187

The Credit Agreement 2011 is an agreement, entered into by

Prysmian on 7 March 2011 with a syndicate of major banks, for

Euro 800 million with a five-year maturity. This agreement

comprises a loan for Euro 400 million (Term Loan Facility 2011)

and a revolving facility for Euro 400 million (Revolving Credit

Facility 2011). The entire amount of the Term Loan Facility

2011 is scheduled for repayment on 7 March 2016; the loan has

therefore been classified in non-current liabilities.

At 31 December 2013, the fair values of the Credit Agreements

2010 and 2011 approximate the related carrying amounts.

Fair values have been determined using valuation techniques

that refer to observable market data (Level 2 of the fair value

hierarchy).

The Revolving Credit Facility 2010 and the Revolving Credit

Facility 2011 are both intended to finance ordinary working

capital requirements, while only the Revolving Credit Facility

2010 can also be used for the issue of guarantees.

The securitization programme was terminated on 25 July 2013

upon reaching its end date.

EIB Loan

On 18 December 2013, Prysmian S.p.A. entered into a loan

agreement with the European Investment Bank (EIB) for

Euro 100 million, to fund the Group’s European research &

development (R&D) programmes over the period 2013-2016.

The EIB Loan is particularly intended to support projects

developed in the Group’s R&D centres in six countries: France,

Great Britain, The Netherlands, Spain, Germany and Italy

and represents about 50% of the Prysmian Group’s planned

investment expenditure in Europe during the period concerned.

The EIB Loan was received on 5 February 2014; it will be repaid

in 12 equal half-yearly instalments starting on 5 August 2015

and ending on 5 February 2021.

Bonds

As at 31 December 2013, the Prysmian Group had issued the

following bonds:

Non-convertible bond issued in 2010

On 31 March 2010, Prysmian S.p.A. completed the placement

of an unrated bond with institutional investors on the

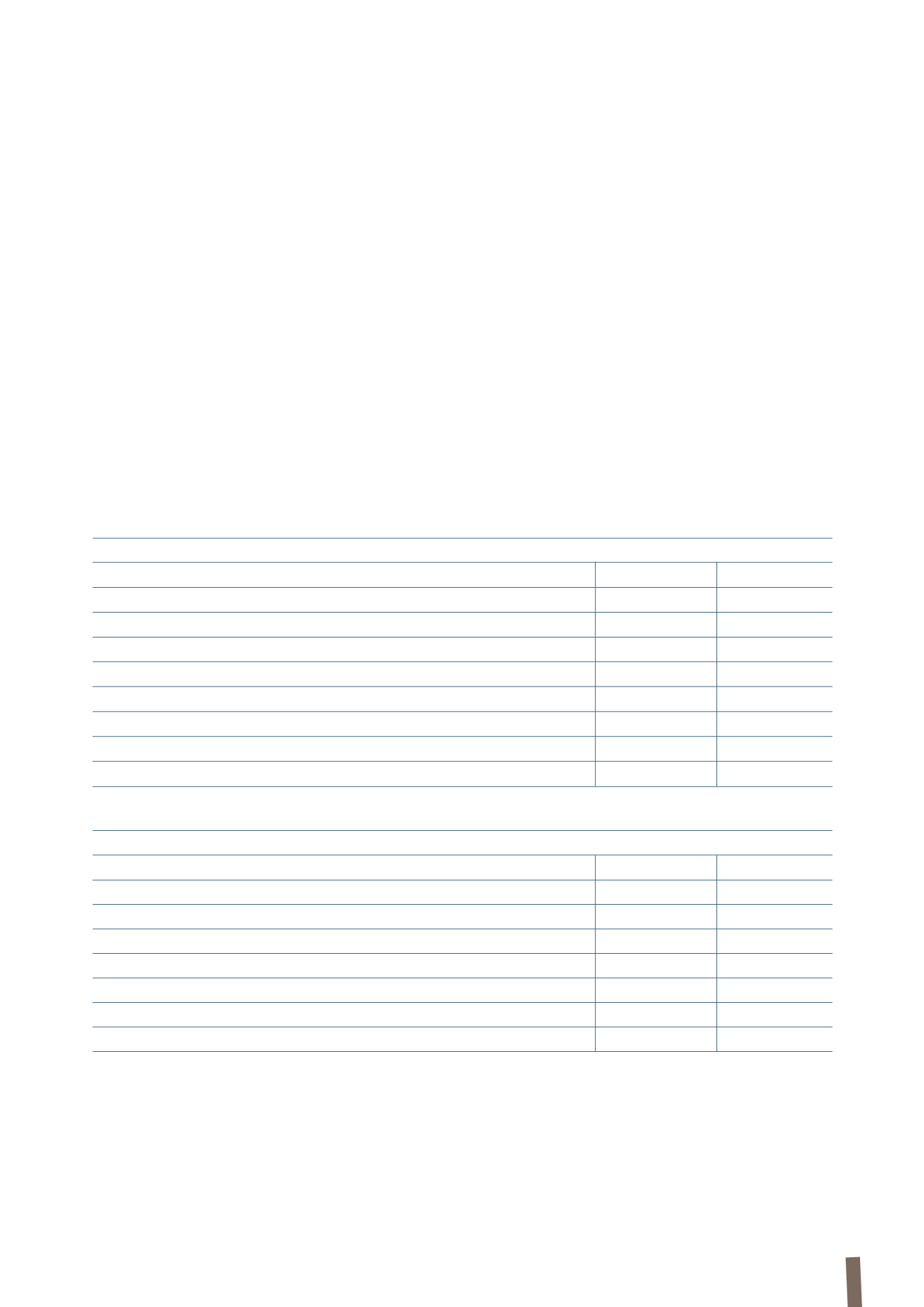

The following tables summarise the Committed Lines available to the Group at 31 December 2013 and 31 December 2012:

