CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

190

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

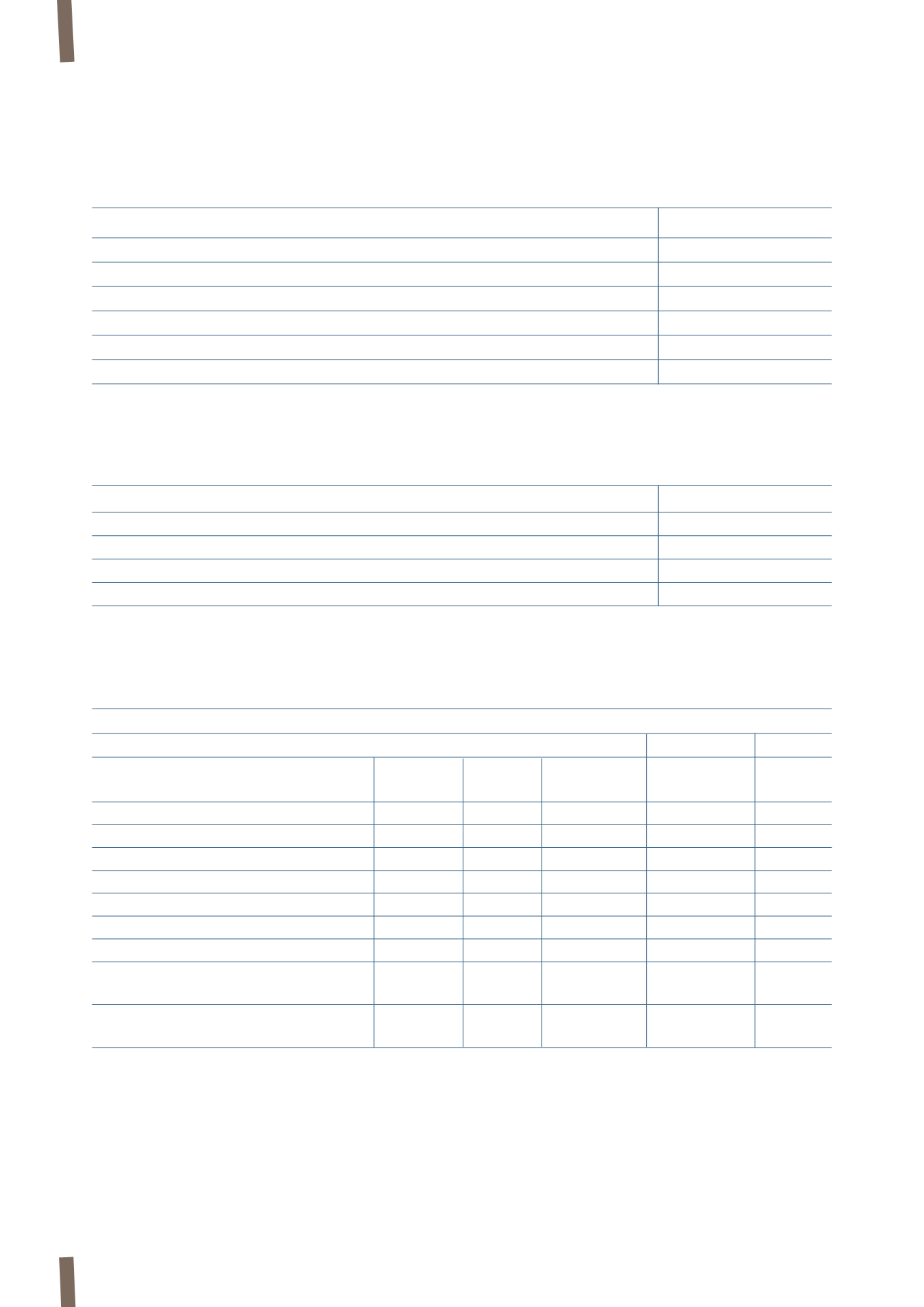

Finance lease obligations represent the liability arising as a result of entering into finance leases. Finance lease obligations are

reconciled with outstanding payments as follows:

