197

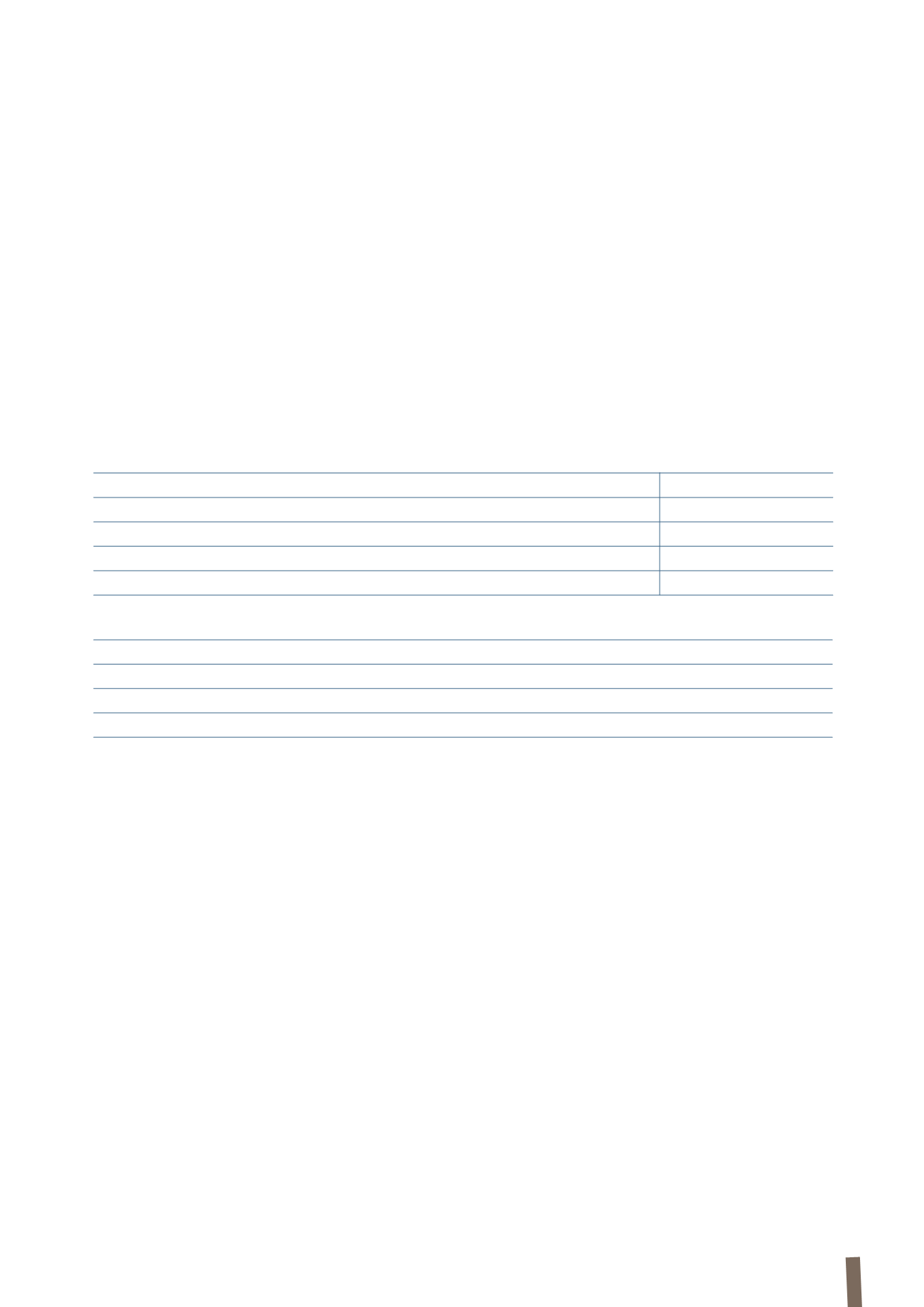

The adoption of IAS 19 (revised) had the following effects, which have been reflected in the consolidated financial statements:

(in millions of Euro)

31 December 2012

1 January 2012

Reserves

2

-

Net profit/(loss) for the year

(2)

