negative currency translation differences of Euro 97 million;

• the release of Euro 10 million, net of tax, in gains from the

cash flow hedge reserve as a result of discontinuing cash

flow hedging, following early repayment of the Term Loan

Facility 2010;

• the positive change of Euro 14 million in the share-based

compensation reserve linked to the stock option plan;

• the positive change of Euro 1 million in the reserve for

actuarial gains on employee benefits;

• the positive post-tax change of Euro 5 million in the fair

value of derivatives designated as cash flow hedges;

• net profit for the year of Euro 154 million;

• the dividend distribution of Euro 92 million;

• capital increases carried out by non-controlling interests in

subsidiary companies, with an impact of Euro 2 million.

At 31 December 2013, the share capital of Prysmian S.p.A.

comprises 214,591,710 shares with a total value of Euro

21,459,171.