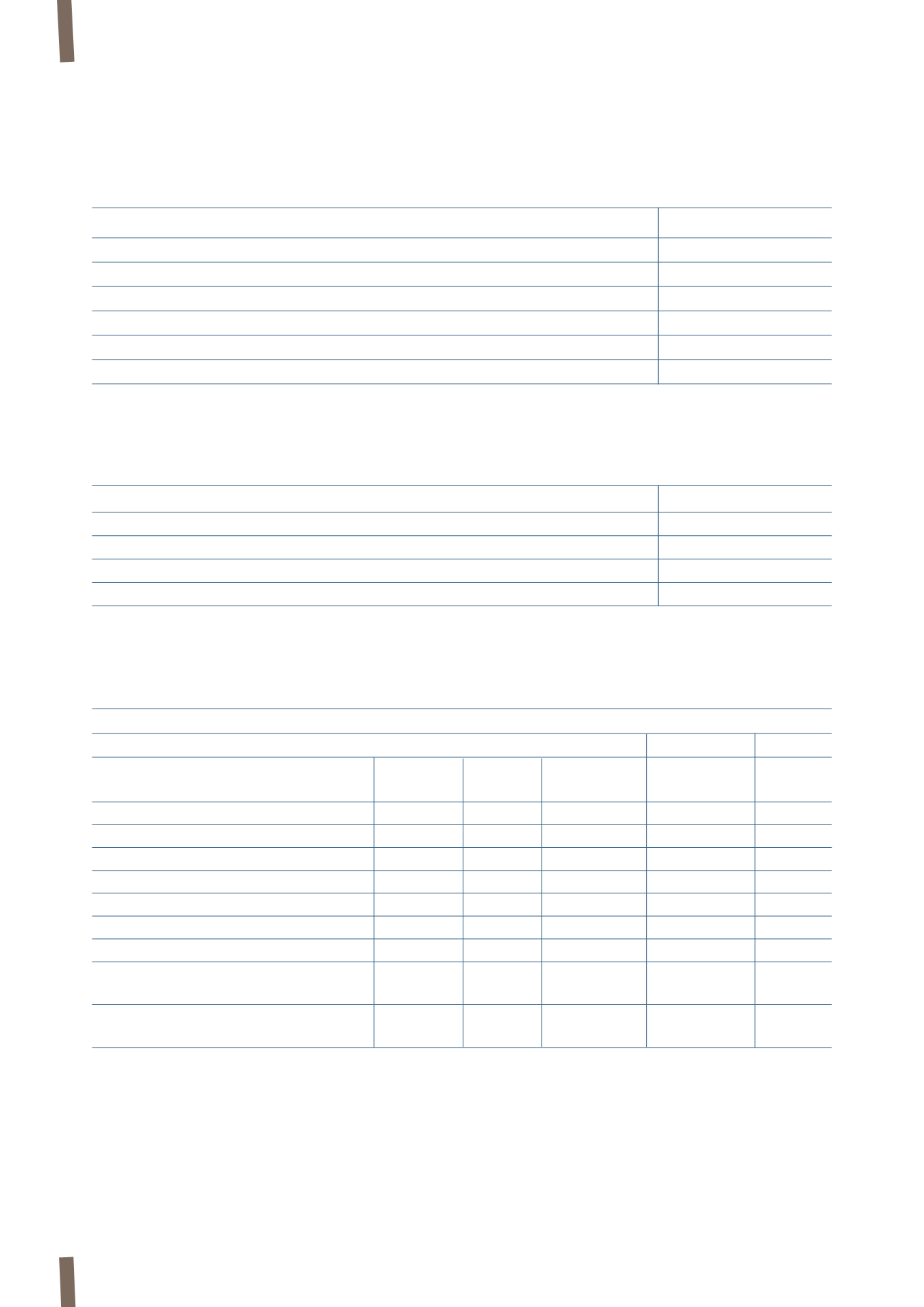

Finance lease obligations are analysed by maturity as follows:

The following tables provide a breakdown of borrowings from banks and other lenders by maturity and currency at 31 December

2013 and 2012:

(a) There are interest rate swaps to hedge interest rate risk on variable rate loans in Euro. The total hedged amount at 31 December 2013 equates to 66.4% of

Euro-denominated debt at that date. In particular, interest rate hedges consist of interest rate swaps which exchange a variable rate (3 and 6-month Euribor

for loans in Euro) with an average fixed rate (fixed rate + spread) of 3.8% for Euro-denominated debt. The percentages representing the average fixed rate

refer to 31 December 2013.

(in millions of Euro)

31 December 2013

31 December 2012

Due within 1 year

3

2

Due between 1 and 5 years

7

10

Due after more than 5 years

11

8

Minimum finance lease payments

21

20

Future interest costs

(4)

(6)

Finance lease obligations

17

14

(in millions of Euro)

31 December 2013

31 December 2012

Due within 1 year

2

2

Due between 1 and 5 years

5

7

Due after more than 5 years

10

5

Total

17

14

(in millions of Euro)

31 December 2013

Variable interest rate

Fixed interest rate

Total

Euro

USD

GBP Other currencies

Euro and other

currencies

Due within 1 year

164

51

-

36

87

338

Due between 1 and 2 years

-

-

-

6

423

429

Due between 2 and 3 years

397

31

-

2

8

438

Due between 3 and 4 years

-

5

-

-

3

8

Due between 4 and 5 years

-

-

-

-

266

266

Due after more than 5 years

9

-

-

-

4

13

Total

570

87

-

44

791

1,492

Average interest rate in period,

as per contract

1.7%

2.4% 0.0%

7.2%

4.9%

3.5%

Average interest rate in period,

including IRS effect

(a)

3.1%

2.4% 0.0%

7.2%

4.9%

4.1%