CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

179

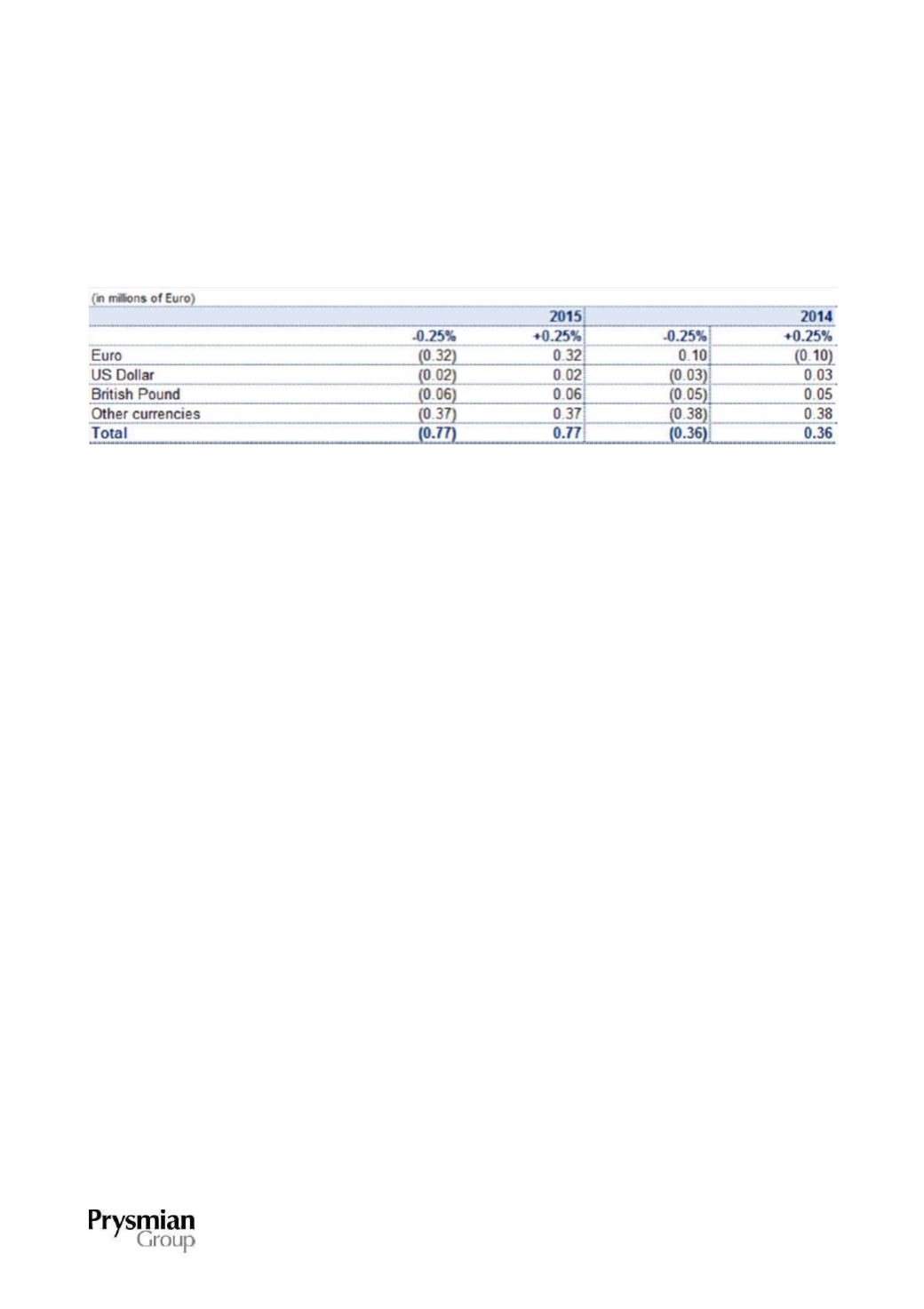

The potential effects shown below refer to net liabilities representing the bulk of Group debt at the reporting

date and are determined by calculating the effect on net finance costs following a change in annual interest

rates.

The net liabilities considered for sensitivity analysis include variable rate financial receivables and payables,

cash and cash equivalents and derivatives whose value is influenced by rate volatility.

At 31 December 2015, there were no derivatives designated as cash flow hedges; at 31 December 2014, the

increase/decrease in the fair value of derivatives designated as cash flow hedges arising from an

increase/decrease of 25 basis points in interest rates on year-end rates would have respectively increased

other equity reserves by Euro 0.3 million and decreased them by Euro 0.3 million for hedges of underlying

transactions in Euro.

[c] Price risk

The Group is exposed to price risk in relation to purchases and sales of strategic materials, whose purchase

price is subject to market volatility. The main raw materials used by the Group in its own production

processes consist of strategic metals such as copper, aluminium and lead. The cost of purchasing such

strategic materials accounted for approximately 48.5% of the Group's total cost of materials in 2015 (51.2%

in 2014), forming part of its overall production costs.

In order to manage the price risk on future trade transactions, the Group negotiates derivative contracts on

strategic metals, setting the price for projected future purchases.

Although the ultimate aim of the Group is to hedge risks to which it is exposed, these contracts do not qualify

as hedging instruments for accounting purposes.

The derivative contracts entered into by the Group are negotiated with major financial counterparties on the

basis of strategic metal prices quoted on the London Metal Exchange ("LME"), the New York market

("COMEX") and the Shanghai Futures Exchange ("SFE").

The following sensitivity analysis shows the effect on net profit and consolidated equity of a 10%

increase/decrease in strategic material prices versus prices at 31 December 2015 and 31 December 2014,

assuming that all other variables remain equal.