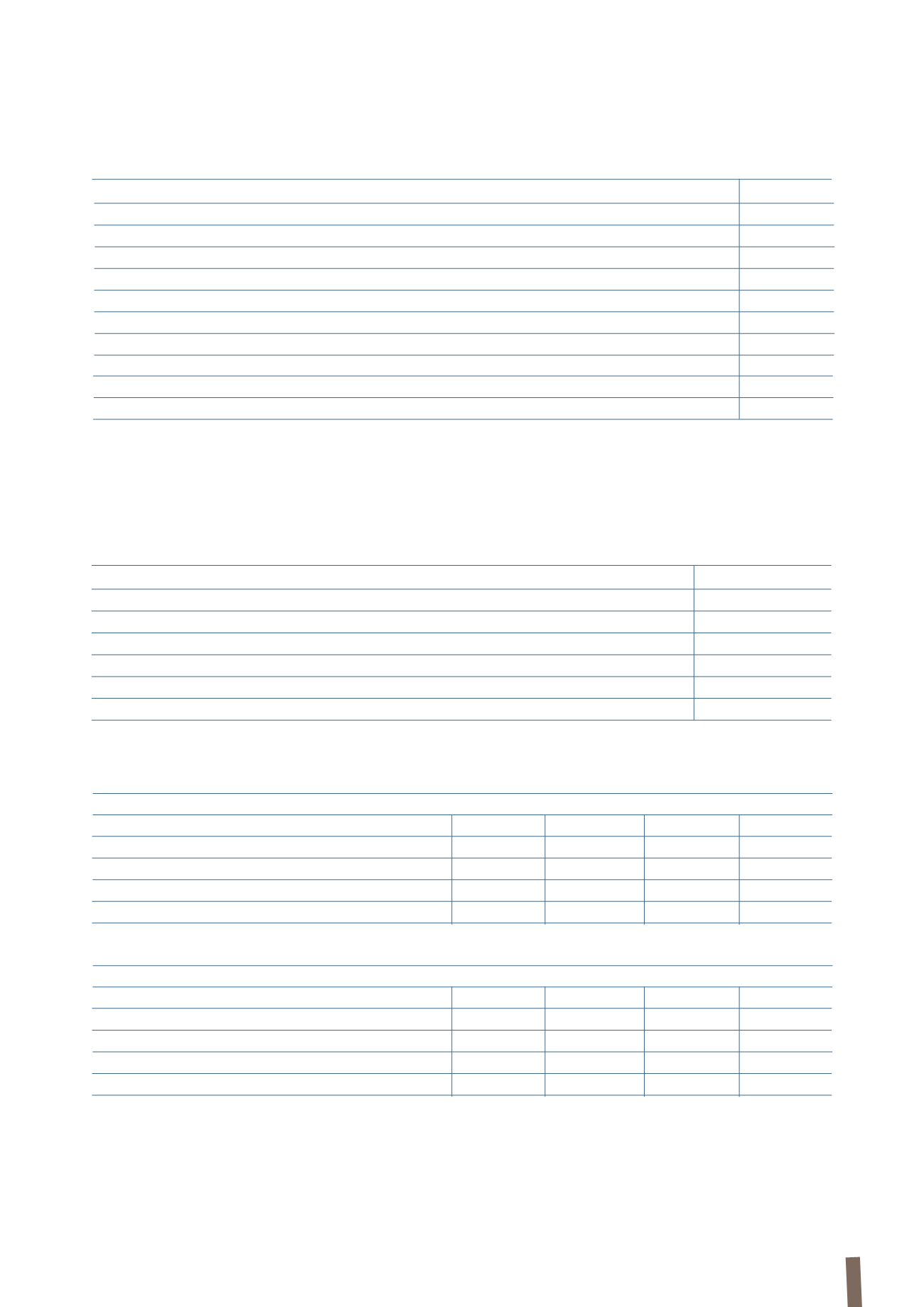

201

(in millions of Euro)

31 December 2013

Germany

Great Britain The Netherlands Other countries

Total

Personnel costs

1

-

1

1

3

Interest costs

5

6

3

3

17

Expected returns on plan assets

-

(4)

(3)

(2)

(9)

Total pension plan costs

6

2

1

2

11

(in millions of Euro)

31 December 2012

Germany

Great Britain The Netherlands Other countries

Total

Personnel costs

1

-

1

5

7

Interest costs

6

6

4

4

20

Expected returns on plan assets

-

(5)

(4)

(2)

(11)

Total pension plan costs

7

1

1

7

16

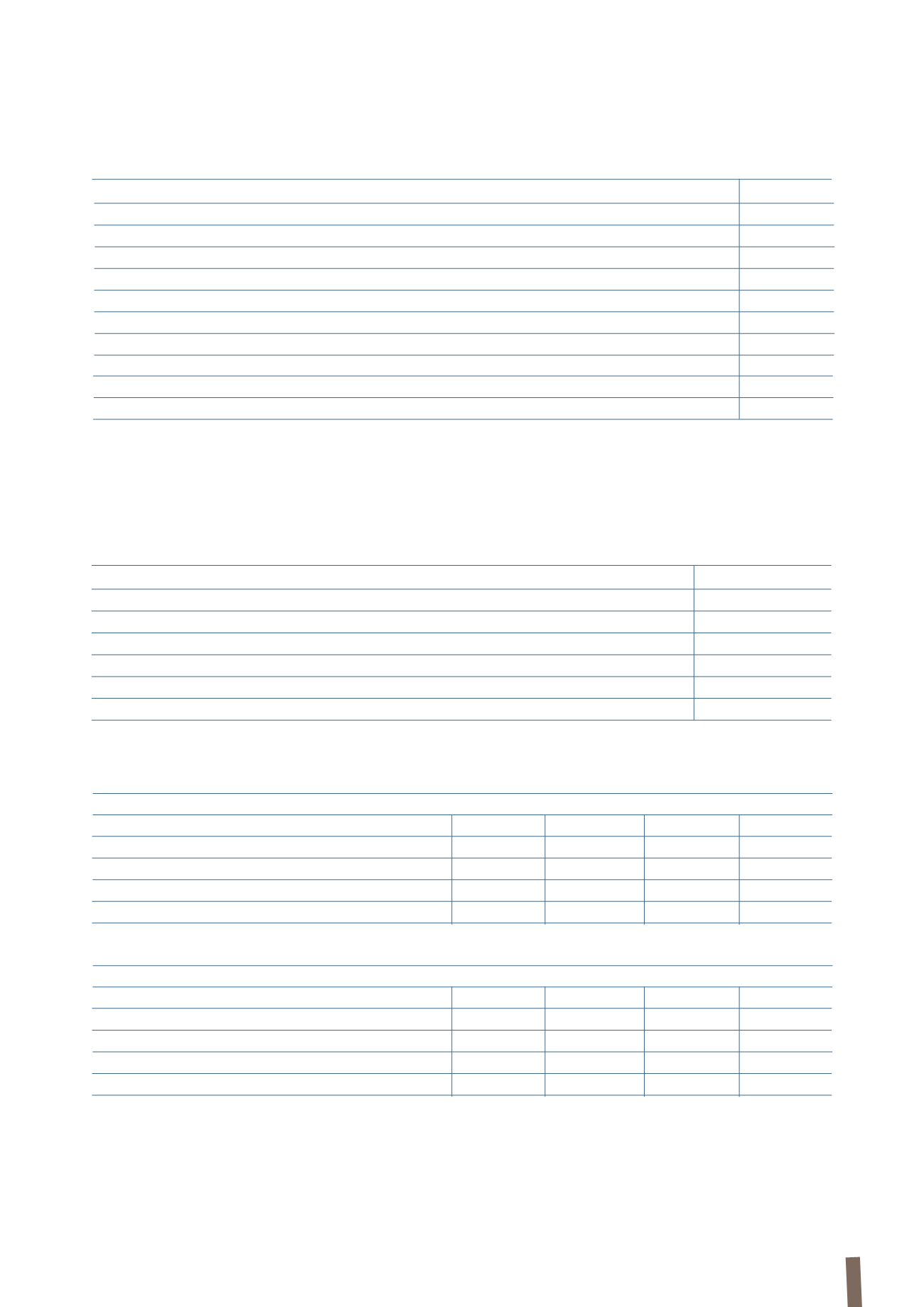

Changes during the year in pension plan assets are as follows:

(in millions of Euro)

2013

2012

Opening Plan Assets

243

221

Interest income on Plan Assets

9

11

Actuarial gains/(losses) recognised in equity

10

15

Contributions paid by the Group

14

15

Contributions paid in by plan participants

-

1

Disbursements

(19)

(21)

Plan settlements

(9)

-

Currency translation differences

(5)

1

Total movements

-

22

Closing Plan Assets

243

243

At 31 December 2013, pension plan assets consisted of equities (47.5% versus 45.3% in 2012), government bonds (33.7% versus 33.6%

in 2012), corporate bonds (13.7% versus 14.4% in 2012), and other assets (5.1% versus 6.7% in 2012).

Movements in the asset ceiling over the period are as follows:

(in millions of Euro)

2013

2012

Opening asset ceiling

1

13

Interest costs

-

1

Changes in assets recognised in equity

2

(13)

Currency translation differences

-

-

Total movements

2

(12)

Closing asset ceiling

3

1

Pension plan costs recognised in the income statement are analysed as follows :