CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

202

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

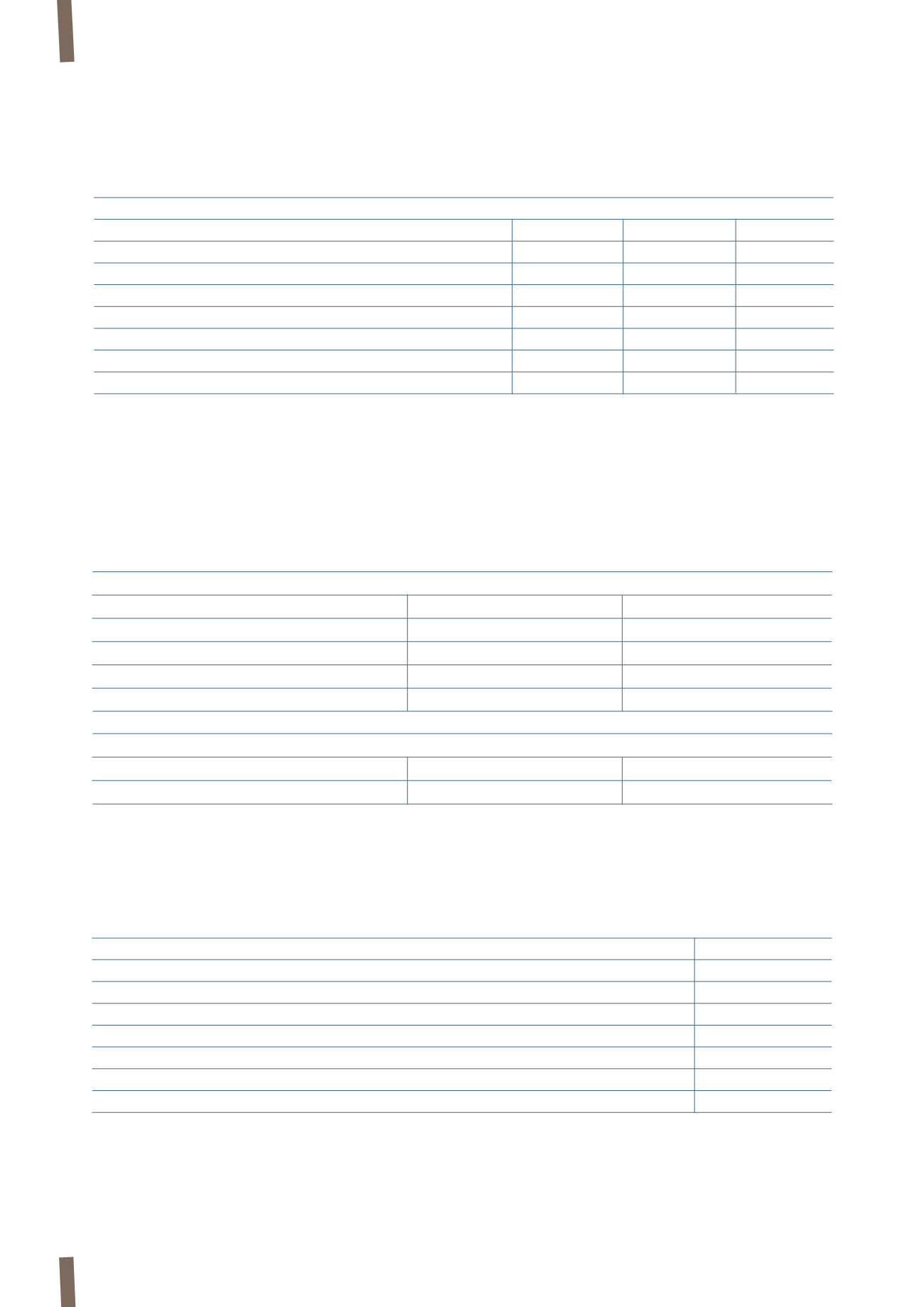

Life expectancy at age 65:

Male

Female

Male

Female Male

Female

People currently aged 65

18.71

22.79

21.36

23.46

22.00

24.20

People currently aged 50

20.74

24.72

22.66

24.96

23.40

25.00

31 December 2013

Germany

Great Britain The Netherlands

Interest rate

3.25%

4.40%

3.25%

Expected future salary increase

2.00%

n.a.

2.00%

Expected increase in pensions

2.00%

n.a.

