CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

188

(h) Incentive plans

The employee share purchase plan involves granting shares to almost all of the Group's employees. The

operation of this plan is described in Note 21. Personnel costs.

The grant of shares is subject to an employee's continued professional relationship with the Group in the

months between signing up to one of the plan's purchase windows and the purchase of the shares

themselves on the stock market. The plan's financial and economic impact has therefore been estimated on

the basis of the best possible estimates and information currently available.

The incentive plan for 2015-2017 involves granting options to some of the Group's employees and co-

investing part of their annual bonuses. These benefits are granted subject to the achievement of operating

and financial performance objectives and the continuation of a professional relationship for the three-year

period 2015-2017. The plan's financial and economic impact has therefore been estimated on the basis of

the best possible estimates and information currently available.

More details can be found in Note 21. Personnel costs.

E. BUSINESS COMBINATIONS

Gulf Coast Downhole Technologies (GCDT)

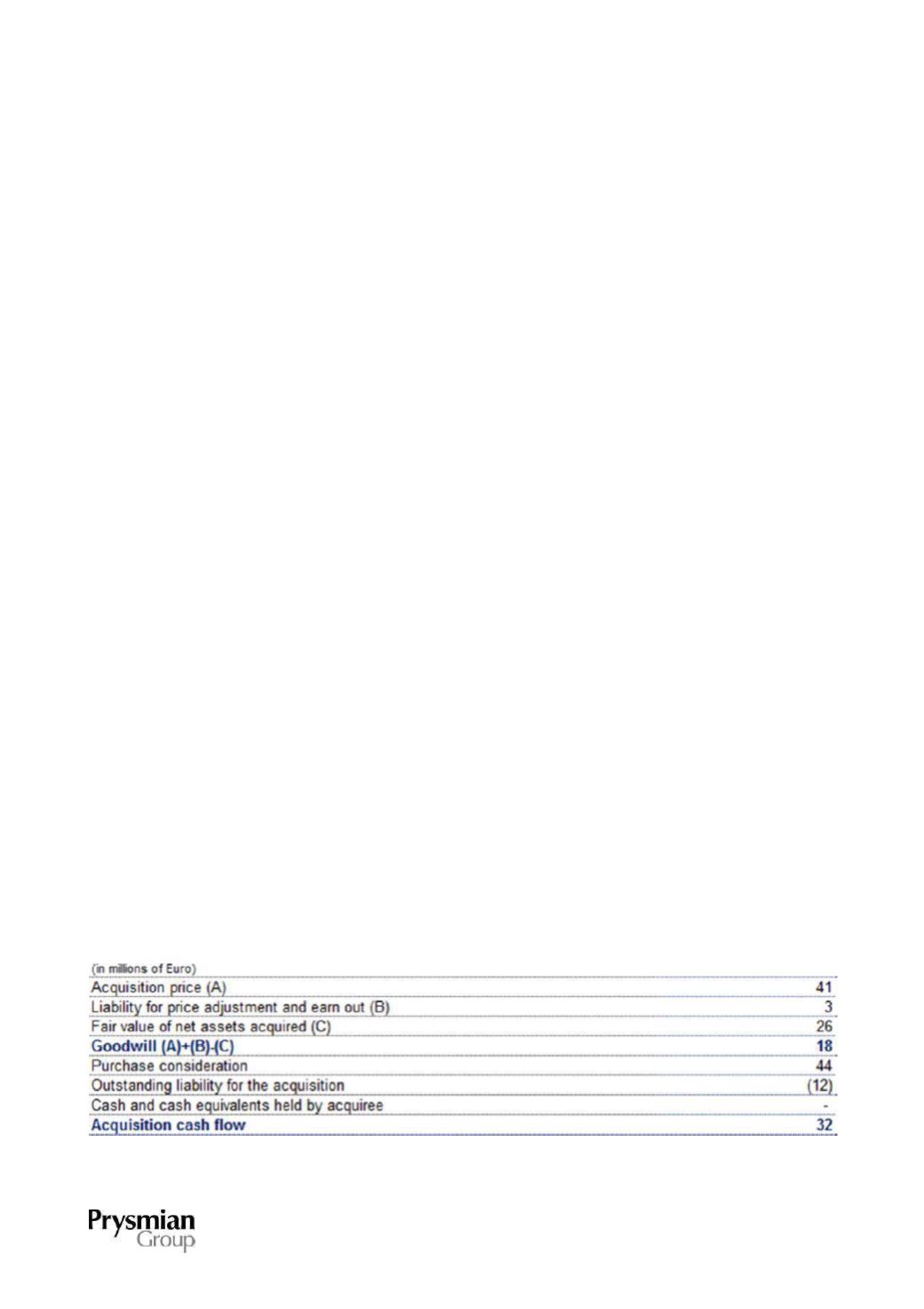

The Prysmian Group signed an agreement on 24 September 2015 to acquire 100% of Gulf Coast Downhole

Technologies (GCDT), a privately-owned US company, for an initial consideration, subject to adjustment, of

approximately USD 45 million. There is also an earn-out determined on an average combined EBITDA in the

next three years, with the maximum pay-out capped at about USD 21 million. The closing transaction was

completed on 1 October 2015, meaning that its accounting effects have been reflected as from that date.

As at 31 December 2015, the purchase consideration amounted to Euro 44 million, of which Euro 32 million

already paid at the closing. Acquisition-related costs, classified in "Other expenses", amount to around Euro

0.6 million, before tax effects of some Euro 0.2 million.

In compliance with IFRS 3, the fair values of the assets, liabilities and contingent liabilities have been

determined on a provisional basis in view of the fact that some valuation processes were incomplete at the

present reporting date.

These provisional amounts may undergo adjustment over the course of the 12-month period from the

acquisition date.