183

9.

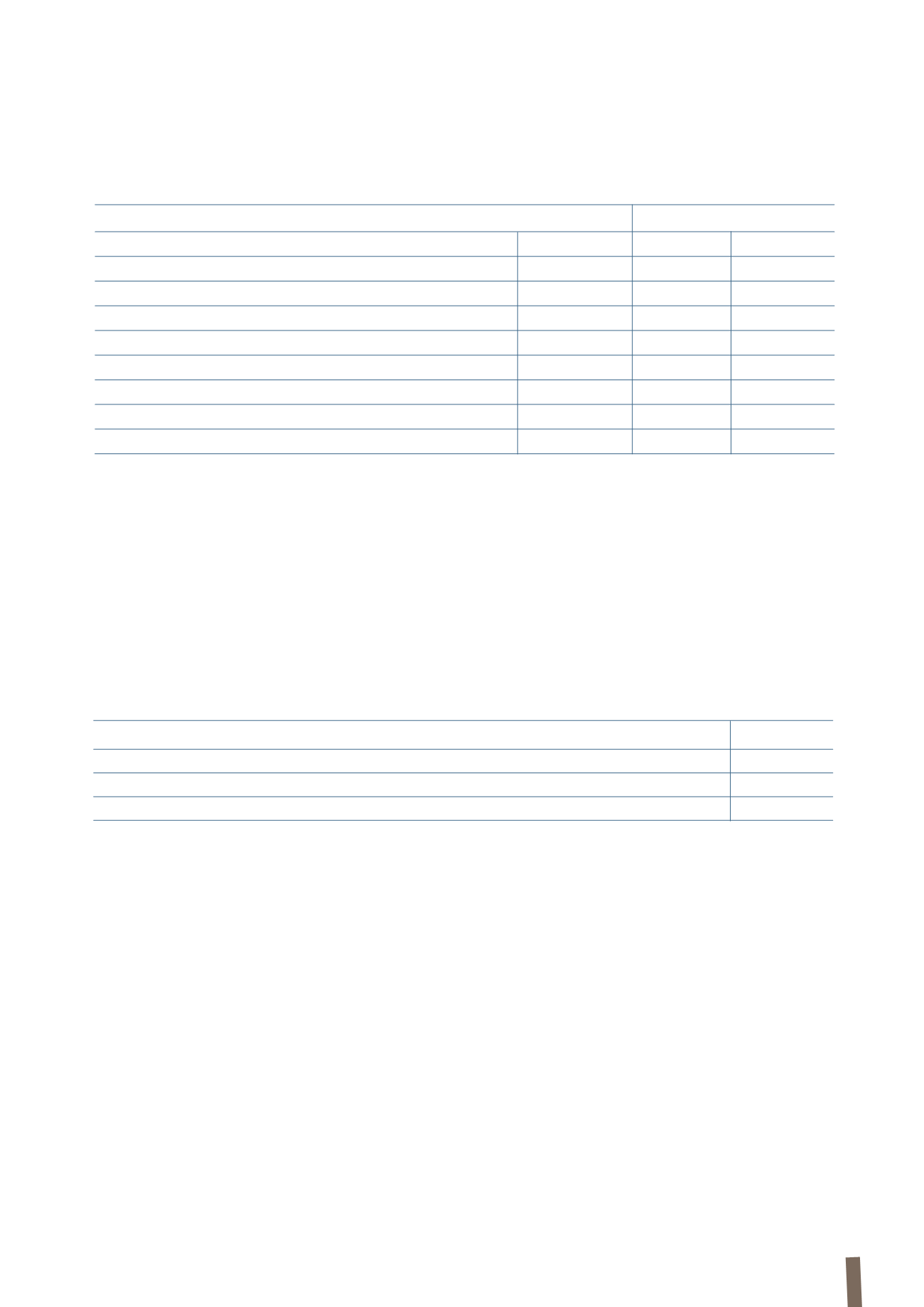

CASH AND CASH EQUIVALENTS

These are detailed as follows:

Cash and cash equivalents, deposited with major financial

institutions, are managed centrally through the Group’s

treasury companies or in its various operating units.

