191

(a) There are interest rate swaps to hedge interest rate risk on variable rate loans in Euro. The total hedged amount at 31 December 2012 equates to 66.1% of

Euro-denominated debt at that date. In particular, interest rate hedges consist of interest rate swaps which exchange a variable rate (3 and 6-month Euribor

for loans in Euro) with an average fixed rate (fixed rate + spread) of 4.3% for Euro-denominated debt. The percentages representing the average fixed rate

refer to 31 December 2012.

The Credit Agreement 2010 and Credit Agreement 2011 do not require any collateral security. Further information can be found

in Note 32. Financial covenants.

Risks relating to sources of finance and to financial investments/receivables are discussed in the section entitled “Risks factors

and uncertainties” forming part of the Directors’ Report.

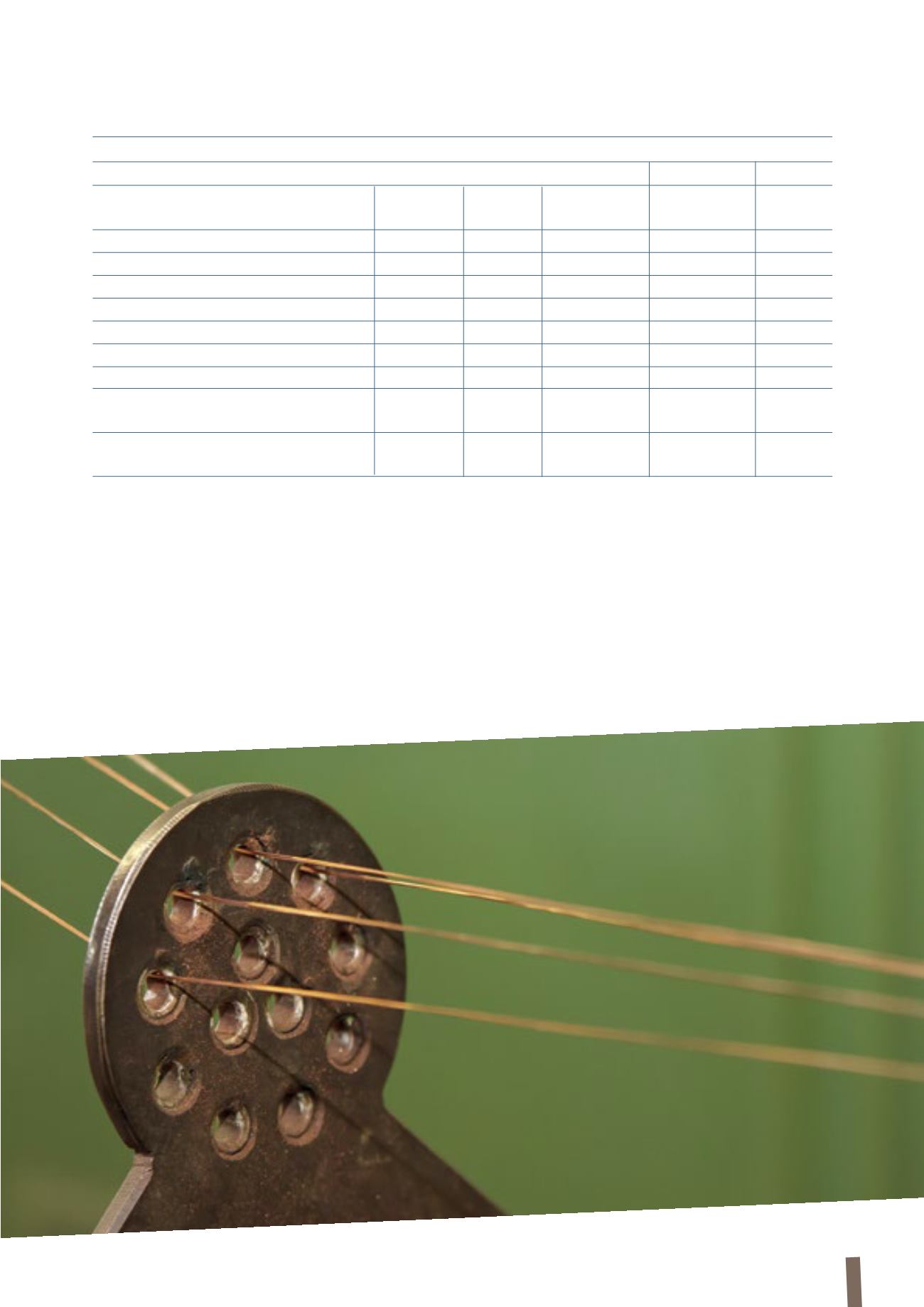

(in millions of Euro)

31 December 2012

Variable interest rate

Fixed interest rate

Total

Euro

USD

GBP Other currencies

Euro and other

currencies

Due within 1 year

157

70

20

55

59

361

Due between 1 and 2 years

483

73

-

7

43

606

Due between 2 and 3 years

-

4

-

6

413

423

Due between 3 and 4 years

389

-

-

1

3

393

Due between 4 and 5 years

-

-

-

1

3

4

Due after more than 5 years

-

-

-

-

7

7

Total

1,029

147

20

70

528

1,794

Average interest rate in period,

as per contract

2.6%

2.5% 1.3%

7.4%

5.5%

3.6%

Average interest rate in period,

including IRS effect

(a)

3.7%

2.5% 1.3%

7.4%

5.5%

4.2%