CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

177

Czech Koruna/Euro: in relation to trade and financial transactions by Czech companies on the

Eurozone market and vice versa;

Canadian Dollar/Euro: in relation to trade and financial transactions by Eurozone companies on the

Canadian market and vice versa;

Euro/Hungarian Forint: in relation to trade and financial transactions by Hungarian companies on the

Eurozone market and vice versa.

In 2015, trade and financial flows exposed to the above exchange rates accounted for around 86.8% of the

total exposure to exchange rate risk arising from trade and financial transactions (87.4% in 2014).

The Group is also exposed to appreciable exchange rate risks on the following exchange rates:

Euro/Romanian Leu, Euro/Swedish Krona, Renmimbi/Singapore Dollar, Renmimbi/US Dollar; none of these

exposures, taken individually, accounted for more than 1.8% of the overall exposure to transactional

exchange rate risk in 2015.

It is the Group's policy to hedge, where possible, exposures in currencies other than the accounting

currencies of its individual companies. In particular, the Group hedges:

Firm cash flows: invoiced trade flows and exposures arising from loans and borrowings;

Projected cash flows: trade and financial flows arising from firm or highly probable contractual

commitments.

The above hedges are arranged using derivative contracts.

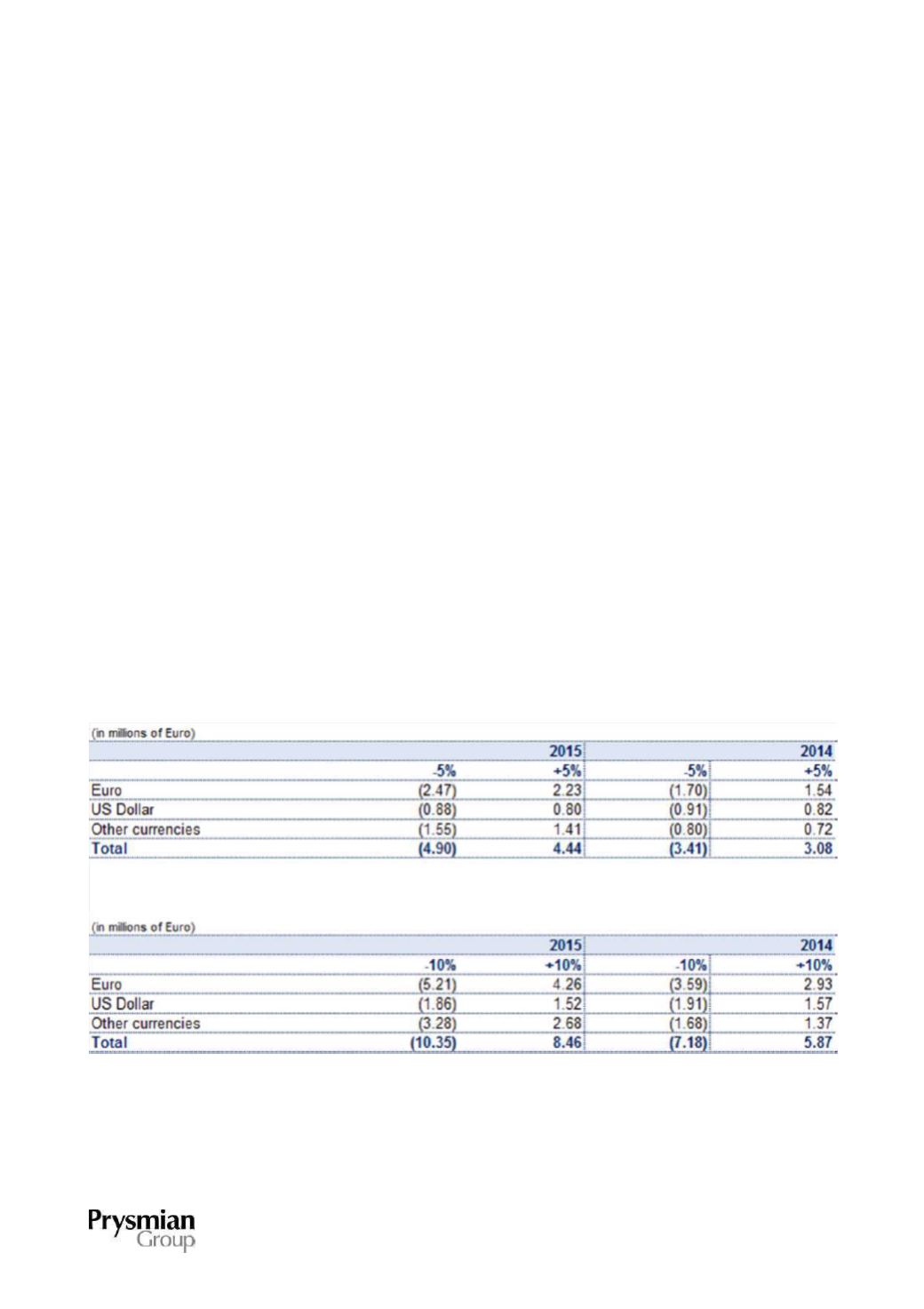

The following sensitivity analysis shows the effects on net profit of a 5% and 10% increase/decrease in

exchange rates versus closing exchange rates at 31 December 2015 and 31 December 2014.

When assessing the potential impact of the above, the assets and liabilities of each Group company in

currencies other than their accounting currency were considered, net of any derivatives hedging the above-

mentioned flows.