Cash and cash equivalents managed by Group treasury

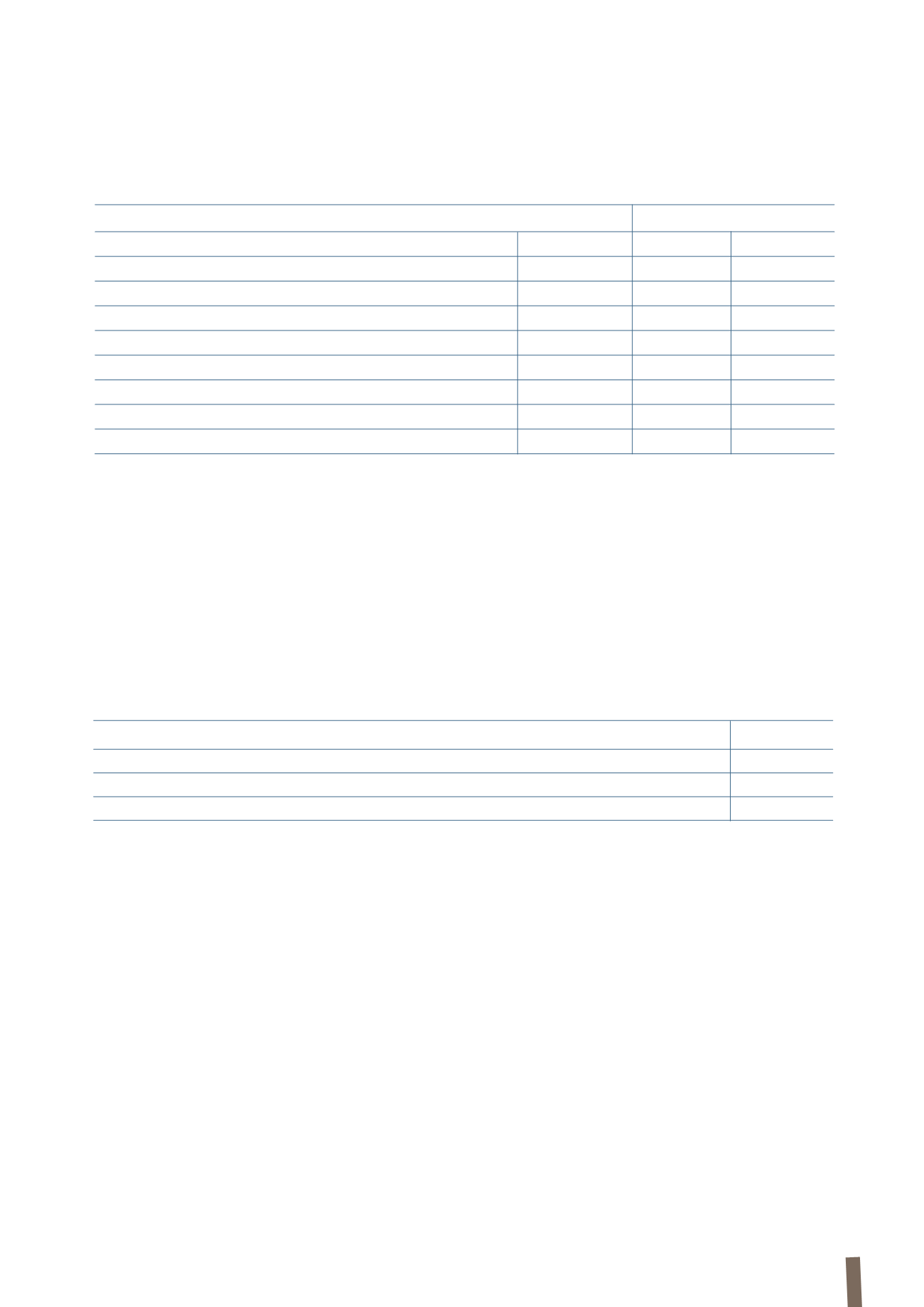

The early repayment of the Credit Agreement 2010 has led to discontinuance of the related interest rate cash flow hedges,

resulting in the recognition of Euro 10 million in net losses for hedge ineffectiveness, net of Euro 5 million in tax effects.

The following table shows movements in both reporting periods in the cash flow hedge reserve for designated hedging

derivatives:

companies amount to Euro 208 million at 31 December 2013,

compared with Euro 354 million at 31 December 2012.

For additional details about the change in cash and cash

equivalents, please refer to Note 37. Statement of cash flows.

(in millions of Euro)

31 December 2013 31 December 2012

Cash and cheques

-

7

Bank and postal deposits

561

805

Total

561

812

(in millions of Euro)

2013

2012

Gross reserve

Tax effect

Gross reserve

Tax effect

Opening balance

(34)

11

(25)

8

Changes in fair value

3

(1)

(15)

5

Reserve for other finance income/(costs)

11

(4)

11

(3)

Reserve for exchange gains/(losses)

(1)

-

(1)

-

Release to finance costs/(income)

1

-

-

-

Discontinued hedge accounting for interest rate swaps

15

(5)

-

-

Release to construction contract costs/(revenues)

(5)

1

(4)

1

Closing balance

(10)

2

(34)

11