189

The convertible bond (equity component and debt

component) has a fair value of Euro 339 million at 31

December 2013, of which the fair value of the debt component

is Euro 265 million. In the absence of trading on the relevant

market, fair value has been determined using valuation

techniques that refer to observable market data (Level 2 of

the fair value hierarchy).

Other borrowings from banks and financial institutions and

Finance lease obligations

These have reported the following changes during 2013:

• the receipt of Euro 55 million in new funds, mainly

comprising Euro 26 million by the joint venture Yangtze

Optical Fibre and Cables Joint Stock Co. Ltd., Euro 11 million

by Prysmian S.p.A. in respect of the finance lease for

the “Ansaldo 16” building and other financial liabilities

contracted by Spanish and German subsidiaries;

• repayments of Euro 122 million, primarily relating to

extinguishment of the securitization agreement and to

repayments by Brazilian and Chinese subsidiaries.

(1) Includes the accelerated amortisation of Euro 5 million in bank fees following the early repayments of the Credit Agreement 2010.

(2) “Drawdowns/New funds” pertaining to the convertible bond are stated net of the equity component of Euro 39 million and of Euro 4 million in related

expenses.

(1) “Drawdowns/new funds” are stated net of Euro 10 million in bank fees relating to the Term Loan Facility 2010.

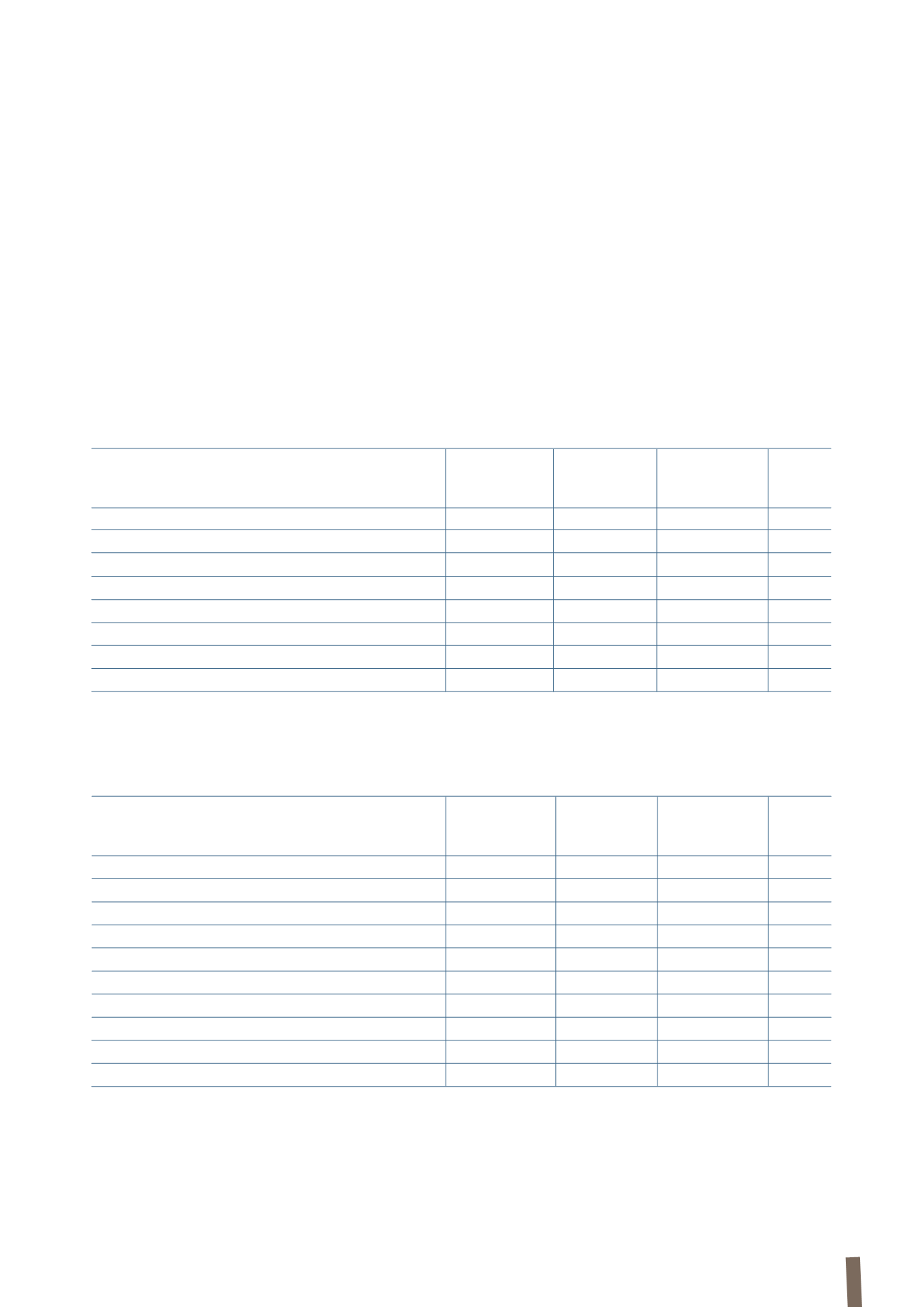

(in millions of Euro)

Credit

Non-convertible Convertible bond

(2)

