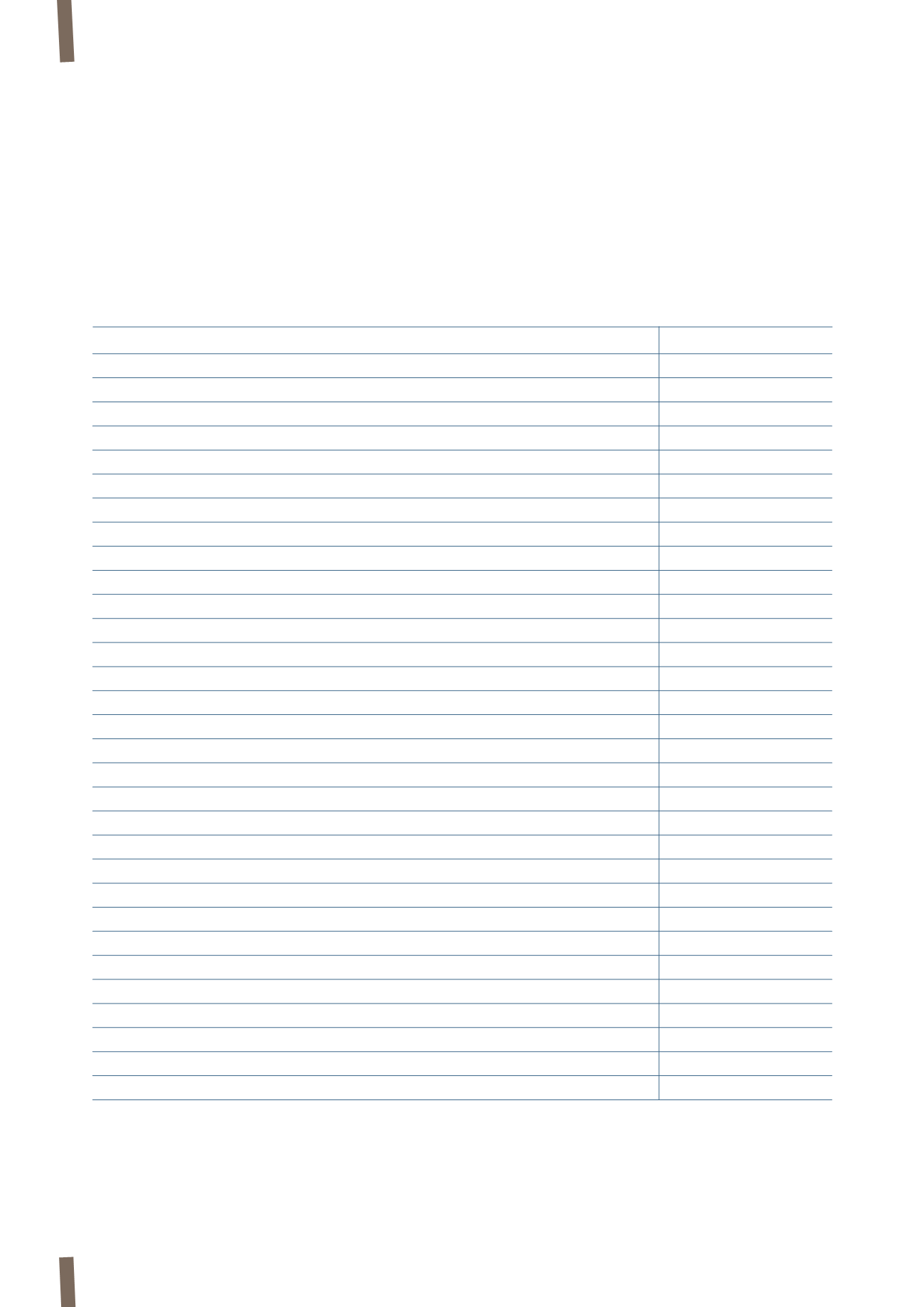

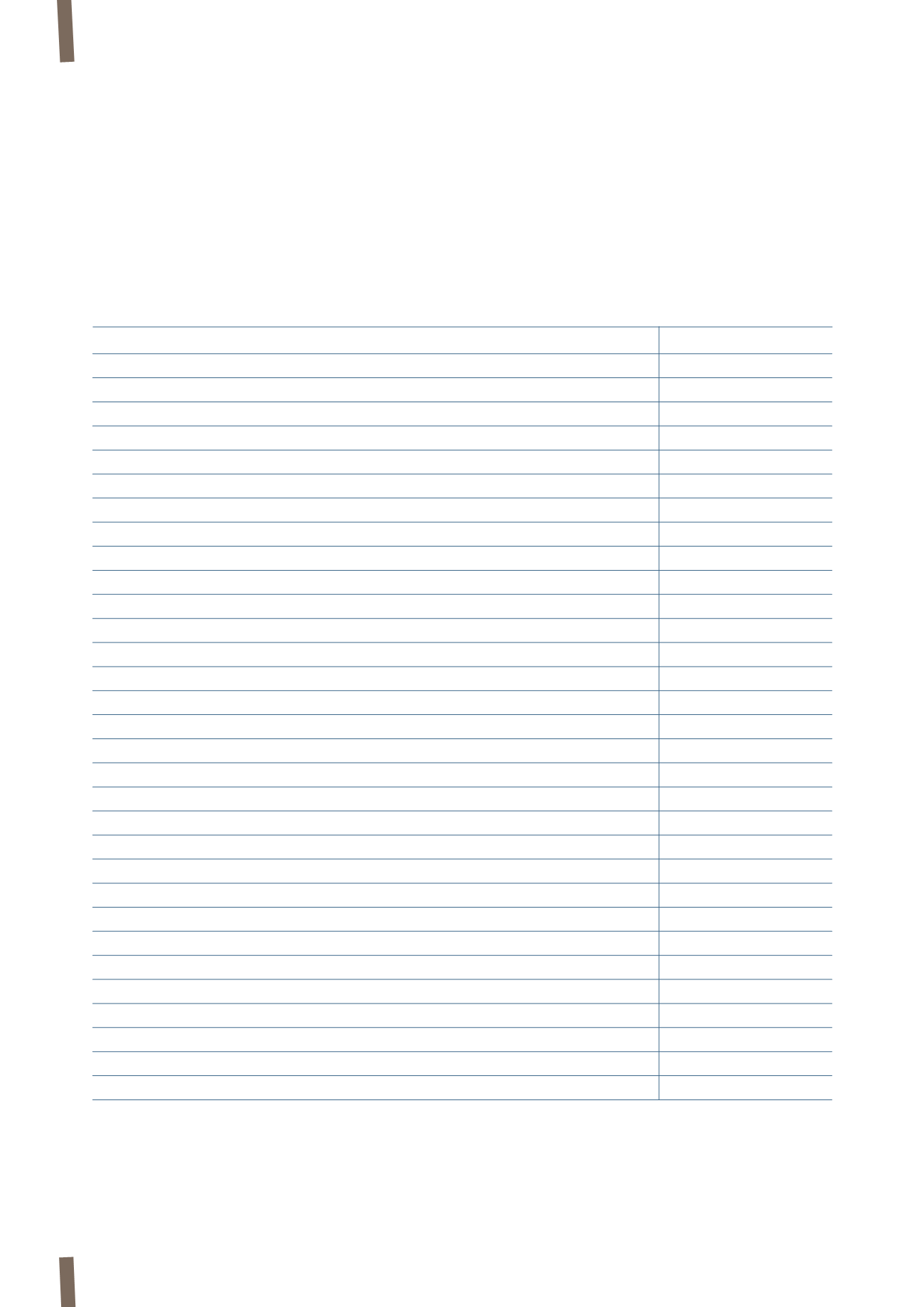

CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

220

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

As required by Consob Communication DEM/6064293 dated 28 July 2006, the effects of non-recurring events and transactions

on the income statement are shown below, involving total net non-recurring expenses of Euro 97 million in 2013 and Euro 123

million in 2012.

36. SIGNIFICANT NON-RECURRING EVENTS AND TRANSACTIONS

(in millions of Euro)

2013

2012

Non-recurring other income:

Gains on asset disposals

5

3

Remeasurement of minority put option liability

-

7

Non-recurring other income

5

12

Total non-recurring other income

10

22

Non-recurring personnel costs:

Company reorganisation

(34)

(64)

Terminated pension plans

2

-

Italian pensions reform

-

(1)

Non-recurring other costs

(2)

-

Total non-recurring personnel costs

(34)

(65)

Non-recurring impairment:

Impairment of property, plant and equipment

(25)

(24)

Total non-recurring impairment

(25)

(24)

Non-recurring other expenses:

Draka integration costs

-

(9)

Tax inspections

-

(3)

Antitrust investigations

6

(1)

Company reorganisation

(16)

(10)

Environmental remediation and other costs

3

(3)

Non-recurring other expenses

(19)

(25)

Total non-recurring other expenses

(26)

(51)

Non-recurring other finance costs

Non-recurring net losses on interest rate swaps

(15)

-

Non-recurring other finance costs

(7)

(5)

Non-recurring other foreign currency exchange losses

-

(3)

Total non-recurring other finance costs

(22)

(8)

Non-recurring other finance income:

Non-recurring other finance income

-

3

Total non-recurring other finance income

-

3

Total

(97)

(123)