(in millions of Euro)

31 December 2013

Total lines

Used

Unused

Term Loan Facility 2010

184

(184)

-

Term Loan Facility 2011

400

(400)

-

Revolving Credit Facility 2010

400

(3)

397

Revolving Credit Facility 2011

400

400

Total Credit Agreements

1,384

(587)

797

EIB Loan

100

-

100

Securitization

-

-

-

Total

1,484

(587)

897

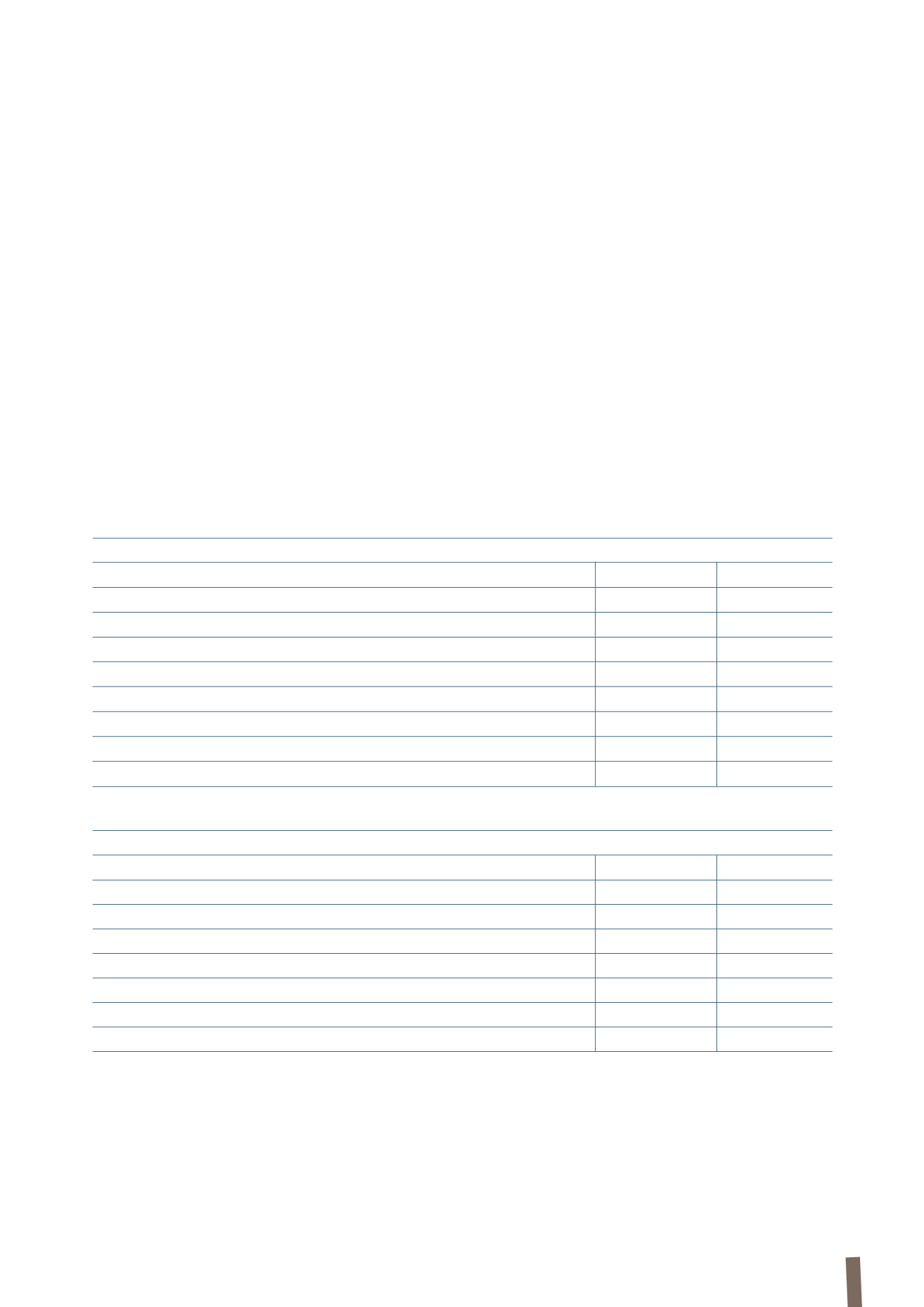

(in millions of Euro)

31 December 2012

Total lines

Used

Unused

Term Loan Facility 2010

670

(670)

-

Term Loan Facility 2011

400

(400)

-

Revolving Credit Facility 2010

400

(4)

396

Revolving Credit Facility 2011

400

-

400

Total Credit Agreements

1,870

(1,074)

796

Securitization

150

(75)

75

Total

2,020

(1,149)

871