CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

213

the positive change of Euro 113 million to account for the net effect of recording non-controlling

interests after acquiring a majority stake in and consequent control of Oman Cables Industry SAOG;

capital payments of Euro 3 million;

the net profit for the year of Euro 214 million;

the distribution of Euro 91 million in dividends.

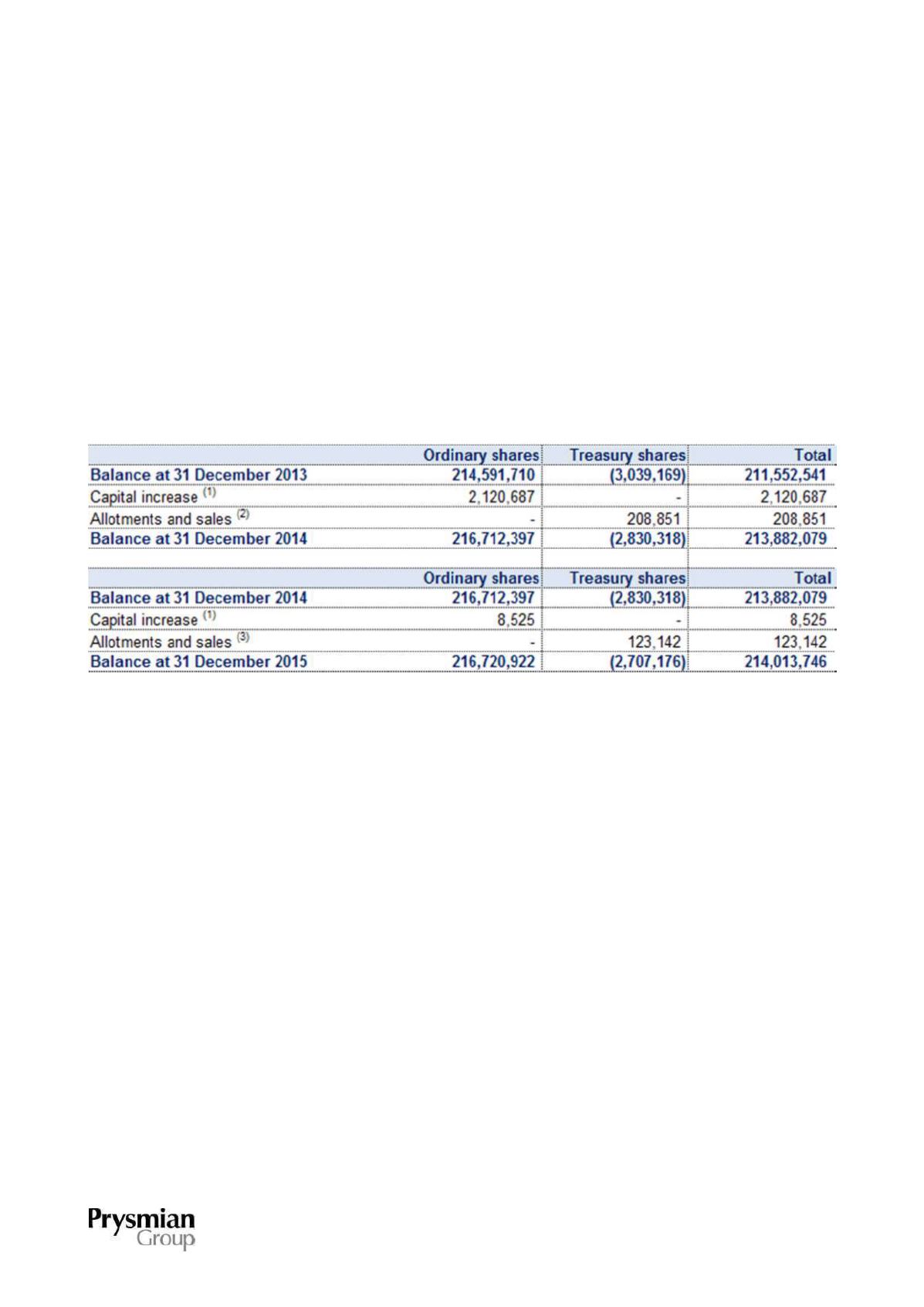

At 31 December 2015, the share capital of Prysmian S.p.A. comprises 216,720,922 shares with a total value

of Euro 21,672,092.20.

Movements in the ordinary shares and treasury shares of Prysmian S.p.A. are reported in the following table:

(1)

Capital increase following exercise of the options under the Long-term incentive plan 2011-2013.

(2)

The movement in treasury shares reflects the allotment of 187,299 shares under the Group employee share purchase plan (YES

Plan), the allotment of 1,411,552 shares under the Long-term incentive plan 2011-2013, and the buy-back of 1,390,000 shares.

(3)

Allotment of 5,665 treasury shares under the Long-term incentive plan 2011-2013 and of 106,975 treasury shares under the Group

employee share purchase plan (YES Plan), as well as sale of 16,167 shares to serve this plan.

Treasury shares

Movements in treasury shares during the year referred solely to allotments under stock option plans:

during 2015, the number of treasury shares decreased by 5,665 for allotments under the Long-term

incentive plan 2011-2013.

the number of treasury shares recorded a further decrease of 117,477 for allotments to employees

participating in the YES employee share purchase plan.

The following table reports movements in treasury shares during the period: