CONSOLIDATED FINANCIAL STATEMENTS >

EXPLANATORY NOTES

182

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

The Prysmian Group entered into no new interest rate swaps

during 2013.

The early repayment of the Credit Agreement 2010 has led

to the discontinued effectiveness of the related cash flow

hedges outstanding as at the date of repayment. The notional

value of these now ineffective interest rate swaps amounted

to Euro 300 million, maturing on 31 December 2014.

Interest rate swaps have a notional value of Euro 680 million

at 31 December 2013 (unchanged compared with 31 December

2012), of which Euro 380 million in derivatives designated

as cash flow hedges (Euro 680 million at 31 December 2012).

Such financial instruments convert the variable component of

interest rates on loans received into a fixed rate of between

1.1% and 3.7%.

Forward currency contracts have a notional value of Euro

2,332 million at 31 December 2013 (Euro 1,971 million at 31

December 2012); total notional value at 31 December 2013

includes Euro 691 million in derivatives designated as cash

flow hedges (Euro 728 million at 31 December 2012).

At 31 December 2013, like at 31 December 2012, almost all

the derivative contracts had been entered into with major

financial institutions.

Metal derivatives have a notional value of Euro 482 million at

31 December 2013 (Euro 614 million at 31 December 2012).

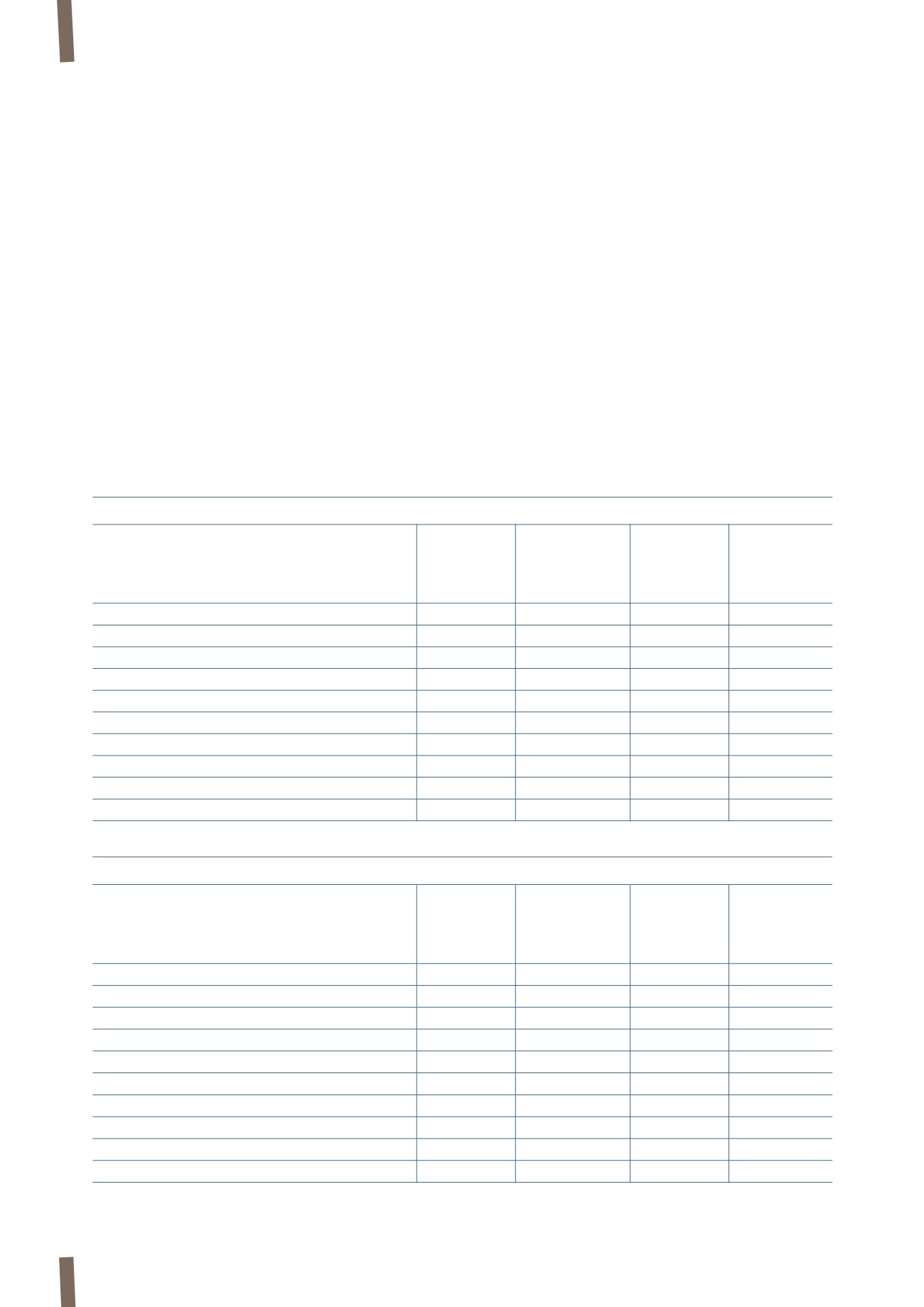

The following tables show the impact of offsetting assets

and liabilities for derivative instruments, done on the basis of

master netting arrangements (ISDA and similar agreements).

