CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

229

amount of the liability and of service costs is the discount rate, identified by reference to market yields of AA

corporate bonds denominated in Euro.

Great Britain

Two defined benefit plans were in operation at 31 December 2015: the Draka pension fund and the

Prysmian pension fund. Both are final salary plans, in which the retirement age is generally set at 65 for the

majority of plan participants. Neither plan has admitted any new members or accrued any new liabilities

since 2013. Currently all employees participate in defined contribution plans.

As at 31 December 2015, the plans had an average duration of approximately 19.8 years (approximately

20.3 years at 31 December 2014).

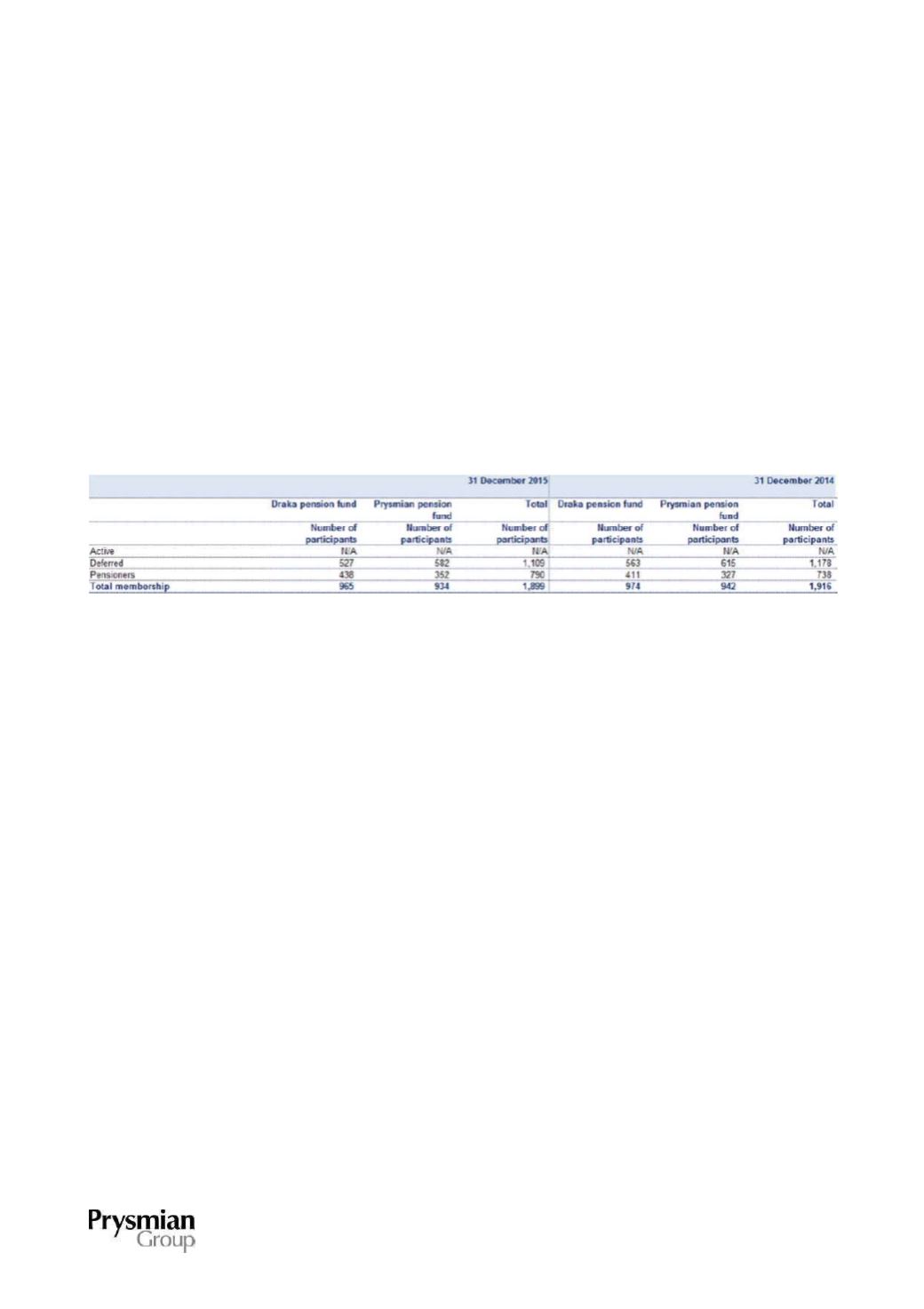

Total plan membership is made up as follows:

Both plans operate under trust law and are managed and administered by a Board of Trustees on behalf of

members and in accordance with the terms of the Trust Deed and Rules and current legislation. The assets

that fund the liabilities are held by the Trust, for both plans.

For the purposes of determining the level of funding, the Trustees appoint an actuary to value the plans

every three years, with annual updates. The latest valuations of the Draka pension fund and the Prysmian

pension fund were conducted as at 25 March 2013 and 31 December 2014 respectively. The latter valuation

is in progress and will be completed by 31 March 2016.

Even the contribution levels are set every three years at the time of performing the valuation to determine the

level of plan funding. Currently, the contribution levels are set at Euro 3.3 million a year for the Draka

pension fund (Euro 1.8 million at 31 December 2014) and Euro 0.2 million a year for the Prysmian pension

fund (unchanged since the prior year).

The Trustees decide on the investment strategy in agreement with the company. The strategies differ for

both plans. In particular, the Draka pension fund has invested a larger proportion of its assets in equities; the

fund's investment split is as follows: 18% in equities, 37% in bonds and 45% in other financial instruments.

The Prysmian pension fund has invested its assets as follows: 41% in bonds and the remaining 59% in other

financial instruments.

The main risk for the Prysmian Group in Great Britain is that mismatches between the expected return and

the actual return on plan assets would require contribution levels to be revised.

The liabilities and service costs are sensitive to the following variables: life expectancy of plan participants

and future growth in benefit levels. Another variable to consider when determining the amount of the liability