205

OTHER INFORMATION

Contributions and payments for employee benefit obligations

are estimated at Euro 5 million for 2014 (of which Euro 2

million in The Netherlands and Euro 2 million in Great Britain).

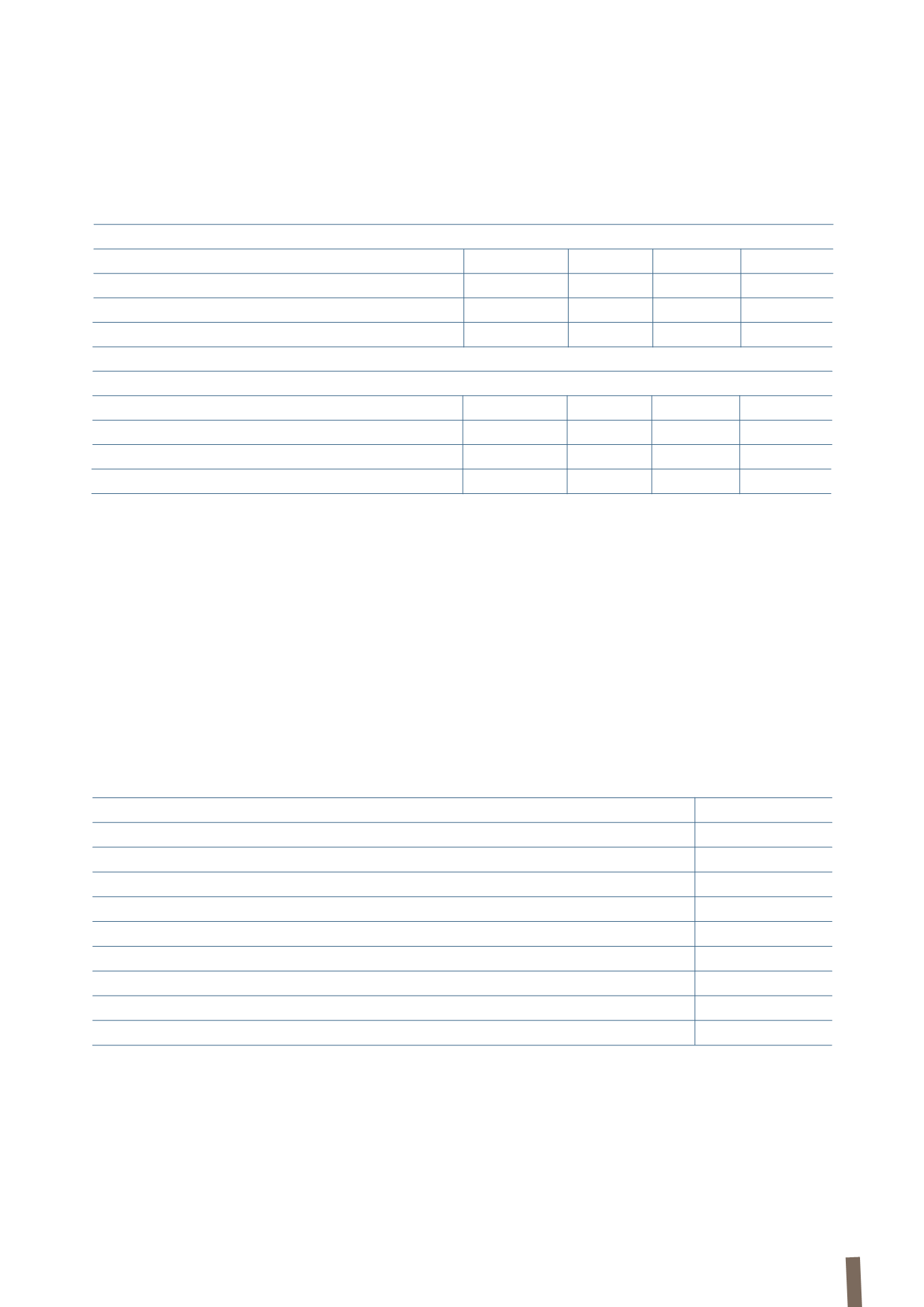

Headcount

Average headcount in the period is reported below for each

category, compared with closing headcount at the end of each

period:

The calculation of average and closing headcount for 2012

and 2013 includes 100% of the workforce of companies in

which the Prysmian Group has a majority interest as well as

those managed by the Group but in which it does not have a

majority interest.

On this basis, the headcount numbers exclude Yangtze Optical

Fibre and Cable Joint Stock Limited Co. (China).

