CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

217

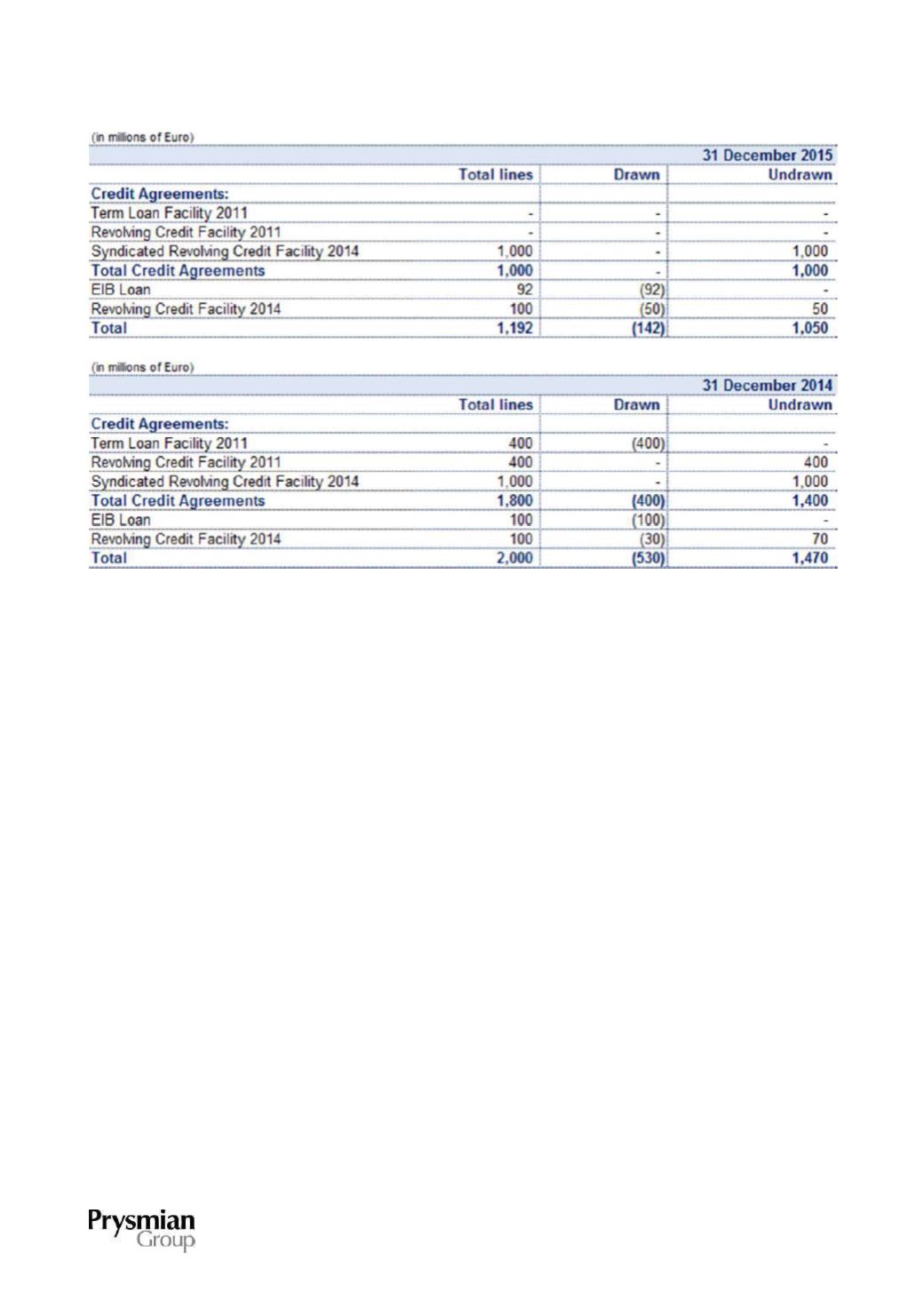

The Revolving Credit Facilities are intended to finance ordinary working capital requirements.

Bonds

The Prysmian Group had the following bonds outstanding as at 31 December 2015:

Non-convertible bond issued in 2015

On 10 March 2015, the Board of Directors of Prysmian S.p.A. authorised management to proceed,

depending on prevailing market conditions and in any case by 30 June 2016, with the issuance and private

or public placement of bonds in one or more tranches. These bonds were intended for sale to institutional

investors only.

Consequently, on 30 March 2015 Prysmian S.p.A. completed the placement with institutional investors of an

unrated bond, on the Eurobond market, for a total nominal value of Euro 750 million. The bond, with an issue

price of Euro 99.002, has a 7-year maturity and will pay a fixed annual coupon of 2.50%. The individual

bonds, maturing on 11 April 2022, have minimum denominations of Euro 100,000, plus integral multiples of

Euro 1,000.

The bond settlement date was 9 April 2015. The bond has been admitted to the Luxembourg Stock

Exchange's official list and is traded on the related regulated market.

The fair value of the non-convertible bond is Euro 746 million at 31 December 2015. Fair value has been

determined with reference to the quoted price in the relevant market (Level 1 of the fair value hierarchy).