CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

183

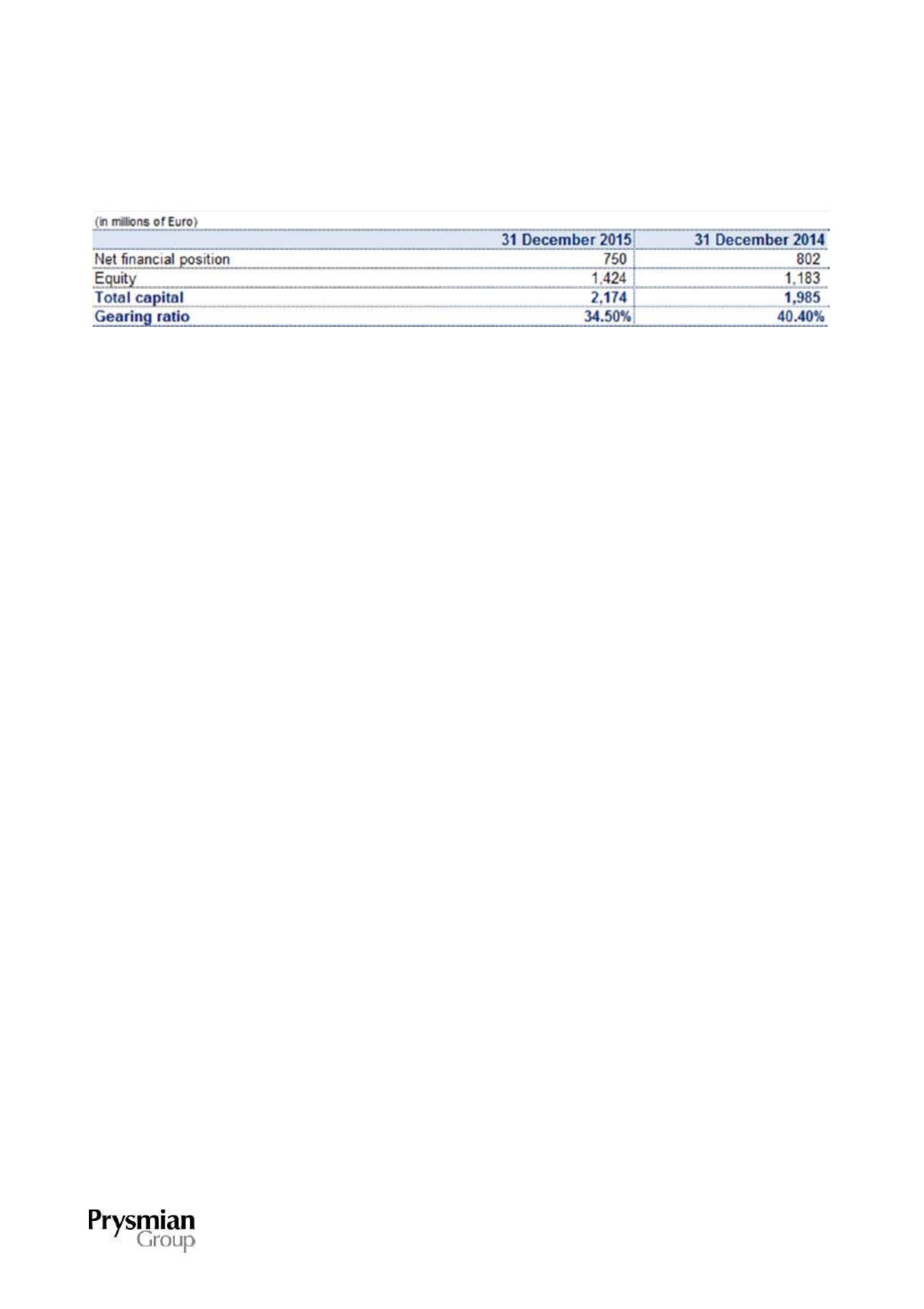

The gearing ratios at 31 December 2015 and 31 December 2014 are shown below:

C.2 FAIR VALUE

With reference to assets and liabilities recognised in the statement of financial position, IFRS 13 requires

such amounts to be classified according to a hierarchy that reflects the significance of the inputs used in

determining fair value.

Financial instruments are classified according to the following fair value hierarchy:

Level 1

: fair value is determined with reference to quoted prices (unadjusted) in active markets for identical

financial instruments. Therefore, the emphasis within Level 1 is on determining both of the following:

(a)

the principal market for the asset or liability or, in the absence of a principal market, the most

advantageous market for the asset or liability; and

(b)

whether the entity can enter into a transaction for the asset or liability at the price in that market at

the measurement date.

Level 2

: fair value is determined using valuation techniques where the input is based on observable market

data. The inputs for this level include:

(a)

quoted prices for similar assets or liabilities in active markets;

(b)

quoted prices for identical or similar assets or liabilities in markets that are not active;

(c)

inputs other than quoted prices that are observable for the asset or liability, for example:

i.

interest rate and yield curves observable at commonly quoted intervals;

ii.

implied volatilities;

iii.

credit spreads;

(d)

market-corroborated inputs.

Level 3

: fair value is determined using valuation techniques where the input is not based on observable

market data.