CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

212

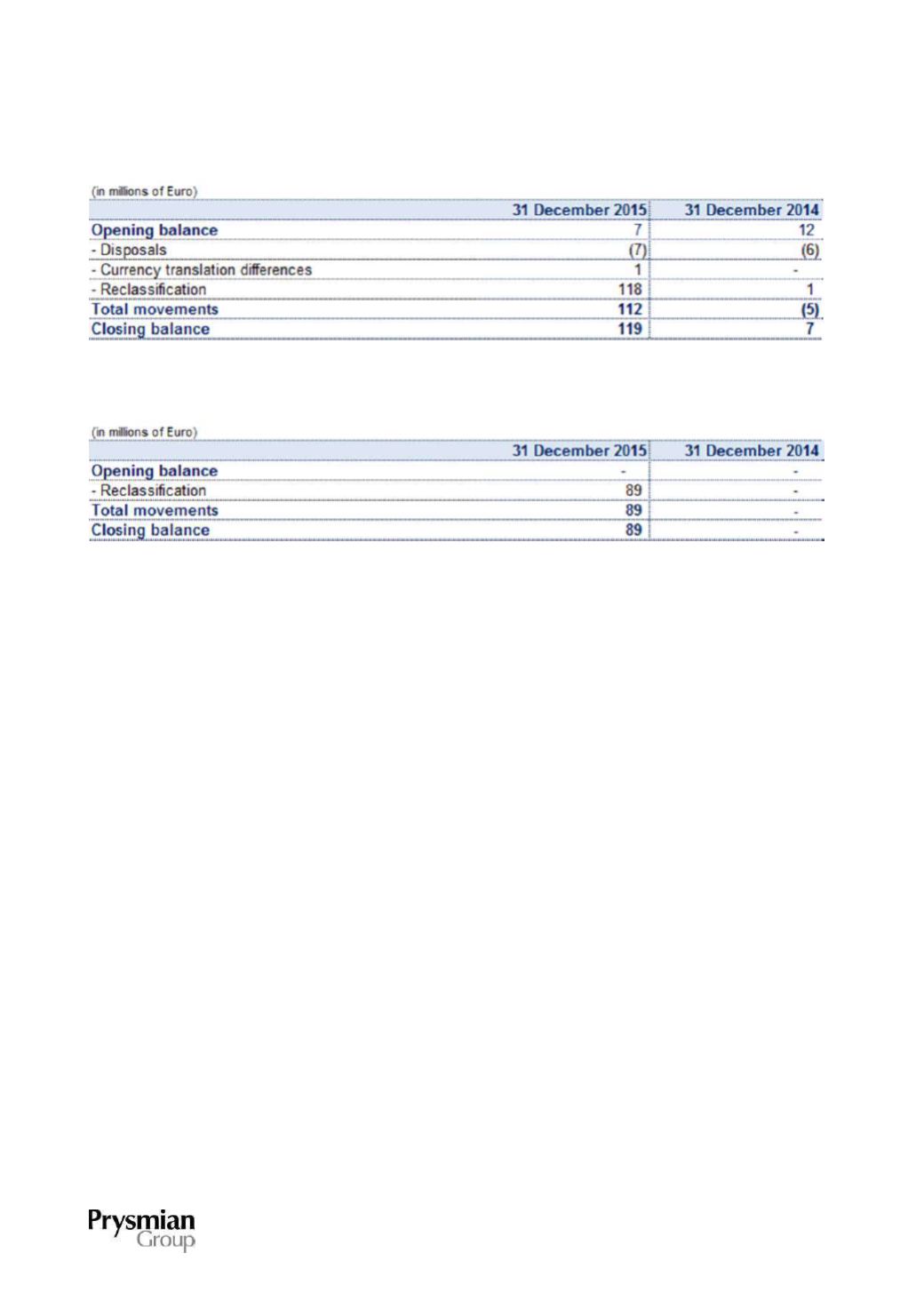

Movements in assets held for sale are analysed as follows:

Movements in liabilities held for sale are analysed as follows:

The movements in Assets and Liabilities held for sale mainly refer to assets and liabilities of other Group

companies, amounting to Euro 119 million and Euro 89 million respectively, which met the criteria for

classification in this line item at 31 December 2015.

Management expects the assets classified in this line item to be sold within the next 12 months.

Assets held for sale are classified in Level 3 of the fair value hierarchy.

11. SHARE CAPITAL AND RESERVES

Consolidated equity has recorded an increase of Euro 241 million since 31 December 2014, mainly reflecting

the effect of:

negative currency translation differences of Euro 44 million;

the release of a positive Euro 1 million, net of tax, from the cash flow hedge reserve as a result of

discontinuance of cash flow hedge accounting, following early repayment of the Term Loan Facility

2011;

the positive post-tax change of Euro 1 million in the fair value of derivatives designated as cash flow

hedges;

the positive change of Euro 25 million in the share-based compensation reserve linked to the stock

option plan;

the positive change of Euro 19 million in the reserve for actuarial gains on employee benefits;