2.00%

Inflation rate

2.00%

3.50%

2.00%

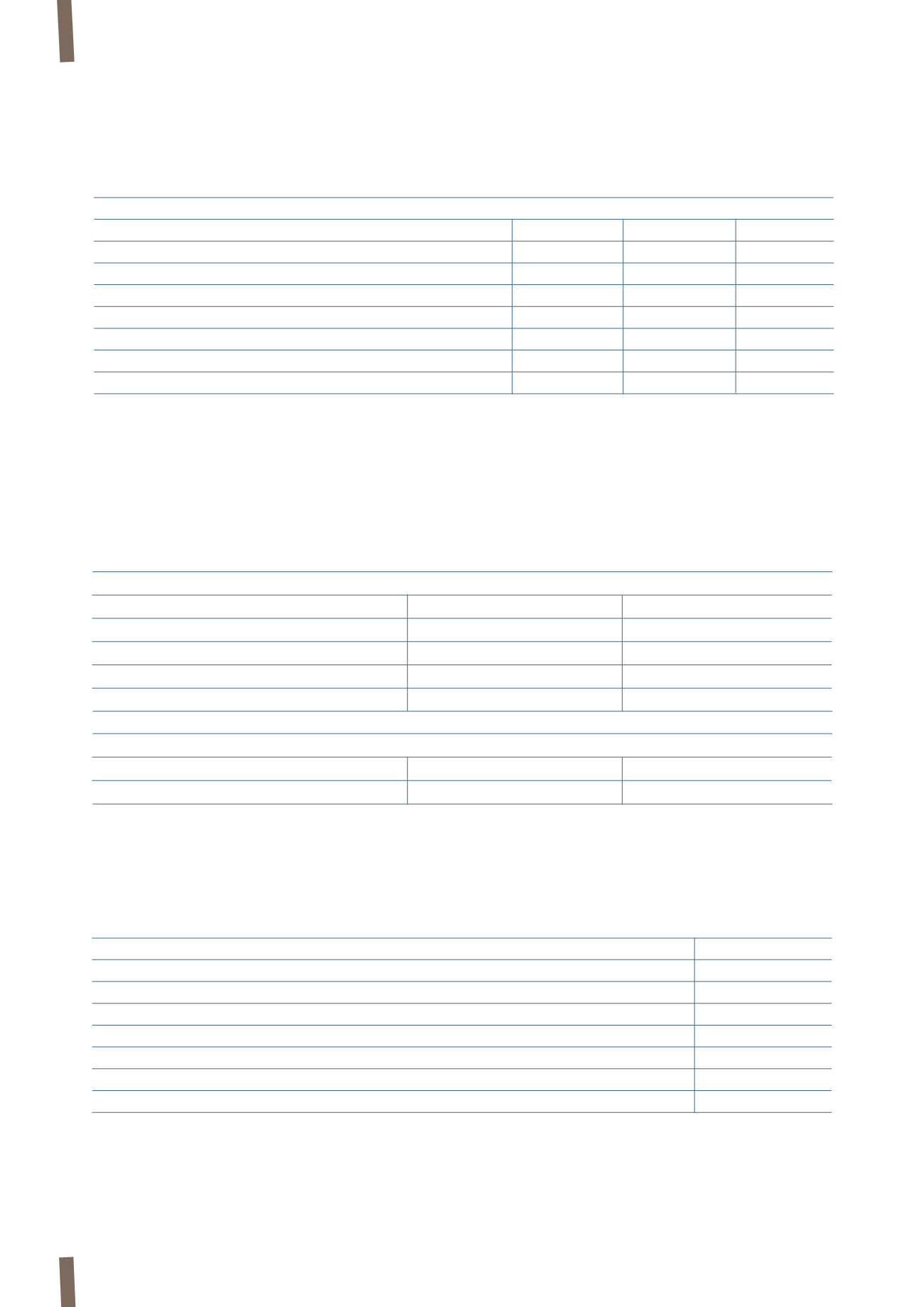

The following table presents a sensitivity analysis of the

effects of an increase/decrease in the most significant

actuarial assumptions used to determine the present value of

pension plan obligations, such as the interest rate, inflation

rate and life expectancy.

The sensitivity of the inflation rate includes any effects

relating to assumptions about salary increases and increases

in pension plan contributions.

31 December 2013

Germany

Great Britain

The Netherlands

decrease - 0.50% increase + 0.50% decrease - 0.50%

increase + 0.50% decrease - 0.50% increase + 0.50%

Interest rate

+7.45%

-6.65%

+10.54%

-9.23%

+8.31%

-7.31%

decrease - 0.25% increase + 0.25% decrease - 0.25%

increase + 0.25%

decrease - 0.25% increase + 0.25%

Inflation rate

-2.79%

+2.93%

-3.72%

+3.93%

-3.83%

+4.08%

31 December 2013

Germany

Great Britain

The Netherlands

1-year increase in life expectancy

+4.36%

+2.60%

+3.60%

EMPLOYEE INDEMNITY LIABILITY

Employee indemnity liability refers only to Italian companies and is analysed as follows:

(in millions of Euro)

2013

2012

Opening balance

25

22

Personnel costs

-

-

Interest costs

1

1

Actuarial (gains)/losses recognised in equity

(1)

4

Disbursements

(3)

(2)

Total movements

(3)

3

Closing balance

22

25

More details can be found in Note 21. Personnel costs.

The weighted average actuarial assumptions used to value the pension plans are as follows: