CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

178

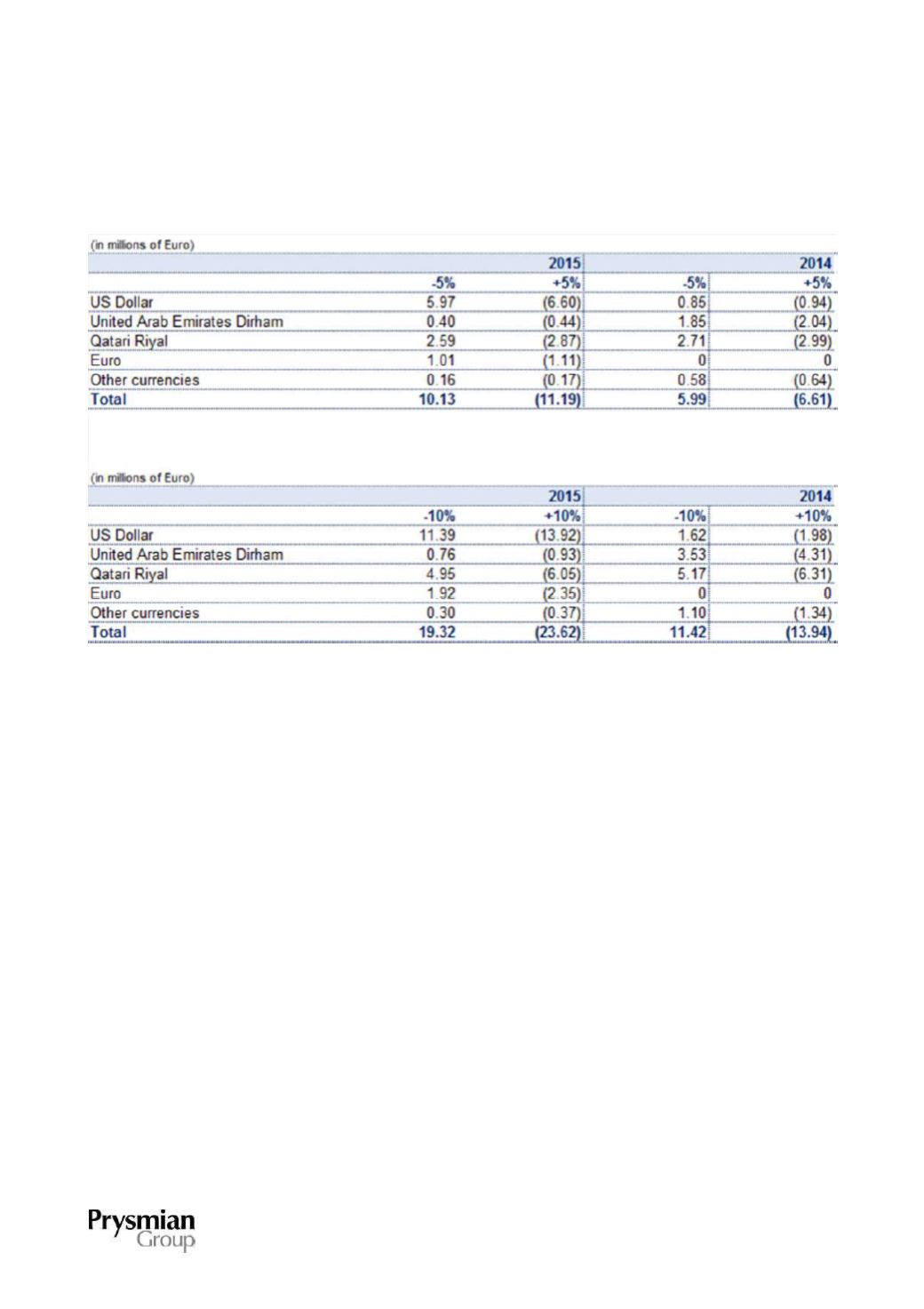

The following sensitivity analysis shows the post-tax effects on equity reserves of an increase/decrease in

the fair value of designated cash flow hedges following a 5% and 10% increase/decrease in exchange rates

versus closing exchange rates at 31 December 2015 and 31 December 2014.

The above analysis ignores the effects of translating the equity of Group companies whose functional

currency is not the Euro.

Further details can be found in the individual notes to the financial statements.

[b] Interest rate risk

The interest rate risk to which the Group is exposed is mainly on long-term financial liabilities, carrying both

fixed and variable rates.

Fixed rate debt exposes the Group to a fair value risk. The Group does not operate any particular hedging

policies in relation to the risk arising from such contracts.

Variable rate debt exposes the Group to a rate volatility risk (cash flow risk). In order to hedge this risk, the

Group can use derivative contracts that limit the impact of interest rate changes on the income statement.

The Group Finance Department monitors the exposure to interest rate risk and adopts appropriate hedging

strategies to keep the exposure within the limits defined by the Group Administration, Finance and Control

Department, arranging derivative contracts, if necessary.

The following sensitivity analysis shows the effects on consolidated net profit of an increase/decrease of 25

basis points in interest rates on the interest rates at 31 December 2015 and 31 December 2014, assuming

that all other variables remain equal.