CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

206

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

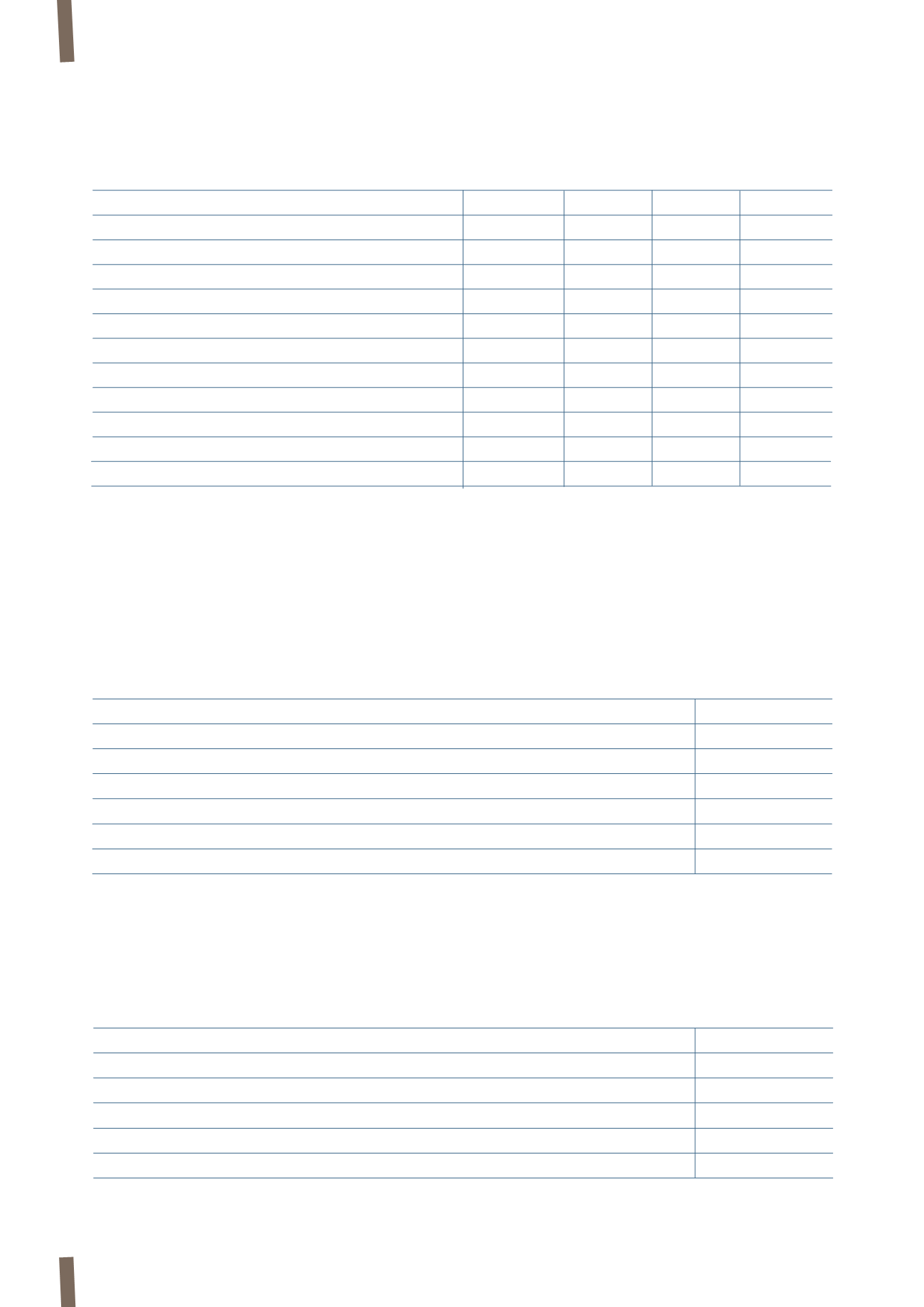

Movements in deferred taxes are detailed as follows:

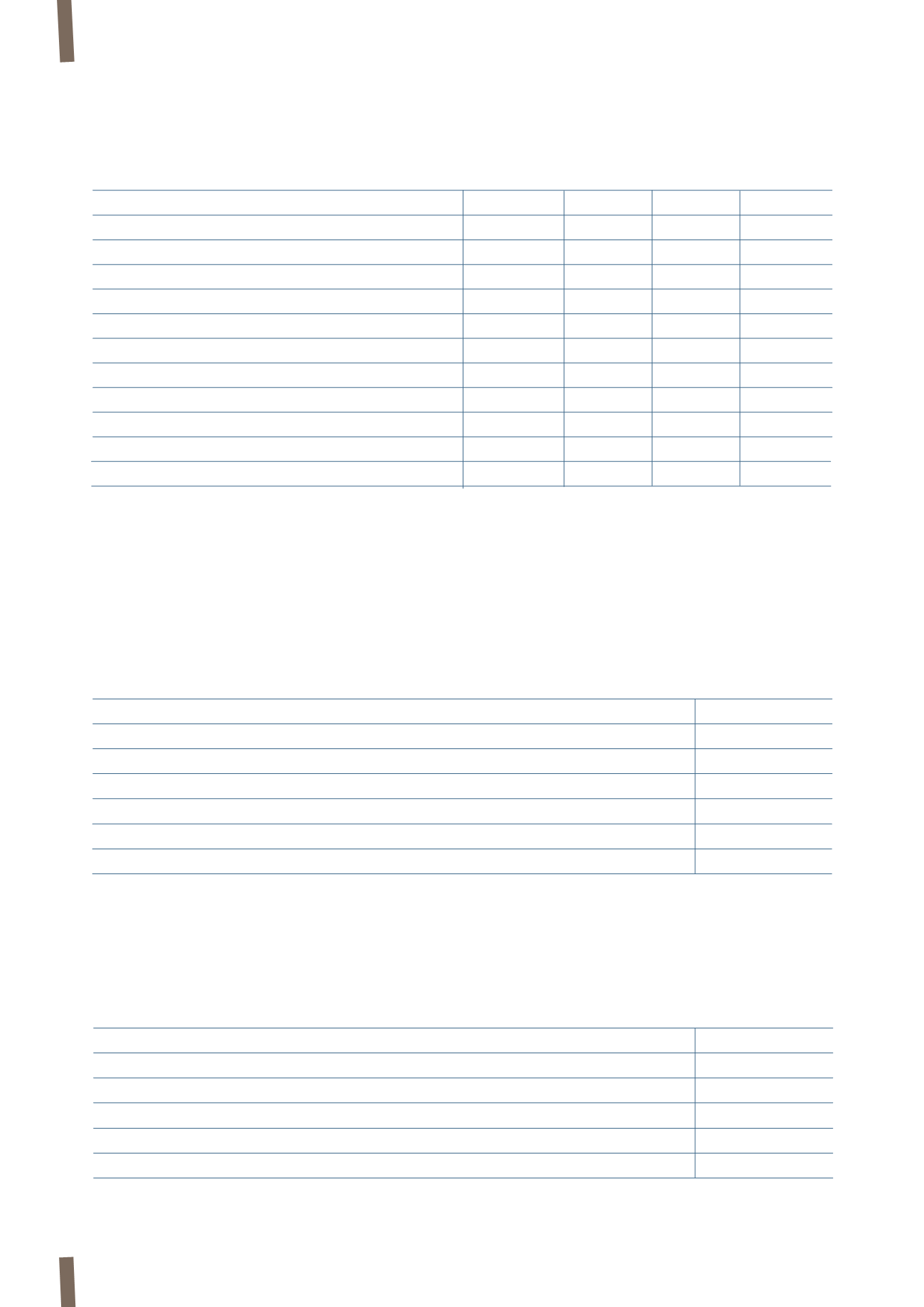

The following table presents details of carryforward tax losses:

These are detailed as follows:

The Group has not recognised any deferred tax assets for

carryforward tax losses of Euro 651 million at 31 December 2013

(Euro 675 million at 31 December 2012), or for future deductible

temporary differences of Euro 180 million at 31 December 2013

(Euro 187 million at 31 December 2012). Unrecognised deferred

tax assets relating to these carryforward tax losses and

deductible temporary differences amount to Euro 240 million

at 31 December 2013 (Euro 251 million at 31 December 2012).

(in millions of Euro)

Accumulated depreciation Provisions (*)

Tax losses

Other

Total

Balance at 31 December 2011

(163)

51

49

54

(9)

Currency translation differences

1

(3)

-

(1)

(3)

Impact on income statement

4

13

22

(7)

32

Impact on equity

-

14

-

3

17

Other and reclassifications

(5)

30

-

(30)

(5)

Balance at 31 December 2012

(163)

105

71

19

32

Currency translation differences

4

(4)

(1)

(5)

(6)

Impact on income statement

12

(24)

(1)

22

9

Impact on equity

-

(2)

-

-

(2)

Other and reclassifications

1

(6)

-

6

1

Balance at 31 December 2013

(146)

69

69

42

34

(in millions of Euro)

31 December 2013

31 December 2012

Carryforward tax losses

953

986

of which recognised as assets

302

311

Carryforward expires within 1 year

9

20

Carryforward expires between 2-5 years

110

112

Carryforward expires beyond 5 years

307

348

Unlimited carryforward

527

506

(in millions of Euro)

2013

2012

Finished goods

5,925

6,552

Construction contracts

912

802

Services

84

174

Other

352

320

Total

7,273

7,848

17.

SALES OF GOODS AND SERVICES

(*) These comprise Provisions for risks and charges (current and non-current) and Employee benefit obligations,