CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

210

(1)

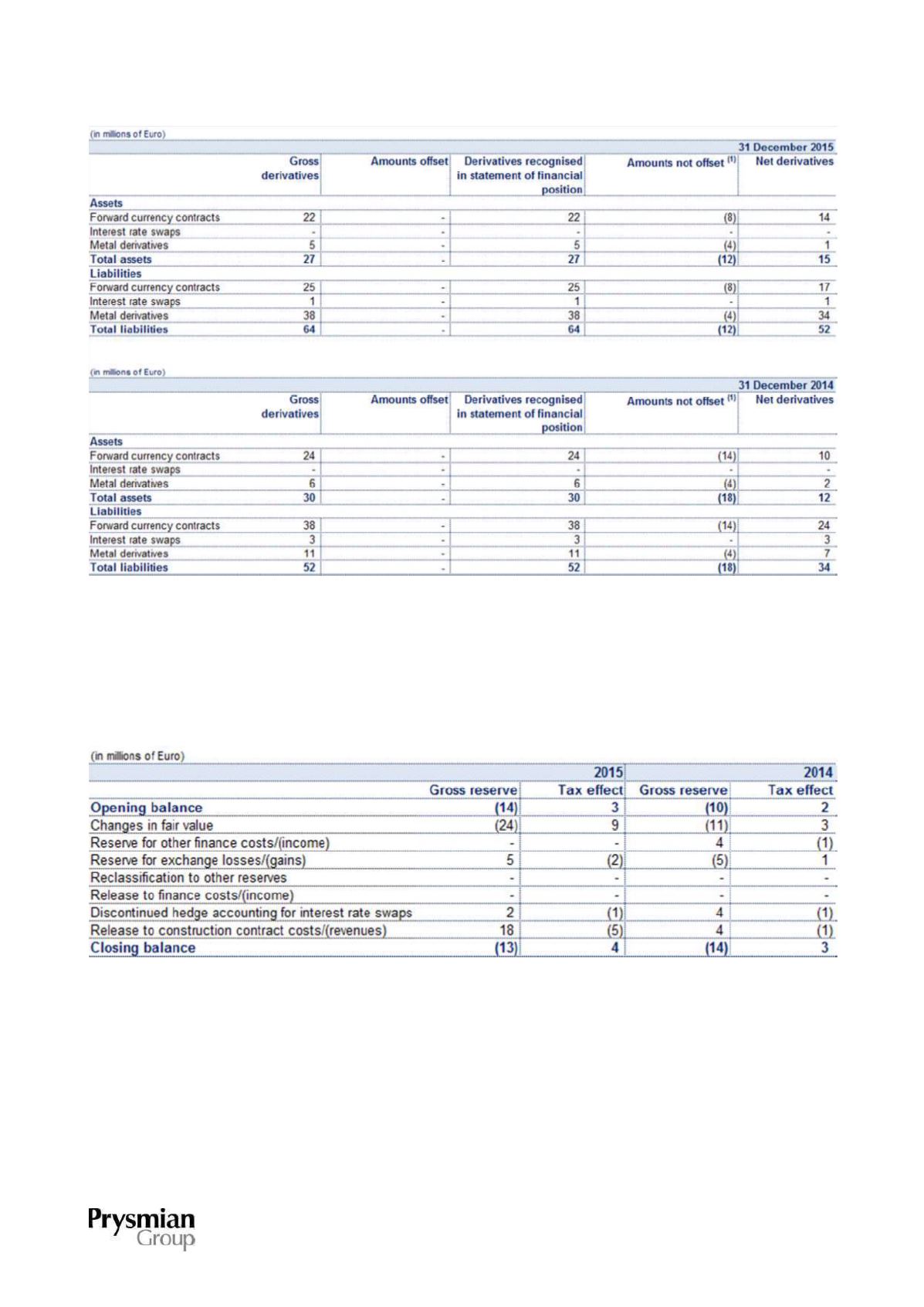

Derivatives potentially offsettable in the event of default events under master agreements.

The following table shows movements in both reporting periods in the cash flow hedge reserve for

designated hedging derivatives:

The early repayment of the remaining balance on the Term Loan Facility 2011 on 29 May 2015 has triggered

the discontinuance of hedge accounting for the related interest rate cash flow hedges, resulting in the

recognition of Euro 1 million in net losses for hedge ineffectiveness, net of tax.