-

Impact on equity attributable to the Group

-

-

Employee benefit obligations

-

-

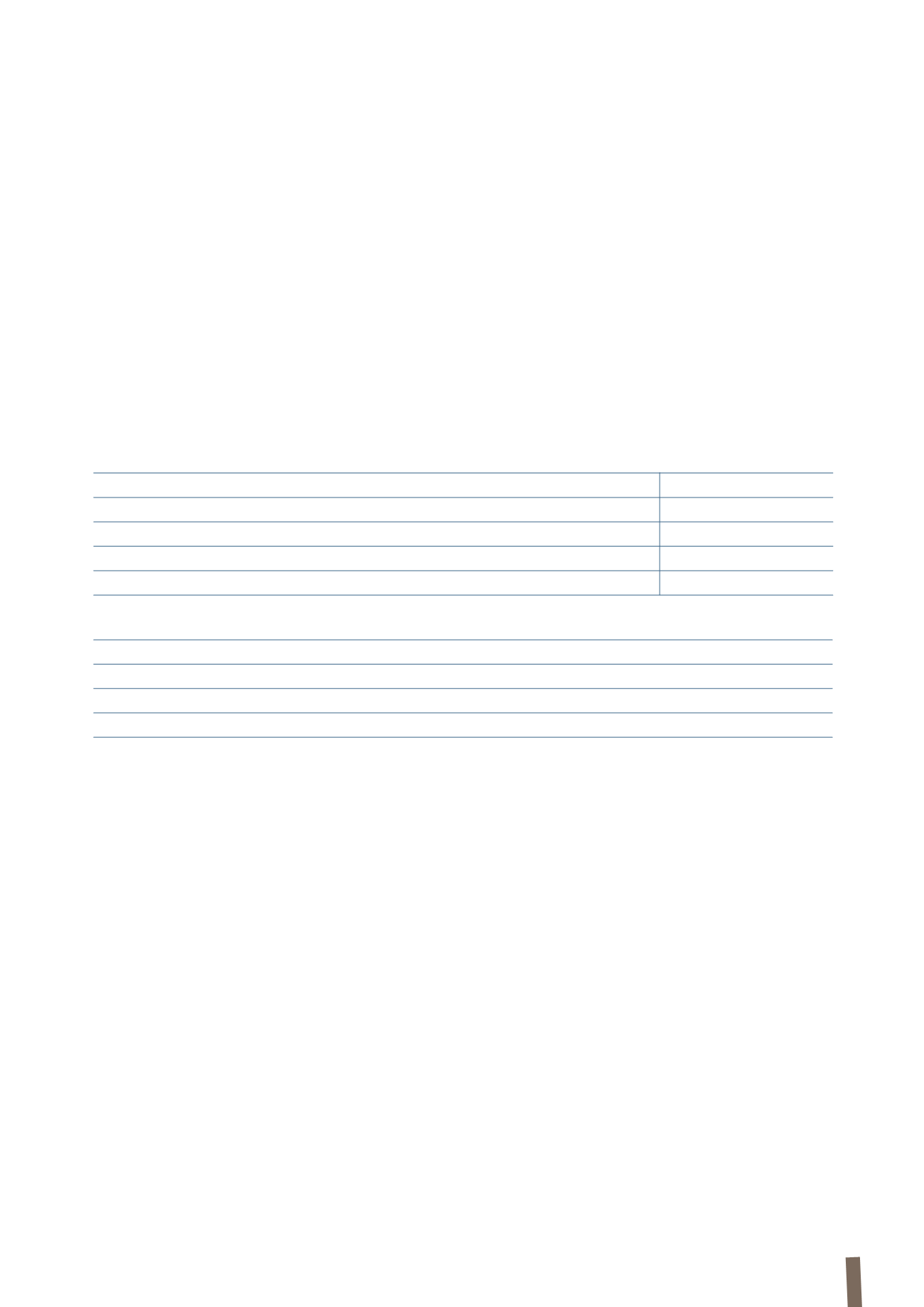

(in millions of Euro)

2012

Finance costs

(2)

Deferred taxes

-

Net profit/(loss) for the year

(2)

Restatement of comparative figures at 31 December 2012

following application of IAS 19 (revised)

As from 1 January 2013, the Group has applied IAS 19 (revised) to

measure the Group’s employee benefit obligations; the revised

version of this standard has resulted in the following main

changes:

• the return on plan assets recognised in net interest expense

must be calculated using the discount rate applying to plan

liabilities and no longer using the expected rate of return on

plan assets;

• past service costs must be recognised immediately in profit or

loss in the period a plan is amended and not on a straight-line

As a result, the application of the revised standard has

involved recognising Euro 2 million more in “Finance costs”

at 31 December 2012, with a consequent adjustment of Euro 2

million to “Net profit/(loss) for the year” and “Reserves”.

Pension plan amendments in 2013

The following plans were amended during 2013:

• Draka Comteq Funded Plan in Norway: as a result of

individual negotiations, the obligations relating to

non-active members have been almost completely

transferred to an insurance company; this has resulted

basis over subsequent periods until such time as the benefits

are vested;

• the administration costs of managing plan assets must be

recognised as they are incurred in profit or loss, where they

are classified as operating costs and no longer as finance

costs.

In accordance with the IAS 19 transition rules, the Group has

applied the amendments to IAS 19 retrospectively from 1 January

2013 by adjusting the balances in the statement of financial

position at 1 January 2012 and at 31 December 2012, as well as

the previously published figures in the 2012 income statement.

in the recognition of a gain in the income statement

of approximately Euro 2 million and in a corresponding

reduction in liabilities;

• Draka UK Pension Plan in Great Britain: the plan has been

converted from a defined benefit to a defined contribution

plan for future benefits with effect from 31 December 2013.

This conversion has resulted in the recognition of a gain in

the income statement of approximately Euro 0.3 million.

Both the above gains have been classified as non-recurring

items in the 2013 income statement.