Other borrowings/

Total

Agreement

bond

Finance lease

obligations

Balance at 31 December 2012

1,060

413

-

321

1,794

Business combinations

(1)

-

-

(20)

(21)

Drawdowns/new funds

-

-

257

55

312

Repayments

(486)

-

-

(122)

(608)

Amortisation of bank and financial fees and other expenses

(1)

8

1

-

-

9

Interest and other movements

(1)

-

7

-

6

Total movements

(480)

1

264

(87)

(302)

Balance at 31 December 2013

580

414

264

234

1,492

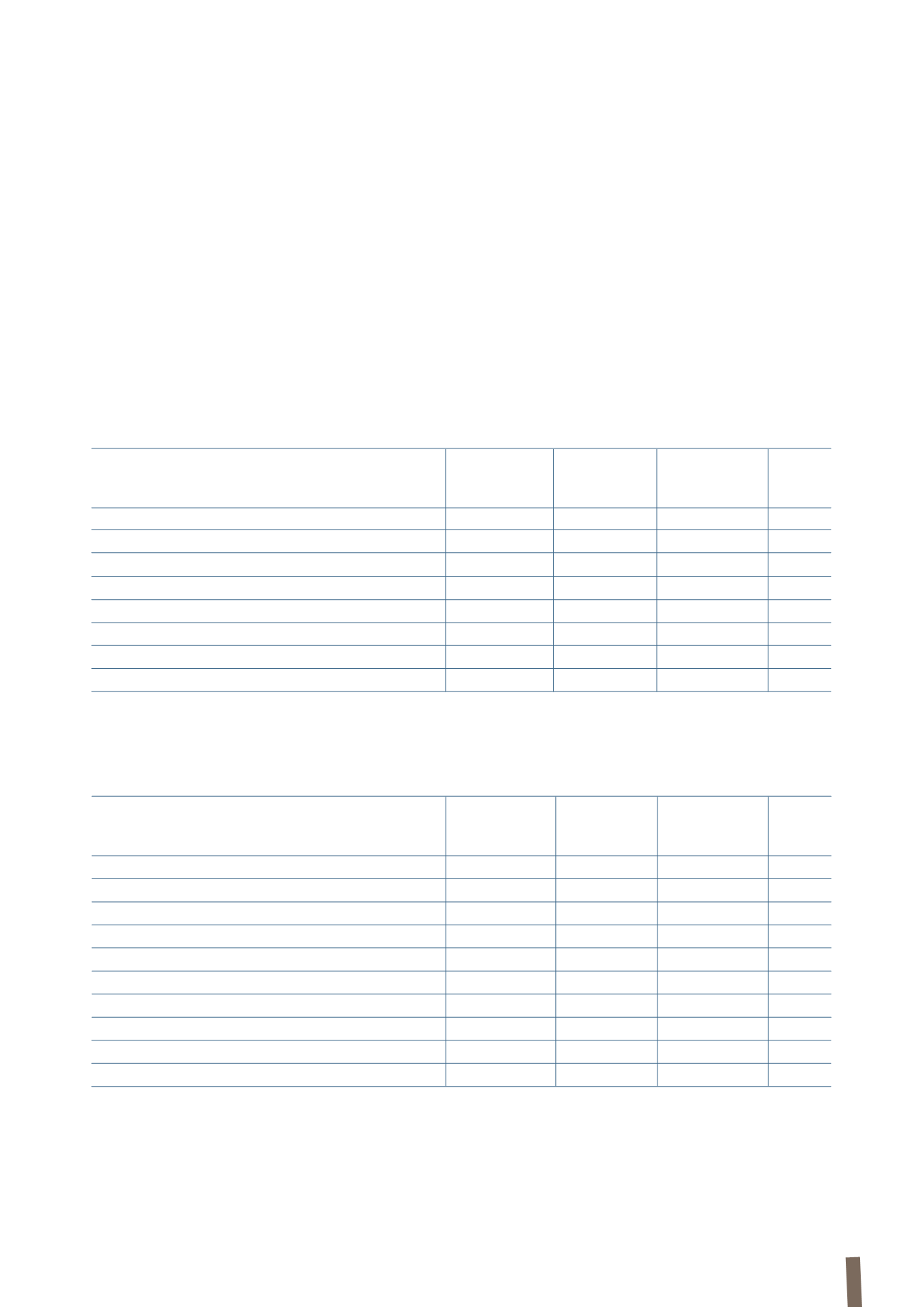

The following tables report movements in borrowings from banks and other lenders:

(in millions of Euro)

Credit

Non-convertible

Convertible bond Other borrowings/

Total

Agreement

bond

Finance lease

obligations

Balance at 31 December 2011

1,070

412

-

380

1,862

Business combinations

-

-

-

15

15

Effects of deconsolidation

-

-

-

(16)

(16)

Currency translation differences

(4)

-

-

(11)

(15)

Drawdowns/new funds

(1)

660

-

-

134

794

Repayments

(670)

-

-

(181)

(851)

Amortisation of bank and financial fees and other expenses

4

1

-

-

5

Interest and other movements

-

-

-

-

-

Total movements

(10)

1

-

(59)

(68)

Balance at 31 December 2012

1,060

413

-

321

1,794