CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

189

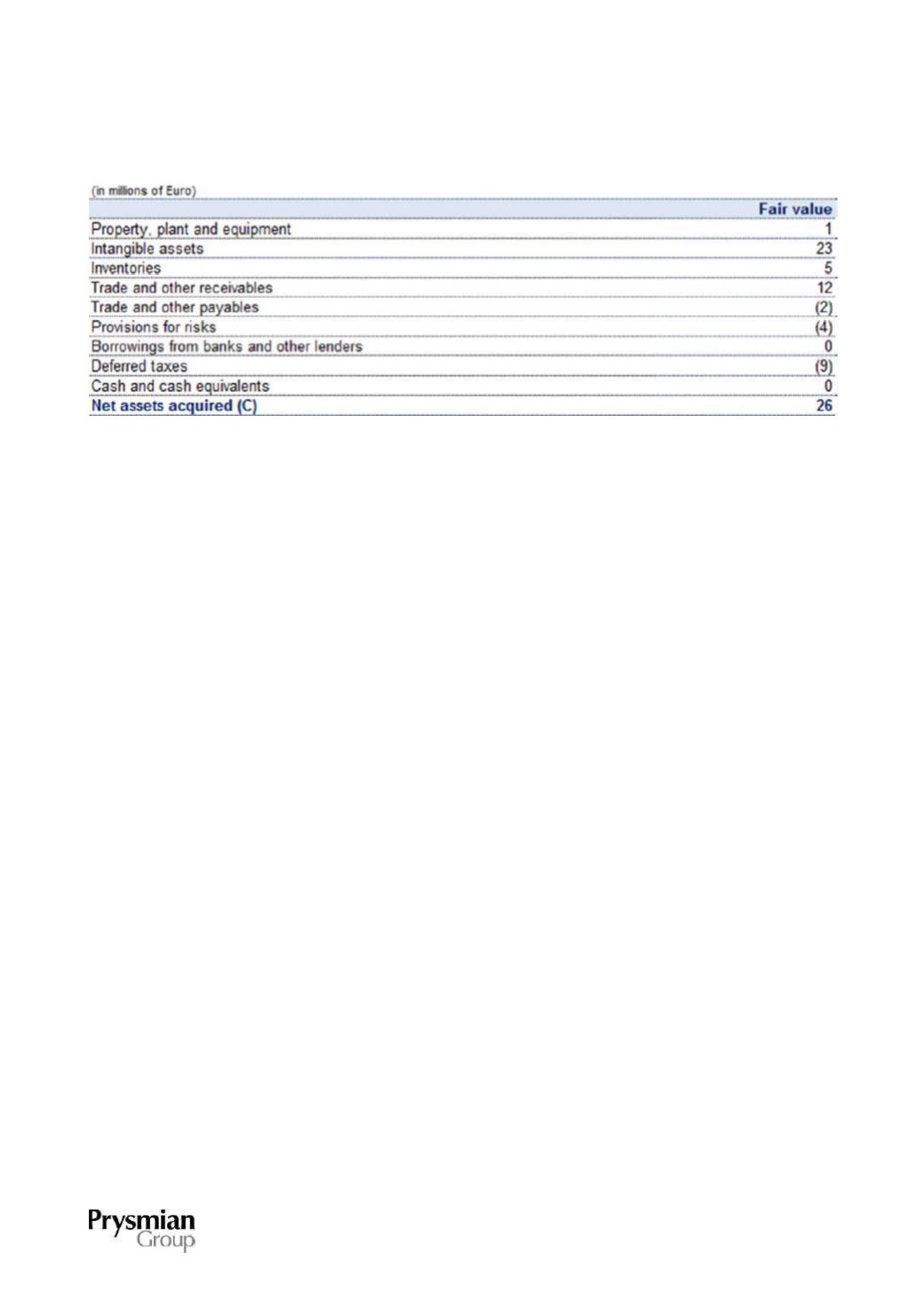

Details of the provisional fair values of the assets/liabilities acquired are as follows:

Intangible assets

The fair value measurement has identified additional values of Euro 14 million for customer relationships and

of Euro 9 million for patents, licences and trademarks.

The acquisition has given rise to a provisional amount of Euro 18 million in goodwill, which has been

recorded in "Intangible assets". If the company had been consolidated from 1 January 2015, its incremental

contribution to sales of goods and services would have been Euro 21 million, while its contribution to the

financial result for 2015 would have been Euro 0.8 million.

Oman Cables Industry (SAOG)

On 16 December 2015, the Prysmian Group signed an agreement to increase its interest in Oman Cables

Industry (SAOG) to approximately 51%, thereby acquiring a majority stake and control of the company. The

Prysmian Group, which already owned 34.78% of the company, purchased an additional interest of

approximately 16% for consideration of around Euro 110 million.

Acquisition-related costs, classified in "Other expenses", amount to around Euro 0.4 million, before tax

effects of some Euro 0.1 million.

In compliance with IFRS 3, the fair values of the assets, liabilities and contingent liabilities have been

determined on a provisional basis in view of the fact that the valuation processes had not yet been started at

the present reporting date.

These provisional amounts may undergo adjustment over the course of the 12-month period from the

acquisition date.