CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

235

The main risk is the volatility of the inflation rate and the interest rate, as determined by the market yield on

AA corporate bonds denominated in Euro. Another risk factor is the possibility that members leave the plan

or that higher advance payments than expected are requested, resulting in an actuarial loss for the plan, due

to an acceleration of cash flows.

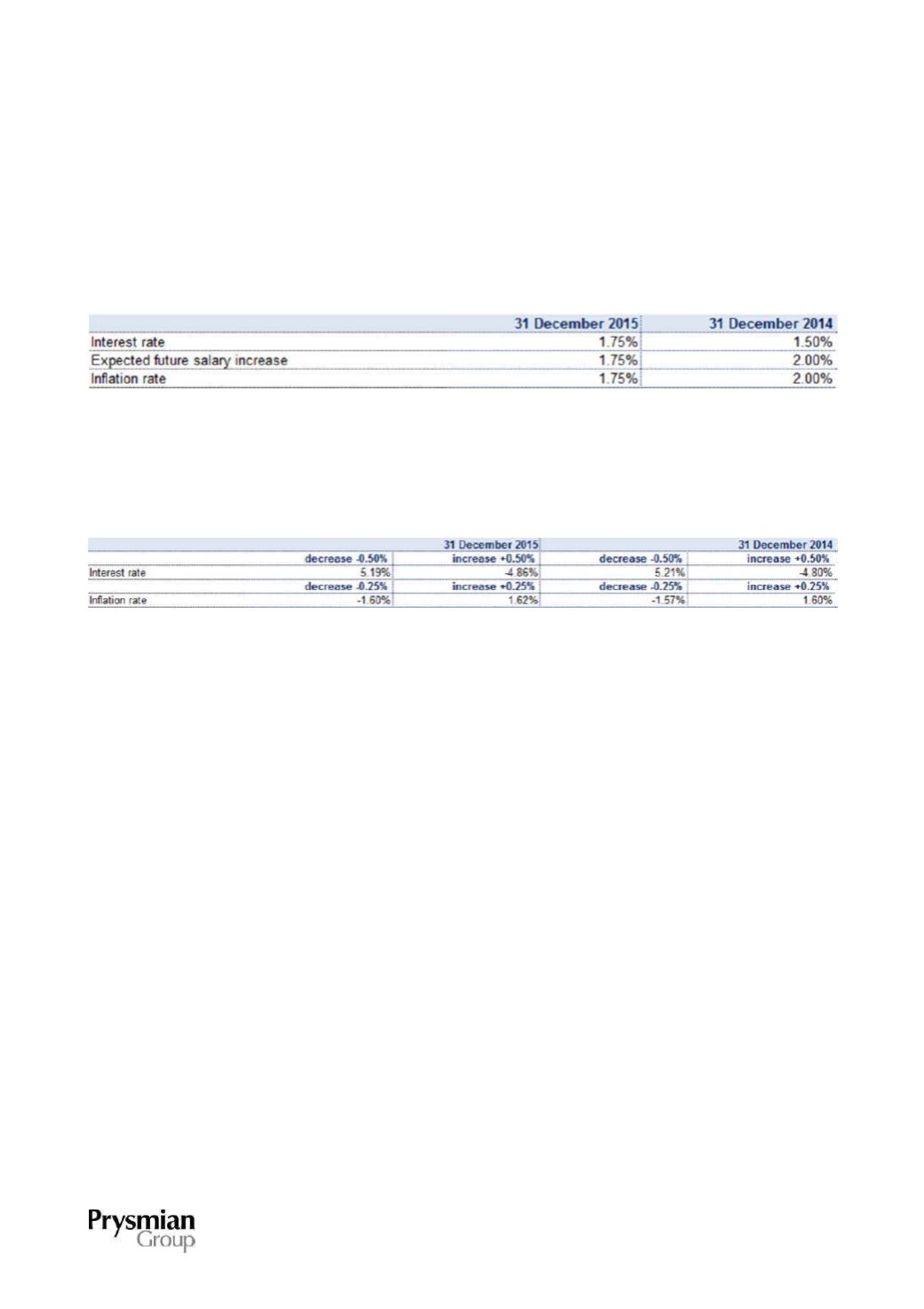

The actuarial assumptions used to value employee indemnity liability are as follows:

The following table presents a sensitivity analysis of the effects of an increase/decrease in the most

significant actuarial assumptions used to determine the present value of benefit obligations, namely the

interest rate and inflation rate:

MEDICAL BENEFIT PLANS

Some Group companies provide medical benefit plans for retired employees. In particular, the Group

finances medical benefit plans in Brazil, Canada and the United States. The plans in the United States

account for approximately 90% of the total obligation for medical benefit plans (unchanged since 31

December 2014).

Apart from interest rate and life expectancy risks, medical benefit plans are particularly susceptible to

increases in the cost of meeting claims. None of the medical benefit plans has any assets to fund the

associated obligations, with benefits paid directly by the employer.

As noted earlier, the US medical benefit plans account for the majority of the benefit obligation. These plans

are not subject to the same level of legal protection as pension plans. The enactment of important health

care legislation in the United States (the Affordable Care Act, also known as "ObamaCare") could result in a

reduction of costs and risks associated with these plans, as plan members move to individual forms of

insurance. Currently the new reform has had no impact on liabilities and costs.