CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

227

to be held harmless for all claims made by the European Commission in implementation of the latter's

decision and for any expenses related to such implementation.

During 2015, the amount of the provision has been adjusted to reflect the events described above as well as

the effect of currency translation differences on the provisions pertaining to foreign jurisdictions. This

adjustment has resulted in the recognition of a net release of Euro 29 million in the 2015 income statement.

As at 31 December 2015, the amount of the provision is approximately Euro 143 million.

Despite the uncertainty of the outcome of the investigations in progress and potential legal action by

customers as a result of the European Commission's decision, the amount of this provision is considered to

represent the best estimate of the liability based on the information now available.

In addition, during August 2015, two employees of a foreign subsidiary were the subject of court orders by

the local authorities as part of an investigation into alleged misappropriation at the subsidiary's expense.

Following this notification, the Group instructed its advisors to review and assess a number of areas of

potential risk and issues arising from possible breaches of internal procedures.

Although it is not possible to accurately quantify the risks, the results of this work to date lead to the Directors

to believe that any liabilities triggered by such issues would nevertheless not be material for the Group.

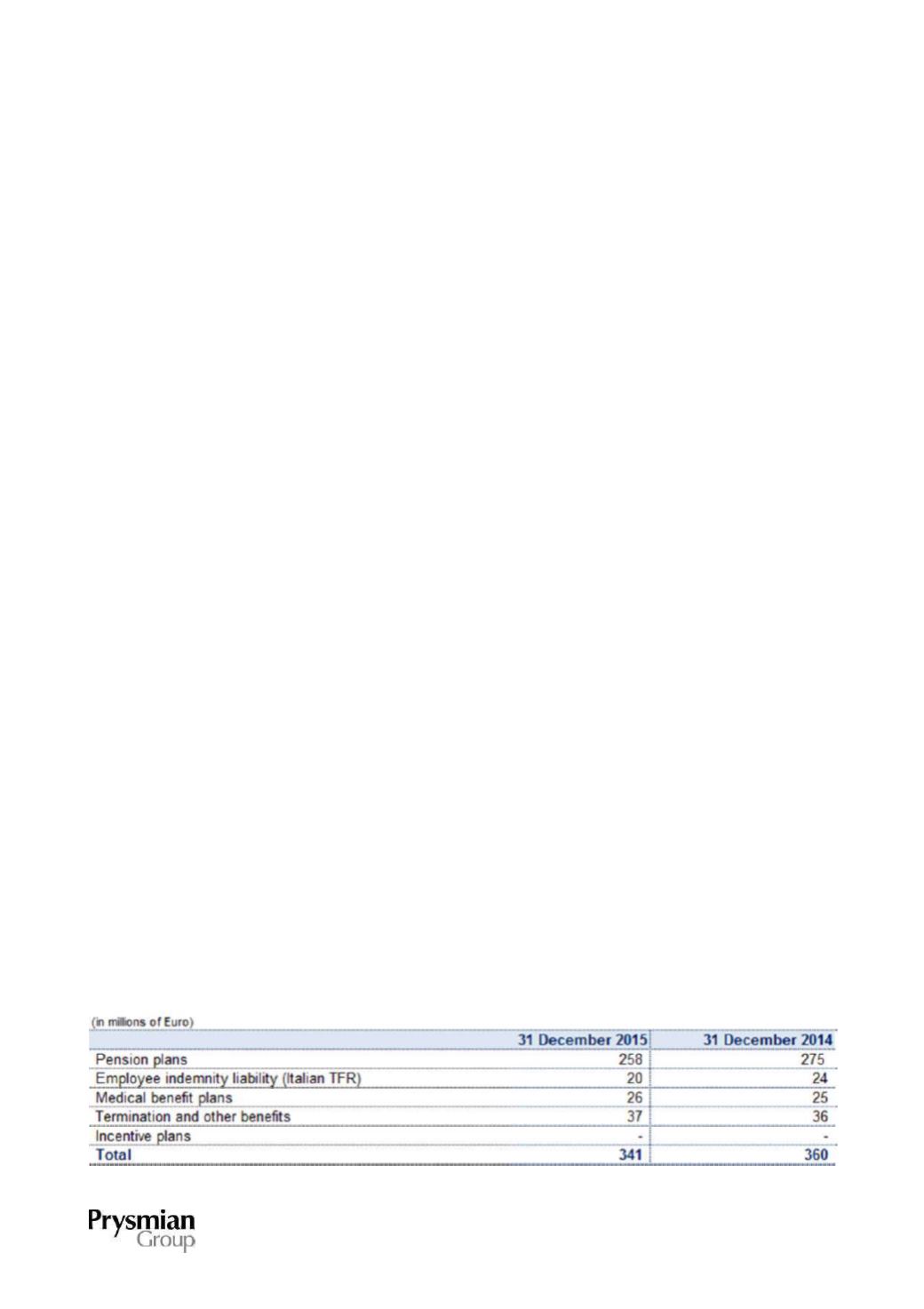

15. EMPLOYEE BENEFIT OBLIGATIONS

The Group provides a number of post-employment benefits through programmes that include defined benefit

plans and defined contribution plans.

The defined contribution plans require the Group to pay, under legal or contractual obligations, contributions

into public or private insurance institutions. The Group fulfils its obligations through payment of the

contributions. At the financial reporting date, any amounts accrued but not yet paid to the above institutions

are recorded in "Other payables", while the related costs, accrued on the basis of the service rendered by

employees, are recognised in "Personnel costs".

The defined benefit plans mainly refer to Pension plans, Employee indemnity liability (for Italian companies),

Medical benefit plans and other benefits such as seniority bonuses.

The liabilities arising from these plans, net of any assets serving such plans, are recognised in Employee

benefit obligations and are measured using actuarial techniques.

Employee benefit obligations are analysed as follows: