215

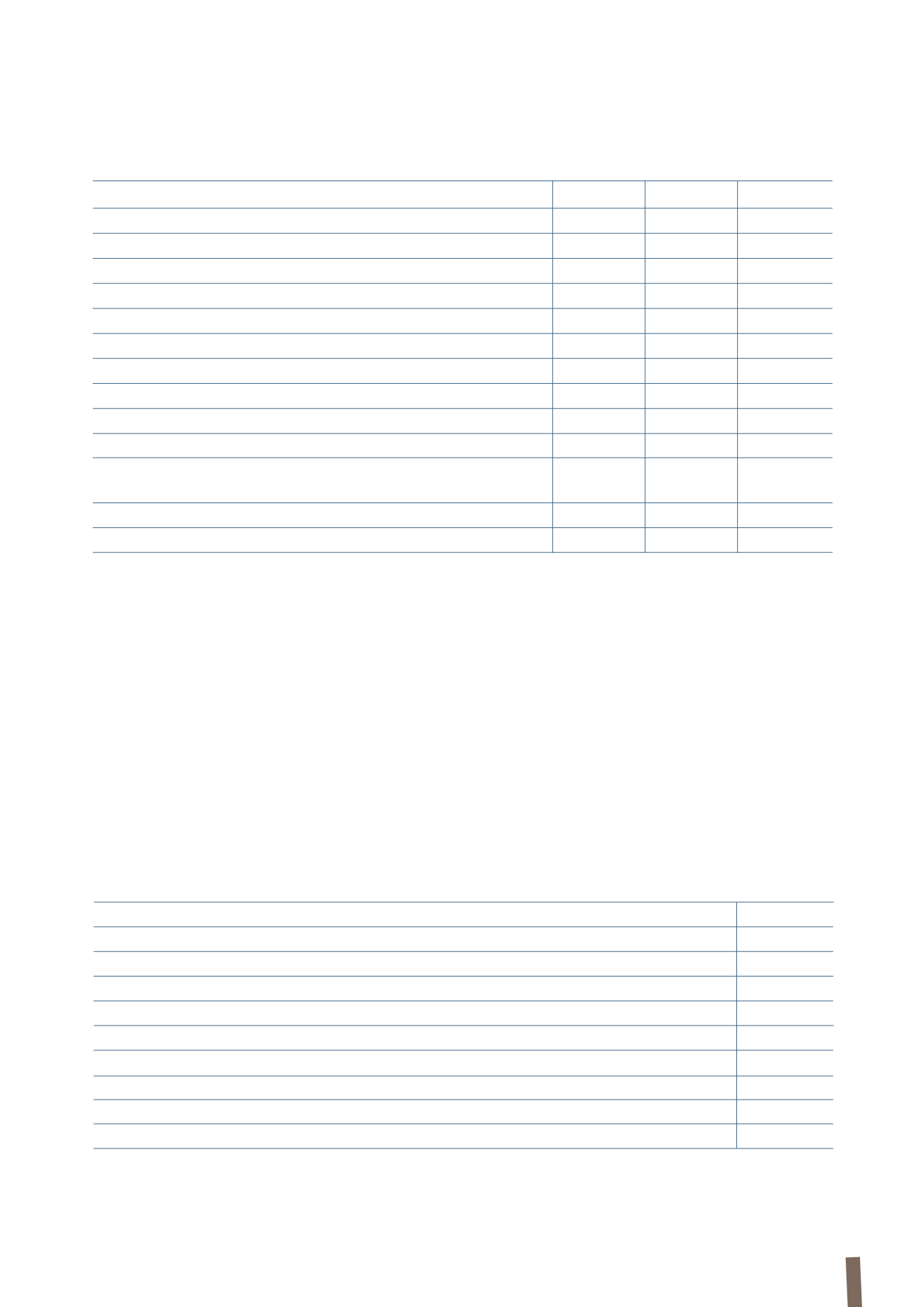

The following table reconciles the effective tax rate with the Parent Company’s theoretical tax rate:

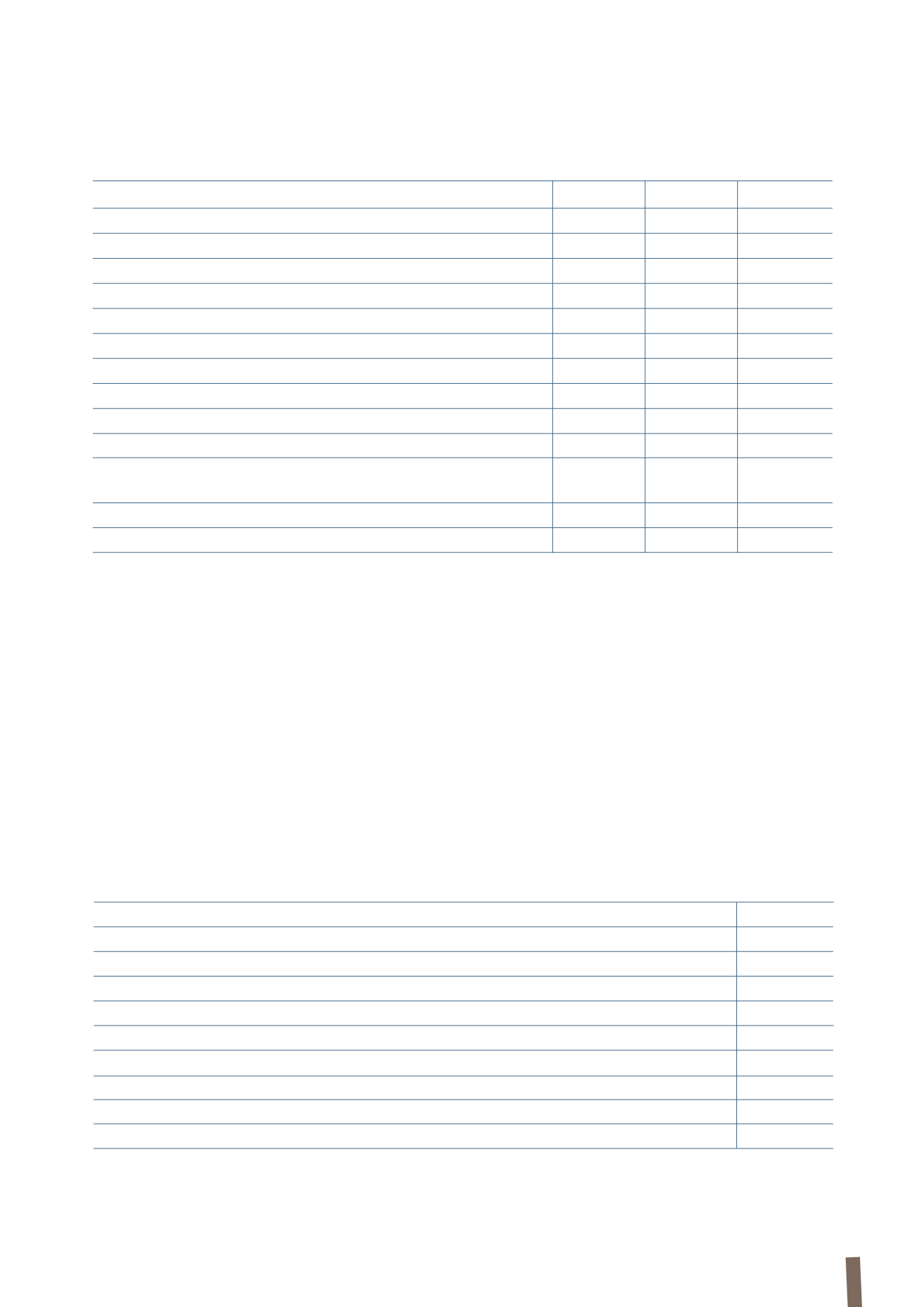

28. EARNINGS/(LOSS) AND DIVIDENDS PER SHARE

Both basic and diluted earnings (loss) per share have

been calculated by dividing the net result for the period

attributable to owners of the parent by the average number

of the Company’s outstanding shares.

The options under the Incentive Plan 2011-2013 have been

considered for the purposes of determining both basic and

diluted earnings/(loss) per share, since they are grantable

based on the level of cumulative EBITDA achieved in the

three-year target period.

Diluted earnings/(loss) per share are affected by the options

relating to adherences to the employee share purchase plan.

Instead, diluted earnings/(loss) per share are not impacted

by the following:

• the options under the Stock Option Plan 2007-2012 which

as at 31 December 2013 were fully vested and exercised;

• the options relating to the convertible bond that would

have an anti-dilutive effect since the conversion is

currently “out of the money”.

(in millions of Euro)

2013

Tax rate

2012

Tax rate

Profit/(loss) before taxes

222

242

Theoretical tax expense at Parent Company’s nominal tax rate

61

27.5%

67

27.5%

Differences in nominal tax rates of foreign subsidiaries

3

1.5%

4

1.7%

Utilisation of unrecognised carryforward tax losses

(20)

-8.8%

(45)

(18.5%)

Unrecognised deferred tax assets

21

9.6%

30

12.5%

Net increase (release) of provision for tax disputes

4

2.0%

(3)

(1.2%)

IRAP (Italian regional business tax)

12

5.3%

13

5.4%

Taxes on distributable reserves

2

0.8%

4

1.7%

Utilisation of prior year credit for taxes paid abroad

(7)

-3.2%

-

-

Asset impairment

4

1.9%

3

1.20%

Deferred tax assets from prior years recognised

and utilised in current year

(2)

-0.9%

(2)

(1.2%)

Non-deductible costs/ (non-taxable income) and other

(10)

-5.3%

2

0.9%

Effective income taxes

68

30.4%

73

30.0%

(in millions of Euro)

2013

2012 (*)

Net profit/(loss) attributable to owners of the parent

149

166

Weighted average number of ordinary shares (thousands)

211,835

211,416

Basic earnings/(loss) per share (in Euro)

0.71

0.79

Net profit/(loss) attributable to owners of the parent

149

166

Weighted average number of ordinary shares (thousands)

211,835

211,416

Adjustments for:

Dilution from incremental shares arising from exercise of stock options (thousands)

6

88

Weighted average number of ordinary shares to calculate diluted earnings per share (thousands)

211,841

211,504

Diluted earnings/(loss) per share (in Euro)

0.71

0.78

(*) The previously published figure for earnings per share in 2012 has been the subject of a restatement. Further details can be found in Section C. Restatement

of comparative figures at 31 December 2012.