They also show the effect of potential offsetting in the event

of currently unforeseen default events:

(in millions of Euro)

31 December 2013

Gross derivatives

Amounts offset

Derivatives

Amounts not

Net derivatives

recognised in

offset (*)

statement of

financial position

Assets

Forward currency contracts

19

-

19

(7)

12

Interest rate swaps

-

-

-

-

-

Metal derivatives

6

-

6

(3)

3

Total assets

25

-

25

(10)

15

Liabilities

Forward currency contracts

12

-

12

(7)

5

Interest rate swaps

18

-

18

-

18

Metal derivatives

19

-

19

(3)

16

Total liabilities

49

-

49

(10)

39

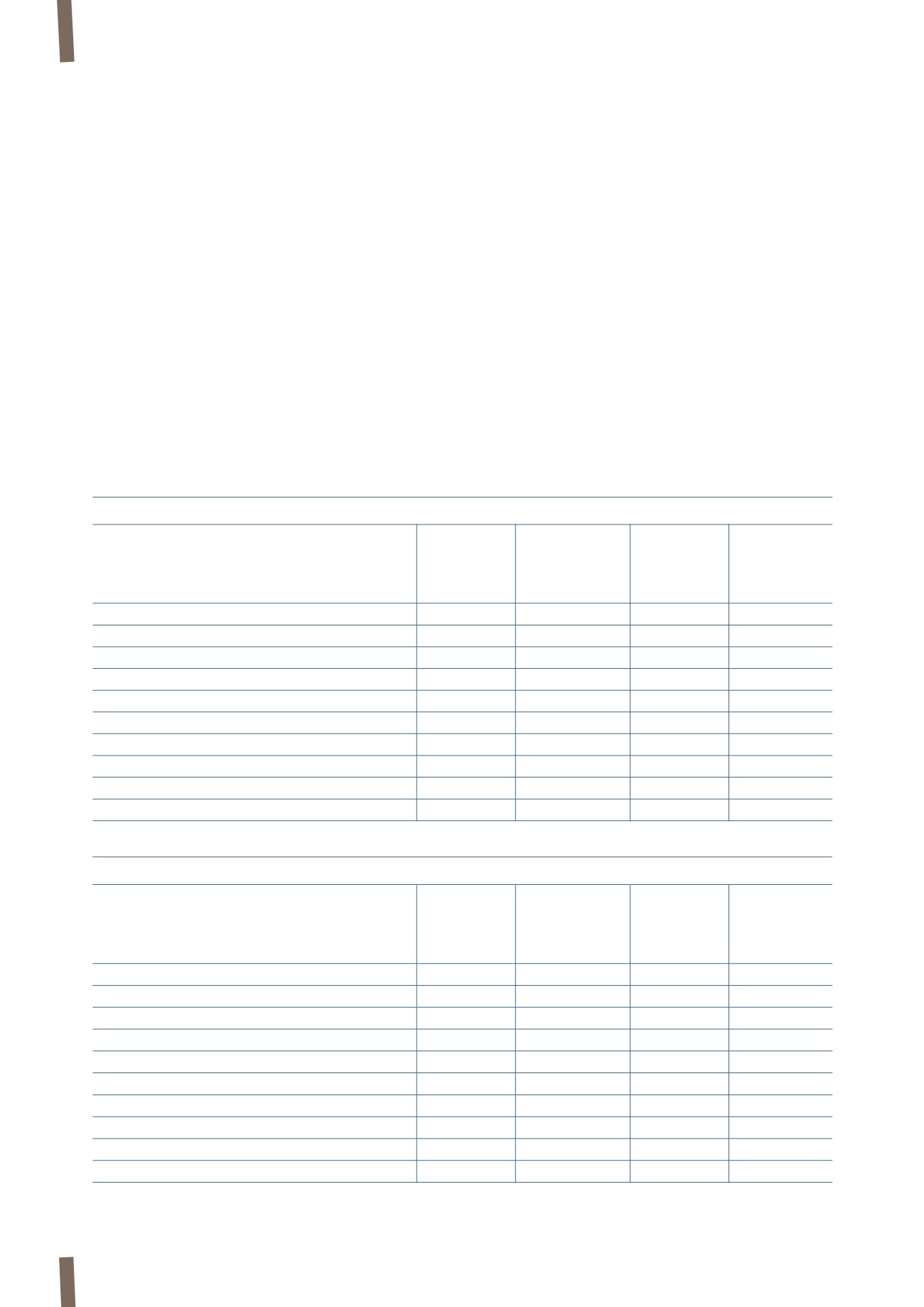

(in millions of Euro)

31 December 2012

Gross derivatives

Amounts offset

Derivatives

Amounts not

Net derivatives

recognised in

offset (*)

statement of

financial position

Assets

Forward currency contracts

15

-

15

(8)

7

Interest rate swaps

-

-

-

-

-

Metal derivatives

4

-

4

(3)

1

Total assets

19

-

19

(11)

8

Liabilities

Forward currency contracts

21

-

21

(8)

13

Interest rate swaps

35

-

35

-

35

Metal derivatives

9

-

9

(3)

6

Total liabilities

65

-

65

(11)

54

(*) Derivatives potentially offsettable in the event of default events under master agreements.