2013

Average

% Closing

%

Blue collar

14,536

74%

14,457

75%

White collar and management

4,996

26%

4,917

25%

Total

19,532

100%

19,374

100%

2012

Average

% Closing

%

Blue collar

14,536

74%

14,457

75%

White collar and management

4,996

26%

4,917

25%

Total

19,532

100%

19,374

100%

These are detailed as follows:

16.

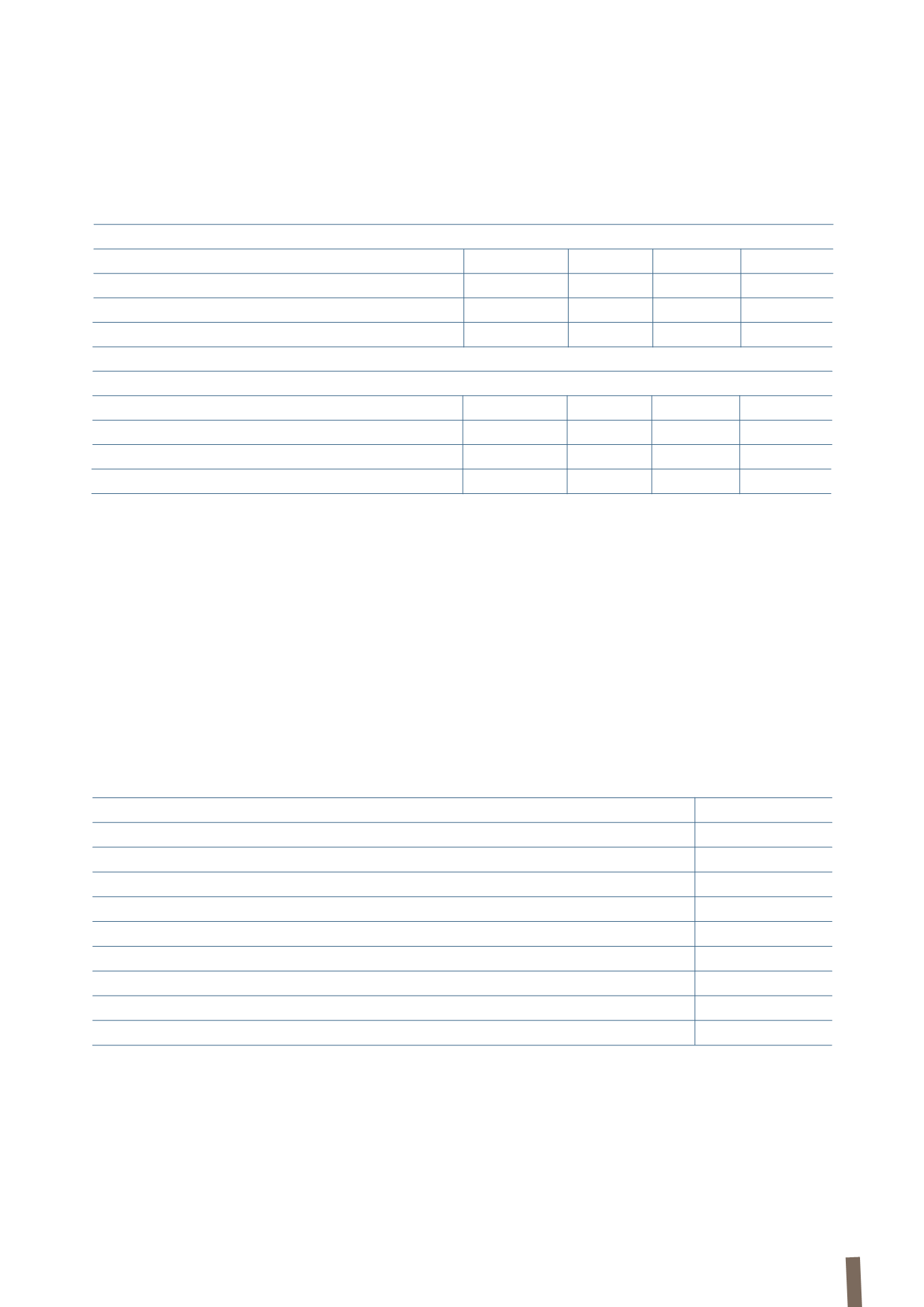

DEFERRED TAXES

(in millions of Euro)

31 December 2013

31 December 2012

Deferred tax assets:

- Deferred tax assets recoverable after more than 12 months

81

108

- Deferred tax assets recoverable within 12 months

53

19

Total deferred tax assets

134

127

Deferred tax liabilities:

- Deferred tax liabilities reversing after more than 12 months

(85)

(78)

- Deferred tax liabilities reversing within 12 months

(15)

(17)

Total deferred tax liabilities

(100)

(95)

Total net deferred tax assets (liabilities)

34

32